Owens-Corning Inc Reports Full-Year Net Sales of $9.7 Billion and Adjusted EBIT of $1.8 Billion

Net Sales: Reported $9.7 billion for the full year, a slight decrease from the previous year.

Adjusted EBIT Margins: Expanded to 19% for the year, demonstrating improved profitability.

Diluted EPS: Delivered $13.14, with an adjusted diluted EPS of $14.42.

Free Cash Flow: Generated $1.2 billion, returning 68% to shareholders through dividends and share repurchases.

Strategic Moves: Announced acquisition of Masonite International Corporation and a review of strategic alternatives for its global glass reinforcements business.

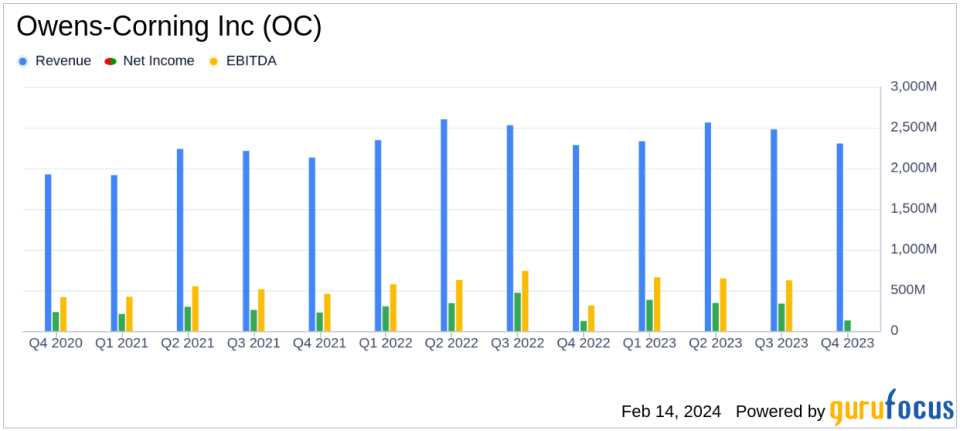

Owens-Corning Inc (NYSE:OC) released its 8-K filing on February 14, 2024, detailing its financial performance for the fourth quarter and full year of 2023. The company, a leading manufacturer of glass fiber utilized in composites and building materials, reported a slight decrease in net sales to $9.7 billion compared to the previous year. However, it expanded its adjusted EBIT margins to 19% and adjusted EBITDA margins to 24%, indicating improved profitability.

Financial Performance and Strategic Developments

Owens-Corning Inc's performance in 2023 was marked by robust earnings despite a marginal decline in net sales. The company's net earnings attributable to OC stood at $1.2 billion, a 4% decrease from the previous year. Adjusted EBIT and EBITDA saw increases of 2%, reaching $1.8 billion and $2.3 billion, respectively. The diluted EPS increased by 3% to $13.14, with an adjusted diluted EPS showing a more significant rise of 12% to $14.42.

OC's enterprise strategy included the acquisition of Masonite International Corporation, which is expected to strengthen its position in the building and construction materials sector. Additionally, the company is exploring strategic alternatives for its global glass reinforcements business, which generates approximately $1.3 billion in annual revenue. These strategic moves are in line with OC's focus on its core business segments and long-term success.

Segment Performance and Outlook

The Roofing segment saw a 10% increase in net sales to $4.0 billion, driven by strong demand and favorable pricing. The Insulation segment experienced a slight decrease in net sales to $3.7 billion, while the Composites segment faced a 14% decline to $2.3 billion due to lower volumes and the impact of divestitures and acquisitions.

Looking ahead to the first quarter of 2024, Owens-Corning Inc anticipates net sales to be slightly below those of the first quarter of 2023, with mid-teens margins expected. The company's financial outlook for 2024 includes general corporate expenses of $240 million to $250 million, interest expenses of $70 million to $80 million, and an effective tax rate on adjusted earnings of 24% to 26%. Capital additions are projected to be approximately $550 million, with depreciation and amortization expected to be around the same figure.

Value Creation and Shareholder Returns

OC's strong earnings and disciplined capital allocation resulted in $1.2 billion of free cash flow, with a significant portion returned to shareholders. The company paid dividends of $188 million and repurchased 5.4 million shares of common stock for $624 million. In December 2023, the Board of Directors declared a 15% increase in quarterly cash dividends, reflecting the company's commitment to shareholder returns.

"In 2023, the strength of our earnings and disciplined capital allocation resulted in $1.2 billion of free cash flow, with 68% returned to shareholders through share repurchases and dividends," said Executive Vice President and Chief Financial Officer Todd Fister. "As we look forward to 2024, we remain committed to maintaining our investment grade balance sheet, investing in attractive acquisitions and capital projects to continue to grow our earnings power, and returning 50% of free cash to shareholders over time."

Owens-Corning Inc's performance in 2023 demonstrates the company's resilience and strategic focus on value creation. Despite slight headwinds in net sales, the company's expanded margins and robust earnings reflect its strong market position and effective management. The strategic acquisition and review of business segments indicate a forward-looking approach to growth and leadership in the building and construction materials industry. For value investors, OC's commitment to returning capital to shareholders and its strategic initiatives present a compelling case for consideration.

Explore the complete 8-K earnings release (here) from Owens-Corning Inc for further details.

This article first appeared on GuruFocus.