Overstock.com Inc's Meteoric Rise: Unpacking the 50% Surge in Just 3 Months

Overstock.com Inc (NASDAQ:OSTK) has seen a significant surge in its stock price over the past three months. The company's market cap stands at $1.22 billion, with its current price at $26.95, a substantial increase from its price of $19.61 three months ago. Over the past week, the stock price has seen a gain of 13.02%, and over the past three months, it has seen a gain of 49.53%. The GF Value, defined by GuruFocus.com, calculates a stock's intrinsic value using historical multiples, past performance adjustments, and future business estimates. Currently, the GF Value of Overstock.com Inc is $30.09, down from $38.66 three months ago. According to the GF Valuation, the stock is modestly undervalued, a shift from its status as a possible value trap three months ago.

Company Overview

Overstock.com Inc operates in the Retail - Cyclical industry. The company is an online retailer that provides products and services through websites. It offers a broad range of products, including furniture, decor, area rugs, bedding and bath, home improvement, outdoor, and kitchen and dining items, BMMG (like books, magazines, CDs), electronics, and other items. The home and garden product line account for a material part of its total revenue. The company operates through a direct business that makes sales from the company's own inventory, and a partner business that sells merchandise from manufacturers, distributors, and other suppliers through the company's websites. The majority of its total revenue comes from the partner business in terms of business format, and from the U.S. in terms of market.

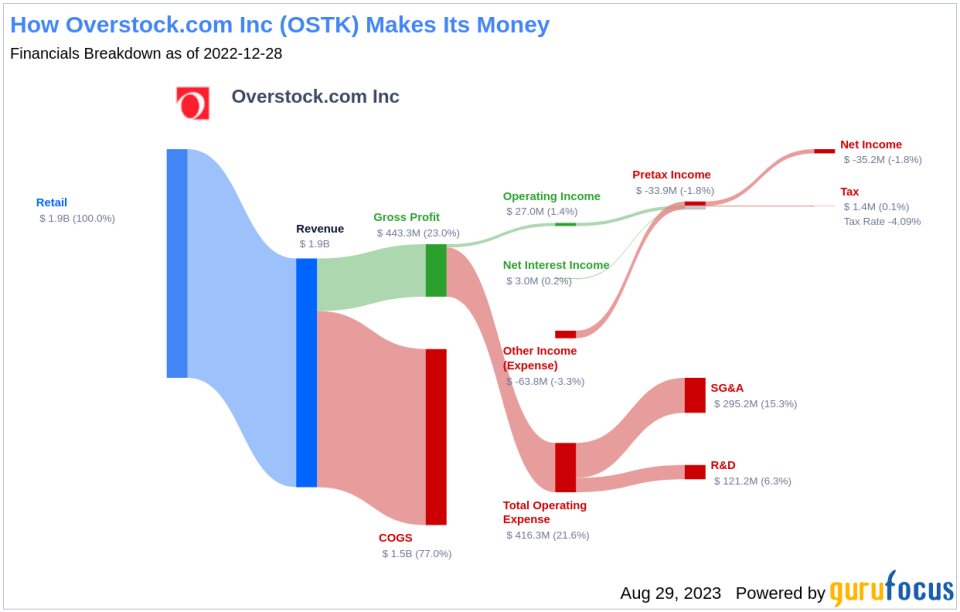

Profitability Analysis

Overstock.com Inc's Profitability Rank is 4/10 as of 2023-06-30, indicating a moderate level of profitability. The company's Operating Margin is -0.58%, which is better than 27.28% of the companies in the industry. Its ROE is -21.00%, better than 12.71% of the companies in the industry, and its ROA is -15.03%, better than 9.77% of the companies in the industry. The company's ROIC is -1.64%, better than 24.37% of the companies in the industry. Over the past decade, the company has had 6 years of profitability, which is better than 39.98% of the companies in the industry.

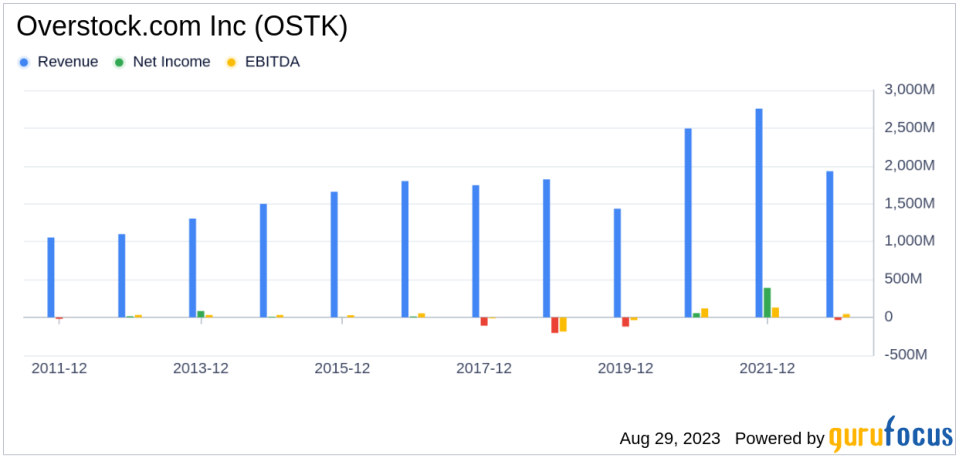

Growth Prospects

The company's Growth Rank is 2/10, indicating a low level of growth. Its 3-Year Revenue Growth Rate per Share is 1.90%, better than 44.32% of the companies in the industry. However, its 5-Year Revenue Growth Rate per Share is -5.10%, which is better than 29.57% of the companies in the industry. The company's 3-Year EPS without NRI Growth Rate is 22.90%, which is better than 64.73% of the companies in the industry.

Major Stock Holders

Jim Simons (Trades, Portfolio) is the top holder of Overstock.com Inc's stock, holding 755,800 shares, which accounts for 1.67% of the company's shares. Chuck Royce (Trades, Portfolio) holds the second-largest number of shares, with 355,250 shares, accounting for 0.79% of the company's shares. Paul Tudor Jones (Trades, Portfolio) holds 51,453 shares, accounting for 0.11% of the company's shares.

Competitive Landscape

Overstock.com Inc faces competition from several companies in the same industry. Farfetch Ltd (NYSE:FTCH) has a stock market cap of $1.13 billion, Revolve Group Inc (NYSE:RVLV) has a stock market cap of $1.09 billion, and Dada Nexus Ltd (NASDAQ:DADA) has a stock market cap of $1.41 billion.

Conclusion

In conclusion, Overstock.com Inc has seen a significant surge in its stock price over the past three months. The company's profitability rank and growth rank indicate moderate profitability and low growth. However, the company's operating margin, ROE, ROA, and ROIC are better than a significant percentage of companies in the industry. The company's top holders include Jim Simons (Trades, Portfolio), Chuck Royce (Trades, Portfolio), and Paul Tudor Jones (Trades, Portfolio). The company faces competition from Farfetch Ltd, Revolve Group Inc, and Dada Nexus Ltd. Despite the challenges, the company's current position and future prospects look promising.

This article first appeared on GuruFocus.