OTIS Benefits From R&D Investments Despite China Market Woes

Otis Worldwide Corporation OTIS is reaping the benefits of substantial investments in research and development (R&D), coupled with robust growth in orders and backlog within the New Equipment sector. Furthermore, the Service segment's notable contributions are further enhancing its upward trajectory.

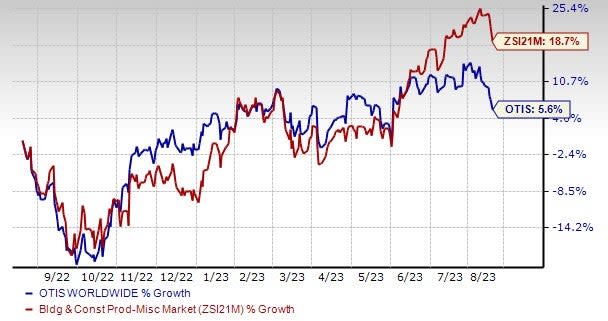

Although shares of OTIS have underperformed the Zacks Building Products - Miscellaneous industry over the past year, earnings estimates have been trending upward. The Zacks Consensus Estimate for earnings per share (EPS) has moved upward over the past 30 days to $3.47 from $3.45. This depicts analysts’ optimism about the stock’s potential. The estimated figure indicates 9.5% year-over-year growth.

Recently, Otis reported impressive second-quarter 2023 results, wherein earnings and sales surpassed the Zacks Consensus Estimate. Its quarterly results reflected 11th consecutive quarters of organic sales growth and solid operating margin expansion contributing to mid-single-digit adjusted EPS growth.

Image Source: Zacks Investment Research

What is Favoring OTIS?

Focus on Innovation: At the core of Otis' strategic approach lies a strong commitment to innovation. The company unifies its worldwide research and development (R&D) endeavors through a dynamic operational model that aligns global and local priorities with the specific demands of customers and market segments. At 2022-end, Otis established 11 cutting-edge R&D centers and 17 manufacturing facilities spanning the globe, strategically concentrated in China, India, France, Spain, and the United States. These strategic placements facilitate the efficient creation of engineering solutions.

As of Dec 31, 2022, the company owned approximately 4,200 globally issued patents and nearly 2,300 patent applications were pending globally, of which 1,300 applications were filed in the last three years. It expects to continue innovating and expanding the digital ecosystem and a suite of digital solutions for both existing service portfolio customers and new equipment shipments from factories.

Solid Backlog: The company remains focused on strong portfolio growth and generating a solid New Equipment backlog. In the second quarter of 2023, the New Equipment adjusted backlog at constant currency increased 5% year over year and 3% sequentially.

The Service segment of OTIS also contributed to the second quarter of 2023 performance. Service’s net sales grew 8.3% to $2.12 billion and adjusted revenues improved 8.8% year over year. A 9.4% rise in organic sales was offset by a 1.1% headwind from foreign exchange. Meanwhile, organic maintenance and repair sales grew 9.1% and organic modernization sales rose 10.9% in the second quarter from the prior-year quarter.

Upbeat View: Given solid performance in the first half of 2023 and with confidence in strategic execution, OTIS lifted its guidance, both top and bottom lines, on the second-quarter earnings call.

For 2023, the company expects adjusted net sales to be within $14-14.3 billion. The new projection indicates 3.5-5.5% year-over-year growth (2.5-4.5% growth expected earlier). Organic sales growth is now projected to be between 4.5 and 6% (up 3-5% for New Equipment and up 6-7% for Service). Adjusted operating profit is projected to be up $155 to $175 million at constant currency.

Adjusted EPS is now anticipated to be $3.45-$3.50 versus $3.40-$3.50 expected earlier. The updated outlook suggests 9-10% year-over-year growth.

Headwinds

Dependency on Chinese Market: Roughly 71.5% of Otis' total net sales originated from its international ventures. Presently, the primary destination for Otis' New Equipment business is China. In the first half of 2023, approximately 17.5% of the overall net sales were attributed to China. However, during the second quarter of 2023, the pricing of New Equipment experienced a decrease in the low-single digits within the Chinese market. This decrease was driven by deflationary pressures and a relatively softer market environment. For 2023, OTIS now expects this market to be down 10% versus 5-10% expected earlier. The downside was due to a weaker run rate than anticipated during the second quarter.

Currency Woes: Otis is exposed to fluctuations in foreign currency exchange rates owing to international sales, purchases, investments and other transactions. In the first half of 2023, foreign exchange reduced net sales by 3.2% year over year. For the remainder of 2023, it expects headwinds from foreign exchange translation to impact sales.

Zacks Rank and Key Picks

Currently, OTIS carries a Zacks Rank #3 (Hold).

Some better-ranked stocks from the Construction sector are EMCOR Group, Inc. EME, TopBuild Corp. BLD and Meritage Homes Corporation MTH.

EMCOR currently sports a Zacks Rank of 1 (Strong Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

EME delivered a trailing four-quarter earnings surprise of 17.2%, on average. Shares of the company have surged 74.3% in the past year. The Zacks Consensus Estimate for EME’s 2023 sales and EPS indicates growth of 11.5% and 35.9%, respectively, from the previous year’s reported levels.

TopBuild currently sports a Zacks Rank of 1. BLD delivered a trailing four-quarter earnings surprise of 14.1%, on average. Shares of the company have rallied 43.2% in the past year.

The Zacks Consensus Estimate for BLD’s 2023 sales and EPS indicates growth of 3.4% and 4.6%, respectively, from the previous year’s reported levels.

Meritage Homes currently sports a Zacks Rank of 1. MTH delivered a trailing four-quarter earnings surprise of 24.1%, on average. Shares of the company have gained 61.6% in the past year.

The Zacks Consensus Estimate for MTH’s 2023 sales and EPS indicates a decline of 7.9% and 35.1%, respectively, from the previous year’s reported levels.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

EMCOR Group, Inc. (EME) : Free Stock Analysis Report

Meritage Homes Corporation (MTH) : Free Stock Analysis Report

TopBuild Corp. (BLD) : Free Stock Analysis Report

Otis Worldwide Corporation (OTIS) : Free Stock Analysis Report