OSI Systems (OSIS) Rides on Expanding Order Book & Clientele

OSI Systems OSIS shares have surged 52.1% in the trailing 12-month period, outperforming the Zacks Computer & Technology sector’s growth of 45.1%. The company is benefiting from strong clientele and expanding order books.

OSIS’ segments — Healthcare, Optoelectronics and Manufacturing and Security — are benefiting from recent order wins.

Its Healthcare division, Spacelabs Healthcare, recently received an order valued at approximately $5 million. Spacelabs will install a range of patient monitoring tools, including the Rothman Index, SafeNSound and Xhibit Central Stations with XTR Telemetry and Qube bedside patient monitors in a U.S.-based hospital.

The Healthcare segment is expected to benefit from an improving order book. In October, Spacelabs Healthcare received an order valued at roughly $4 million to provide patient monitoring solutions and related accessories to a U.S.-based hospital.

Optoelectronics and Manufacturing and Security are also expected to benefit from new order wins.

In early December, OSIS’ Optoelectronics and Manufacturing segment received orders totaling nearly $5 million to provide electronic assemblies to a leading technology OEM. In November, the segment received multiple orders for approximately $4 million in aggregate to provide missile guidance and detection components to a leading defense OEM.

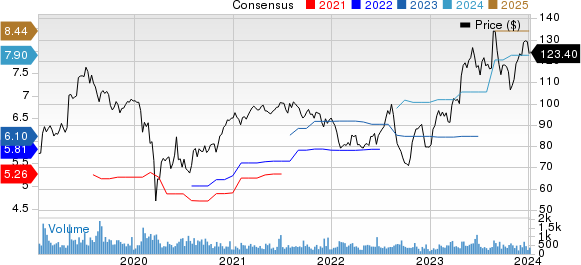

OSI Systems, Inc. Price and Consensus

OSI Systems, Inc. price-consensus-chart | OSI Systems, Inc. Quote

The Security division was awarded a contract valued at approximately $18 million from an international airport to provide various checkpoint and baggage screening solutions. The division received another contract worth roughly $5 million from a Latin American customer to provide cargo and vehicle inspection solutions, including installation and integration support.

OSI Systems’ Prospects Strong

OSIS Security division reported a terrific first-quarter fiscal 2024, with revenues growing double-digit and the operating margin expanding significantly year over year. It fully offset the challenging performance of the Healthcare segment in the fiscal quarter.

OSI Systems exited the reported quarter with a backlog of nearly $1.8 billion, particularly in the Security and Optoelectronics and Manufacturing divisions. The company also expects more robust performance from Healthcare in the rest of fiscal 2024.

For fiscal 2024, revenues are expected to increase more than 18% over fiscal 2023, while earnings are expected to increase more than 27% year over year.

The Zacks Consensus Estimate for fiscal 2024 revenues of $1.51 billion, indicating 25.17% year-over-year growth. The consensus estimates for earnings of $7.90 per share, unchanged over the past 30 days and indicating year-over-year growth of 27.21%.

Zacks Rank & Stocks to Consider

Currently, OSI Systems carries a Zacks Rank #3 (Hold).

BlackLine BL, Ceridian HCM CDAY and Meta Platforms META are some other top-ranked stocks that investors can consider in the broader sector, each sporting a Zacks Rank #1 (Strong Buy) at present. You can see the complete list of today’s Zacks #1 Rank stocks here.

CDAY and META shares have returned 0.4% and 171.8%, respectively, in the past 12 months. BL shares have declined 19.1%.

Long-term earnings growth rates for BlackLine, Ceridian HCM and Meta Platforms are pegged at 50.56%, 44.15% and 21.34%, respectively.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

OSI Systems, Inc. (OSIS) : Free Stock Analysis Report

BlackLine (BL) : Free Stock Analysis Report

Ceridian HCM (CDAY) : Free Stock Analysis Report

Meta Platforms, Inc. (META) : Free Stock Analysis Report