Otter Tail Corp (OTTR) Announces Record Annual Earnings and Increased Dividend

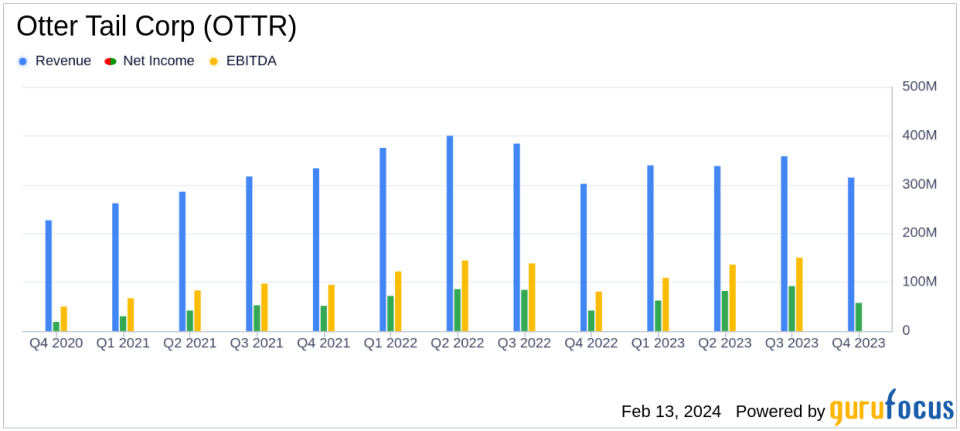

Operating Revenues: Decreased by 8% to $1.3 billion in 2023 from $1.46 billion in 2022.

Net Income: Increased by 4% to $294.2 million in 2023 from $284.2 million in 2022.

Diluted Earnings Per Share (EPS): Increased by 3% to $7.00 in 2023 from $6.78 in 2022.

Quarterly Dividend: Increased by 7% to an indicated annual rate of $1.87 per share in 2024.

2024 Earnings Guidance: Diluted EPS guidance range of $5.13 to $5.43.

Capital Expenditure Plan: Updated 5-year plan to $1.3 billion, expecting a 7.7% compounded annual rate base growth.

Liquidity: Total available liquidity of $479.8 million as of December 31, 2023.

This Powerful Chart Made Peter Lynch 29% A Year For 13 Years

How to calculate the intrinsic value of a stock?

On February 12, 2024, Otter Tail Corp (NASDAQ:OTTR) released its 8-K filing, announcing its financial results for the quarter and year ended December 31, 2023. The U.S. energy company, which operates primarily in the electric, manufacturing, and plastics segments, reported a decrease in operating revenues but an increase in net income and diluted earnings per share compared to the previous year. The majority of Otter Tail Corp's revenue is derived from its Electric segment and commercial customers, with significant operations in Minnesota, South Dakota, and North Dakota.

Financial Performance and Challenges

Otter Tail Corp's performance in 2023 was marked by record earnings, attributed to the recovery of rate base investments and increased commercial and industrial sales in the Electric segment. The Manufacturing segment saw modest earnings growth, while the Plastics segment experienced a slight decline due to decreased sales volumes. Despite the challenges in the Plastics segment, Otter Tail Corp capitalized on favorable industry conditions, resulting in strong financial results compared to pre-2021 levels. The company's financial achievements are particularly noteworthy in the Utilities - Regulated industry, where consistent performance and reliable dividends are highly valued by investors.

President and CEO Chuck MacFarlane highlighted the company's diversified business model and strategic investments as key drivers of the 2023 success. MacFarlane stated,

Electric segment earnings grew 6 percent compared to 2022, driven by the recovery of rate base investments and increased commercial and industrial sales."

He also emphasized the company's financial strength and the absence of a need for additional equity financing to fund capital expenditures over the next five years.

Key Financial Metrics and Analysis

Otter Tail Corp's financial strength is further evidenced by its robust cash flow. The company's consolidated cash provided by operating activities reached a record $404.5 million in 2023, an increase from $389.3 million in 2022. This increase was primarily due to a $10.0 million increase in net income and a decrease in pension plan contributions. The company's capital expenditures of $287.1 million in 2023 were mainly directed towards investments within the Electric segment, including the purchase of the Ashtabula III wind farm and investments in solar and wind projects.

The company's balance sheet remains strong, with $249.4 million of available liquidity under credit facilities and $230.4 million of available cash and cash equivalents. The Electric segment's operating revenues decreased by 3.9% to $528.4 million, while net income increased by 5.6% to $84.4 million. The Manufacturing segment's operating revenues increased by $4.8 million, and net income increased by $0.5 million. The Plastics segment, however, saw operating revenues decrease by $94.5 million and net income decrease by $7.6 million.

Otter Tail Corp's 2024 business outlook includes an anticipated diluted earnings per share range of $5.13 to $5.43, with an expected earnings mix of approximately 41% from the Electric segment and 59% from the Manufacturing and Plastics segments. The company's capital expenditure plan for the next five years is expected to drive growth in the Electric segment earnings, with a compounded annual growth rate on average rate base of 7.7%.

In conclusion, Otter Tail Corp's 2023 earnings report reflects a company that is navigating industry challenges while maintaining financial discipline and strategic growth. The increase in net income and EPS, along with the strong cash flow and increased dividend, position Otter Tail Corp favorably for continued success in the Utilities - Regulated industry. Investors and potential members of GuruFocus.com should consider the resilience and growth potential of Otter Tail Corp as part of their value investment strategy.

For a detailed analysis of Otter Tail Corp's financial results and future outlook, interested parties can access the full earnings release and join the live webcast on February 13, 2024, at 10:00 a.m. CT at www.ottertail.com/presentations.

Explore the complete 8-K earnings release (here) from Otter Tail Corp for further details.

This article first appeared on GuruFocus.