Outfront Media Inc. Reports Modest Revenue Growth Amidst Industry Challenges

Revenue Growth: Q4 revenues increased by 1.3% year-over-year to $501.2 million.

Net Income: Net income attributable to OUT reached $60.4 million in Q4, a slight increase from the previous year.

Earnings Per Share: Diluted earnings per share for Q4 rose to $0.35, up from $0.34 year-over-year.

Adjusted OIBDA: Q4 saw a slight decrease in Adjusted OIBDA to $151.7 million.

AFFO Growth: Adjusted Funds From Operations (AFFO) increased by 12.5% to $108.1 million in Q4.

Dividend Announcement: OUT declared a quarterly dividend of $0.30 per share, payable on March 28, 2024.

Liquidity and Debt: As of December 31, 2023, liquidity included $36.0 million in cash and $493.5 million available under the revolving credit facility.

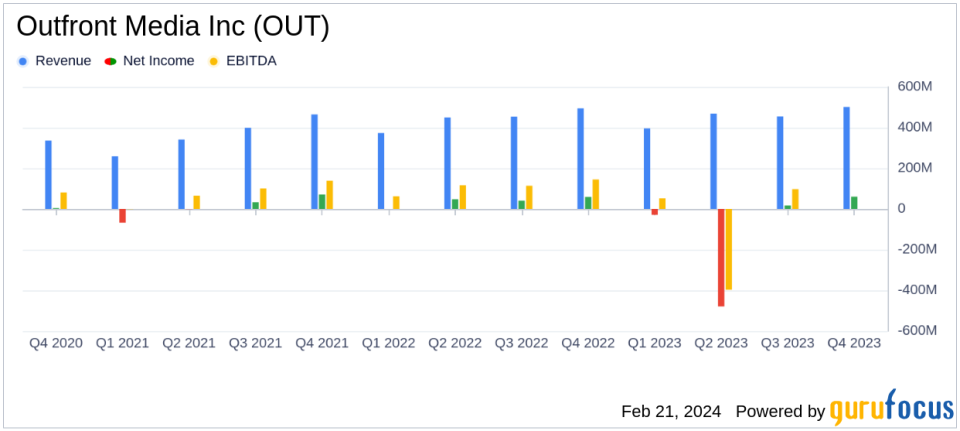

On February 21, 2024, Outfront Media Inc (NYSE:OUT) released its 8-K filing, detailing the financial outcomes for the fourth quarter and the full year of 2023. OUT, a leading real estate investment trust specializing in advertising space on billboards and transit displays, reported a year of resilience and modest growth despite industry challenges.

For the fourth quarter, OUT reported revenues of $501.2 million, marking a 1.3% increase from the same period in the previous year. This growth was attributed to the strength in local business and automated sales channels. The company's net income attributable to Outfront Media Inc. also saw a slight uptick, reaching $60.4 million, or $0.35 per diluted share, compared to $59.2 million, or $0.34 per diluted share, in the fourth quarter of 2022.

Adjusted OIBDA for the quarter was $151.7 million, a minor decrease from the $153.7 million reported in the prior year's quarter. However, the company's Adjusted Funds From Operations (AFFO) showed a notable increase of 12.5% to $108.1 million, reflecting the company's ability to manage its funds effectively.

OUT's Chairman and CEO, Jeremy Male, commented on the results:

"We were pleased to finish the year with our fourth quarter revenues at the higher end of guidance as a result of strength in our local business and automated sales channels, which offset the headwind created by the media strikes. While it is still early in 2024, our business is accelerating and we expect that OUTFRONT, and the entire out-of-home industry, will benefit from a strong media market this year."

Despite the positive revenue and net income figures, the company faced challenges, including a decrease in transit and other revenues by 4.4% due to a drop in average revenue per display. Additionally, OUT recorded impairment charges related to its U.S. Transit and Other reporting unit, primarily concerning the MTA asset group, amounting to $11.2 million for the quarter.

The balance sheet showed a solid liquidity position, with $36.0 million in unrestricted cash and significant availability under credit facilities. Total indebtedness stood at $2.8 billion, excluding deferred financing costs.

Looking ahead, OUT is optimistic about the out-of-home advertising industry's prospects and its position within the market. The company's focus on leveraging technology and creativity to connect brands with consumers continues to be a core strategic element.

For more detailed financial information and the full earnings report, investors and interested parties are encouraged to review the complete 8-K filing provided by Outfront Media Inc.

Explore the complete 8-K earnings release (here) from Outfront Media Inc for further details.

This article first appeared on GuruFocus.