Outset Medical Inc (OM) Reports Mixed Q4 and Full Year 2023 Results

Annual Revenue Increase: Outset Medical Inc (NASDAQ:OM) reported a 13% year-over-year increase in annual revenue to $130.4 million.

Gross Margin Improvement: Gross margin improved significantly in Q4, reaching 25.3% compared to 16.5% in the same quarter of the previous year.

Net Loss Reduction: The company reduced its net loss to ($38.6) million in Q4, compared to ($41.4) million in Q4 of the previous year.

Recurring Revenue Growth: Recurring revenue from Tablo consumables and services exceeded 50% of total revenue in 2023.

Installed Base Expansion: The Tablo installed base grew by 34% to 5,350 consoles by the end of 2023.

2024 Financial Guidance: Outset Medical reaffirmed its 2024 revenue guidance of $145 million to $153 million, with non-GAAP gross margin in the low-30% range.

On February 21, 2024, Outset Medical Inc (NASDAQ:OM) released its 8-K filing, detailing the financial results for the fourth quarter and full year ended December 31, 2023. The company, known for its innovative Tablo Hemodialysis System designed to simplify and reduce the cost of dialysis, has shown a mixed financial performance with revenue growth and margin expansion, despite a quarterly revenue decrease and a net loss.

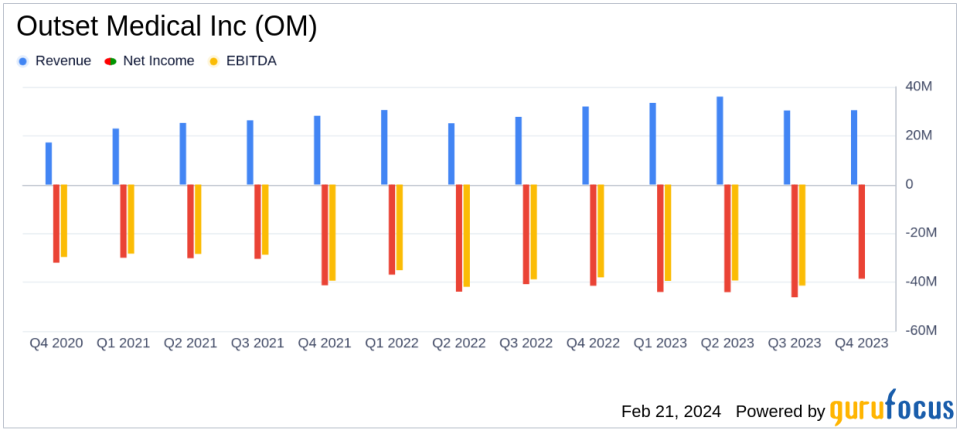

Outset Medical Inc (NASDAQ:OM) reported a 13% increase in annual revenue, reaching $130.4 million in 2023, up from $115.4 million in 2022. The fourth quarter, however, saw a slight decrease in net revenue to $30.5 million, a 4.7% drop compared to the same period in the previous year. The company's gross margin saw a substantial increase in the fourth quarter, reaching 25.3%, a significant improvement from the 16.5% reported in the fourth quarter of 2022.

Despite the revenue dip in Q4, the company's focus on recurring revenue streams paid off, with over 50% of the total revenue in 2023 coming from Tablo consumables and services. The installed base of Tablo consoles grew to 5,350 units, indicating a solid expansion in both acute and home care settings.

Operating expenses remained flat year-over-year at $45.1 million for the quarter, with research and development (R&D) expenses slightly increasing. The net loss for Q4 improved to ($38.6) million, or ($0.77) per share, from a net loss of ($41.4) million, or ($0.86) per share, in the same period of the previous year.

Outset Medical Inc (NASDAQ:OM) ended the year with a strong balance sheet, with total cash, cash equivalents, and short-term investments of $206.7 million as of December 31, 2023, although this was down from $290.8 million at the end of 2022.

The company's CEO, Leslie Trigg, commented on the financial results, emphasizing the growth in the Tablo installed base and the increase in consumable revenue.

We exited 2023 with a record 50% recurring revenue, fourth-quarter gross margin expanding nearly 9 percentage points, and a strong balance sheet to continue to fund our growth. We are proud of the difference Tablo and our team made in 2023 to help providers save substantially on the cost to deliver life-sustaining dialysis, and patients regain control that has been historically lost with their diagnosis,

said Trigg.

Looking ahead, Outset Medical Inc (NASDAQ:OM) has reaffirmed its financial guidance for 2024, projecting revenue growth of 12% to 18% and aiming for a non-GAAP gross margin in the low-30% range, with expectations to exit the year in the mid-30% range.

For a more detailed analysis of Outset Medical Inc (NASDAQ:OM)'s financial performance and future prospects, investors and interested parties can access the full earnings report and join the company's conference call and webcast.

Outset Medical Inc (NASDAQ:OM) is at a pivotal point, with its innovative Tablo system poised to disrupt the dialysis market. The company's ability to increase its installed base and grow recurring revenue streams is a testament to the value proposition of its technology. However, the decrease in Q4 revenue and the ongoing net losses highlight the challenges the company faces in a competitive and cost-conscious healthcare market.

Value investors may find Outset Medical Inc (NASDAQ:OM)'s improving gross margins and expanding market presence appealing, but will also need to consider the company's path to profitability and the management of operating expenses. As the company continues to invest in growth and innovation, its financial trajectory will be closely watched by stakeholders and potential investors alike.

For further information and to stay updated on Outset Medical Inc (NASDAQ:OM)'s financial developments, visit GuruFocus.com.

Explore the complete 8-K earnings release (here) from Outset Medical Inc for further details.

This article first appeared on GuruFocus.