Owens & Minor Inc (OMI) Reports Strong Finish to 2023 with Operating Margin Improvement and ...

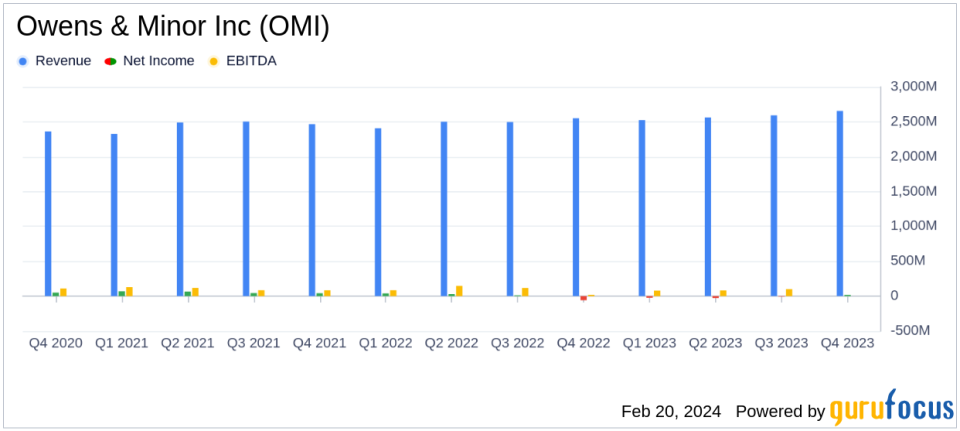

Revenue Growth: Full year revenue increased to $10.3 billion, up from $9.9 billion in 2022.

Operating Income: GAAP operating income for 2023 stood at $104.5 million, compared to $142.9 million in 2022.

Net Income: GAAP net loss reported at $(41.3) million for 2023, a decrease from a net income of $22.4 million in 2022.

Adjusted EBITDA: Non-GAAP adjusted EBITDA reached $525.8 million for the year, slightly down from $543.7 million in the previous year.

Debt Reduction: Significant operating cash flow enabled substantial debt reduction, improving the company's balance sheet.

Earnings Per Share: GAAP net loss per common share was $(0.54) for 2023, while adjusted non-GAAP net income per share was $1.36.

Owens & Minor Inc (NYSE:OMI), a global healthcare solutions company, released its 8-K filing on February 20, 2024, detailing its financial results for the fourth quarter and full year ended December 31, 2023. The company, which operates under two segmentsProducts & Healthcare Services and Patient Directreported a strong finish to the year with top-line growth across both segments, robust profit growth, and exceptional operating cash flow.

Performance and Strategic Highlights

OMI's President & CEO, Edward A. Pesicka, highlighted the company's strategic initiatives and execution that led to meaningful revenue and profit improvements. The Patient Direct segment continued to outperform the market, benefiting from the demand for home-based care. The Products and Healthcare Services segment saw sequential improvements, thanks to the company's strategic focus.

Despite facing challenges such as inflation and pressure on pricing and demand in the Products & Healthcare Services segment, OMI managed to deliver a strong operating margin improvement in the fourth quarter. This performance underscores the importance of the company's strategic initiatives and its ability to navigate a challenging economic environment.

Financial Achievements and Importance

The company's financial achievements, particularly the significant operating cash flow, enabled OMI to reduce its debt considerably, strengthening its balance sheet. This is a critical aspect for OMI and the medical distribution industry, as a strong balance sheet can provide the flexibility to invest in growth opportunities and weather economic downturns.

Key Financial Metrics

OMI's financial metrics for the year reflect a company in transition, with a focus on strategic realignment and cost management. The adjusted EBITDA and adjusted net income figures, which exclude certain non-recurring items, provide a clearer picture of the company's underlying performance. These metrics are important as they are often used by investors to assess the company's operational efficiency and profitability.

"We once again delivered on our commitments and had a strong finish to 2023, demonstrated by our top-line growth across both business segments, robust profit growth and exceptional operating cash flow which allowed us to further strengthen our balance sheet," said Edward A. Pesicka, President & Chief Executive Officer of Owens & Minor.

Analysis of Company's Performance

The company's performance in 2023, particularly the improvement in operating margins and the reduction of debt, positions OMI for a potentially stronger 2024. However, the net loss reported on a GAAP basis indicates that there are still areas that require attention and may be of concern to investors. The company's guidance for 2024 reflects cautious optimism, with assumptions about economic conditions and market pressures factored into their projections.

Owens & Minor's full-year 2023 financial results reveal a company that is executing on its strategic initiatives and improving its financial health. While challenges remain, the company's focus on operational efficiency and market positioning in the healthcare supply chain suggests a commitment to long-term growth and shareholder value.

For more detailed information and analysis, investors are encouraged to review the full 8-K filing and attend the investor conference call scheduled for February 20, 2024.

Explore the complete 8-K earnings release (here) from Owens & Minor Inc for further details.

This article first appeared on GuruFocus.