Otis (OTIS) Q3 Earnings Beat, Modernization Orders Up 13%

Otis Worldwide Corporation OTIS reported impressive results in third-quarter 2023. Its earnings and net sales surpassed the Zacks Consensus Estimate and rose on a year-over-year basis. Its quarterly results reflected 12 consecutive quarters of organic sales growth and solid operating margin expansion, contributing to high-teens adjusted earnings per share (“EPS”) growth.

The company remains focused on strong portfolio growth and generating a solid New Equipment and Modernization backlog. It also intends to expand operating margins, return cash to shareholders through a capital-allocation strategy and pursue additional progress toward ESG goals.

Shares of this elevator and escalator manufacturing company declined 1.66% in the pre-market trading session on Oct 25.

Earnings & Revenue Discussion

The company reported quarterly earnings of 95 cents per share, surpassing the consensus estimate of 87 cents by 9.2% and increasing 18.8% from the year-ago quarter’s figure of 80 cents. The upside was mainly driven by operational improvement, a lower share count and effective tax rate improvement.

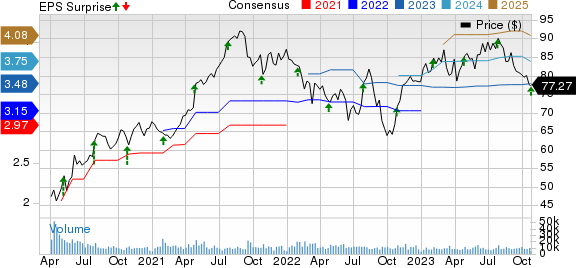

Otis Worldwide Corporation Price, Consensus and EPS Surprise

Otis Worldwide Corporation price-consensus-eps-surprise-chart | Otis Worldwide Corporation Quote

Net sales of $3.52 billion topped the consensus mark of $3.48 million by 1.2% and rose 5.4% on a year-over-year basis. Adjusted net sales grew 5.9% year over year. Organically, net sales rose 5.2% year over year for the quarter. Currency headwinds benefited sales by 0.6%.

Adjusted operating margin expanded 60 basis points (bps) to 16.9% from the year-ago period’s level, backed by the Service unit’s favorable performance and segment mix, partially offset by headwinds in corporate costs. Our model predicted the adjusted operating margin to expand 30 bps year over year to 16%.

Segment Details

New Equipment’s net sales of $1.44 billion fell 0.8%, but adjusted net sales remained stable from the prior-year period. A 1% increase in organic sales was partially offset by a 0.9% headwind from foreign exchange. Our model predicted organic sales for the New Equipment segment to grow 5.2% in the quarter.

New Equipment orders were down 10% at constant currency. Growth in EMEA and Asia Pacific was more than offset by softness in the Americas and China.

The New Equipment’s adjusted backlog at constant currency increased by 2% year over year.

Adjusted operating margin was flat year over year at 7.2%.

Service’s net sales increased 10.1% to $2.09 billion and adjusted revenues surged 10.3% year over year. An 8.4% rise in organic sales and an 8.4% benefit from foreign exchange helped the top line. Organic maintenance and repair sales grew 8.6% and organic modernization sales rose 7.6% from the prior-year quarter. Our model predicted organic sales for the Service segment to grow 6.6% in the quarter.

Modernization orders were up 13% at constant currency during the reported quarter. Modernization backlog at constant currency increased by 15% year over year.

Adjusted operating margin registered an improvement of 90 bps year over year to 24.8%, driven by higher volume, favorable pricing and productivity, partially offset by labor inflation and higher material costs.

Financial Position

Otis had cash and cash equivalents of $1.64 billion as of Sep 30, 2023. This compares unfavorably with the 2022-end figure of $1.19 billion. Long-term debt was $6.82 billion as of Sep 30, 2023, up from $6.1 billion at 2022-end.

Net cash flows provided by operating activities were $306 million for the September quarter, up from $239 million a year ago.

Free cash flow (“FCF”) totaled $272 million for the quarter, up from $215 million a year ago.

2023 Guidance Revised

For 2023, the company now expects adjusted net sales to be nearly $14.1 billion compared with $14-14.3 billion expected earlier. The new projection indicates approximately 4% versus 3.5-5.5% growth expected earlier. Organic sales growth is projected to be 5.5% (up 3% for New Equipment and up 7.5% for Service).

Adjusted operating profit is projected to be up $170 million at constant currency versus $155-$175 million expected earlier.

Adjusted EPS is now anticipated to be $3.52 versus $3.45-$3.50 expected earlier. The updated outlook suggests 11% year-over-year growth.

FCF is expected to be $1.5 billion.

Zacks Rank & Some Recent Construction Releases

Otis currently carries a Zacks Rank #3 (Hold). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Watsco, Inc. WSO reported better-than-expected third-quarter 2023 results, with earnings and revenues topping the Zacks Consensus Estimate.

Watsco delivered record sales and earnings per share, driven by solid HVAC equipment sales growth, improved residential unit volumes and strong price realization. Also, the commercial end markets remained healthy in the quarter.

Acuity Brands, Inc. AYI reported mixed results for fourth-quarter fiscal 2023 (ended Aug 31, 2023), with earnings surpassing the Zacks Consensus Estimate and revenues missing the same. Earnings beat the consensus mark for the 14th consecutive quarter. Revenues missed the same for four quarters in a row following six straight quarters of beat.

Despite a sales decline in the lighting business, AYI reported strong fiscal fourth-quarter performance, driven by an increased focus on margins and cash generation. This approach resulted in a higher adjusted operating profit margin and increased adjusted diluted earnings per share.

RPM International Inc. RPM reported first-quarter fiscal 2024 (ended Aug 31, 2023) results, with earnings and sales beating the Zacks Consensus Estimate.

The company reported solid quarterly results, with record-breaking sales and an all-time high in adjusted EBIT. This remarkable achievement represents the seventh consecutive quarter of setting new records in both quarterly sales and adjusted EBIT. Its growth was driven by its focus on achieving the margin goals outlined in MAP 2025 and effectively utilizing its competitive advantages.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Watsco, Inc. (WSO) : Free Stock Analysis Report

RPM International Inc. (RPM) : Free Stock Analysis Report

Acuity Brands Inc (AYI) : Free Stock Analysis Report

Otis Worldwide Corporation (OTIS) : Free Stock Analysis Report