Outsourcing Industry Up 15.6% in a Year: 3 Stocks to Buy

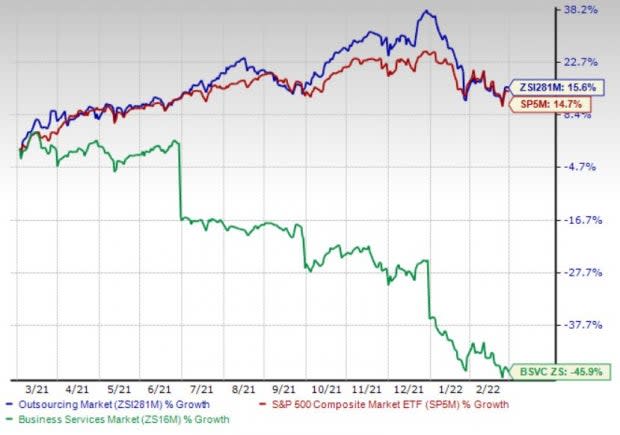

The Zacks Outsourcing industry has gained 15.6% over the past year, outperforming the S&P 500 Index’s 14.7% appreciation. The same came against the 45.9% decline of the broader Zacks Business Services sector.

Image Source: Zacks Investment Research

The industry stands to benefit from the increased adoption of cloud computing and other emerging technologies. These factors drive competitive advantage, increase innovation, improve speed-to-market and boost performance within the industry. Further, wider application of artificial intelligence should lower complications and simplify operations. Industry players are in the process of modernizing their traditional legacy-oriented business processes to keep themselves flexible in any kind of operating environment.

Rising demand for expertise in improving efficiency and reducing costs has been aiding the industry over the past several years. The industry has witnessed growth in revenues, income and cash flow over the past few years, enabling most players to pursue acquisitions and other investments as well as pay out stable dividends.

Automatic Data Processing, Inc.ADP, Paychex, Inc. PAYX and The Brink's Company BCO are some of the stocks that are likely to gain from the above-mentioned favorable industry trends. However, escalating data security issues, thanks to excessive dependency on technology, are concerns for the industry.

3 Outsourcing Stocks to Bet on

Adding stocks from the industry looks like a smart move to enhance your portfolio. The buoyancy in the industry is further confirmed by its Zacks Industry Rank #77, which places it in the top 30% of more than 250 Zacks industries.

Here we present three promising Zacks Rank #2 (Buy) outsourcing stocks, which have a solid expected earnings growth rate for the current year, witnessed upward estimate revisions in the past 90 days and have a strong trailing four-quarter average earnings surprise history. You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

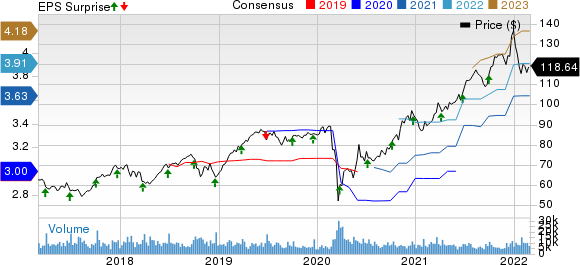

Automatic Data Processing: This New Jersey-based provider of cloud-based human capital management solutions raised its fiscal 2022 outlook. ADP now expects revenues to register 8-9% growth from the prior growth projection of 7-8%. Adjusted EPS is now expected to register 12-14% growth from the previous expected growth rate of 11-13%. Employer Services revenues are now expected to grow at about 6% from the earlier expected growth rate of 5-6%. PEO Services revenue growth rate is expected in the range of 13-15% compared with the expected prior growth rate of 11-13%.

Despite the continuous impact of the COVID-19 pandemic, Automatic Data Processing remains strong backed by its momentum in sales, client satisfaction and client retention. Higher operating revenues and effective cost-containment measures helped ADP improve its margin performance. ADP continues to enjoy a dominant position in the human capital management market through strategic buyouts like Celergo, WorkMarket, Global Cash Card and The Marcus Buckingham Company. The industry player has a strong business model, high recurring revenues, sturdy margins, robust client retention and low capital expenditures.

The Zacks Consensus Estimate for ADP’s 2022 EPS has moved up 0.9% in the past 90 days. Its expected earnings growth rate for the year is 13.3%. Additionally, it has a long-term (three to five years) expected earnings growth rate of 12%. Automatic Data Processing has a trailing four-quarter earnings surprise of 5.5%, on average. Its shares have gained 16% over the past year.

ADP has a market capitalization of $85.87 billion.

Automatic Data Processing, Inc. Price, Consensus and EPS Surprise

Automatic Data Processing, Inc. price-consensus-eps-surprise-chart | Automatic Data Processing, Inc. Quote

Paychex: This New York-based provider of integrated human capital management solutions for human resources, payroll, benefits and insurance services for small- to medium-sized businesses in the United States and Europeraised guidance for fiscal 2022. Total revenues are now expected to register 10-11% growth from the prior expectation of an 8% rise. Adjusted earnings per share are now expected to record 18-20% growth from the prior expectation of 12-14% increase. Management Solutions revenues are now expected to grow 10-11% from the prior expectation of 8% improvement. Adjusted operating margin is expected to be almost 39-40% compared with the prior expectation of 38-39%. The adjusted EBITDA margin is now expected to be nearly 44% compared with the prior expectation of 43%.

Amid a challenging scenario, Paychex continued enjoying higher revenues per client resulting from an improved price realization, growth in client bases across HCM and ancillary products resulting from a strong sales performance and high levels of retention, improved market conditions on asset-based revenues for retirement services and an increased funding for temporary staffing clients. An increased number of average worksite employees, impact of higher average wages per worksite employee, better revenues on state unemployment insurance and a rise in PEO health insurance revenues act as other tailwinds. Additionally, cost-saving initiatives led to a sequential improvement of margins. Acquisitions expanded Paychex's customer base and generated cost and revenue synergies. Consistency in rewarding shareholders through dividend payments and share repurchases boost investor confidence and positively impact earnings per share.

The Zacks Consensus Estimate for Paychex’s 2022 EPS has improved 5.2% in the past 90 days. PAYX’s expected earnings growth rate for the year is 19.7%. Additionally, the industry participant has a long-term (three to five years) expected earnings growth rate of 7.5%. PAYX has a trailing four-quarter earnings surprise of 8.9%, on average. The stock has gained 27.6% over the past year.

Paychex has a market capitalization of $42.95 billion.

Paychex, Inc. Price, Consensus and EPS Surprise

Paychex, Inc. price-consensus-eps-surprise-chart | Paychex, Inc. Quote

The Brink's Company: This Virginia-based entity provides secure transportation, cash management and other security-related services in North America, Latin America, Europe and internationally. Acquisitions and sustainable cost reductions helped BCO witness growth amid COVID-induced market uncertainties. Margin improvements should boost BCO’s bottom line. Further, the industry player is hopeful of witnessing contributions from its acquisitions in 2022.

The Zacks Consensus Estimate for Brink's 2022 EPS has improved 0.4% in the past 90 days. BCO’s expected earnings growth rate for the year is 20%. Its trailing four-quarter earnings surprise is 22.5%, on average.

Brink's has a market capitalization of $3.44 billion.

Brink's Company The Price, Consensus and EPS Surprise

Brink's Company The price-consensus-eps-surprise-chart | Brink's Company The Quote

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Paychex, Inc. (PAYX) : Free Stock Analysis Report

Automatic Data Processing, Inc. (ADP) : Free Stock Analysis Report

Brink's Company The (BCO) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research