Owens Corning (OC) Up 47% in Six Months: More Room to Run?

Owens Corning OC is poised to benefit from robust insulation and the Roofing segment. Also, its focus on product innovation and strategic initiatives bodes well.

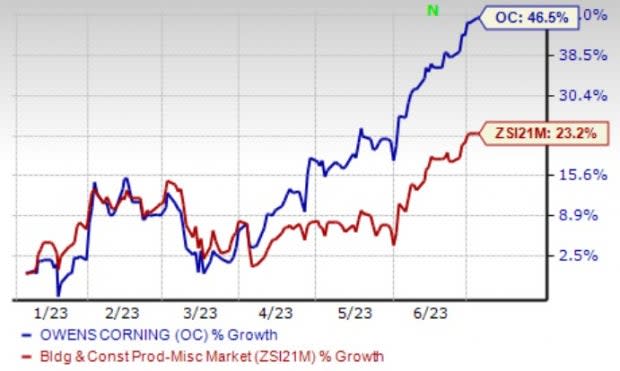

Shares of OC have increased 46.5% in the past six months period compared with the Zacks Building Products - Miscellaneous industry’s rise of 23.2%.

Earnings estimates for 2023 have increased 2.1% in the past 30 days. This depicts analysts' optimism over the company’s growth prospects.

Image Source: Zacks Investment Research

Key Growth Drivers

Owens Corning’s business has been experiencing strength for insulation business. Despite COVID-19 headwinds, the company’s performance revived through 2022. The upside continued in first-quarter 2023. Revenues of $919 million were up 7% year over year. Both EBIT and EBITDA margins increased 200 basis points (bps) from the prior-year period’s levels.

The insulation business benefited from North American residential and technical and global insulation businesses. It witnessed positive price and favorable mix, primarily within the global mineral wool business. Also, the acquisition of Natural Polymers added to the positives. The company expects revenues to be similar to the prior year’s levels for this segment in second-quarter 2023.

In the Roofing segment, it is leveraging vertical integration, material science capabilities and commercial strength to design and market unique roofing shingles and components that attract contractors, homeowners and distributors. Capital investments in roofing business over the past two years have increased incremental capacity at several of its manufacturing facilities. Across the enterprise, the company continues to invest in selected growth and productivity initiatives to serve its customers and improve the overall operating performance.

The company continues to invest in accelerating new product and process innovation to support customers and generate additional growth. In first-quarter fiscal 2023, OC launched 11 new or refreshed products expanding its core platforms in the roofing, insulation and composites businesses. One of the new launches is the Ultra-Pure spray foam, the newest product line addition from natural polymers. The company will likely make a huge investment in its Medina, OH facility to expand its laminate manufacturing capacity, including its market-leading duration shingles, to support its roofing business. The company expects to have this new product line up and running by the end of 2025.

Zacks Rank & Other Key Picks

Owens Corning currently carries a Zacks Rank #2 (Buy).

Some other top-ranked stocks from the Zacks Construction sector are:

Dycom Industries, Inc. DY sports a Zacks Rank #1 (Strong Buy). DY has a trailing four-quarter earnings surprise of 153.7%, on average. Shares of DY have gained 22.5% in the past year. You can see the complete list of today’s Zacks #1 Rank stocks here.

The Zacks Consensus Estimate for DY’s 2024 sales and earnings per share (EPS) indicates a rise of 8.3% and 41%, respectively, from the year-ago period’s levels.

Eagle Materials Inc. EXP sports a Zacks Rank #1. The company has a trailing four-quarter earnings surprise of 6.5%, on average. Shares of EXP have increased 67% in the past year.

The Zacks Consensus Estimate for EXP’s 2024 sales and EPS indicates a rise of 2% and 8.4%, respectively, from the year-ago period’s levels.

Martin Marietta Materials, Inc. MLM flaunts a Zacks Rank #1. The company has a trailing four-quarter earnings surprise of 31%, on average. Shares of MLM have increased 48.1% in the past year.

The Zacks Consensus Estimate for MLM’s 2023 sales and EPS indicates a rise of 18.4% and 31.7%, respectively, from the year-ago period’s levels.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Martin Marietta Materials, Inc. (MLM) : Free Stock Analysis Report

Eagle Materials Inc (EXP) : Free Stock Analysis Report

Dycom Industries, Inc. (DY) : Free Stock Analysis Report

Owens Corning Inc (OC) : Free Stock Analysis Report