Owl Creek Asset Management, L.P. Reduces Stake in 26 Capital Acquisition Corp

On August 16, 2023, Owl Creek Asset Management, L.P., a New York-based investment firm, executed a significant transaction involving 26 Capital Acquisition Corp. (NASDAQ:ADER). This article provides an in-depth analysis of the transaction, the profiles of the firm and the traded company, and the potential implications of the transaction.

Details of the Transaction

Owl Creek Asset Management, L.P. reduced its stake in 26 Capital Acquisition Corp by 45,640 shares, representing a 9.13% decrease in its holdings. The transaction, which occurred on August 16, 2023, had a minor impact of -0.02% on the guru's portfolio. Following the transaction, the firm now holds 454,360 shares in the company, accounting for 0.24% of its portfolio. The firm's holdings represent 4.41% of the traded company's total shares.

Profile of the Firm: Owl Creek Asset Management, L.P.

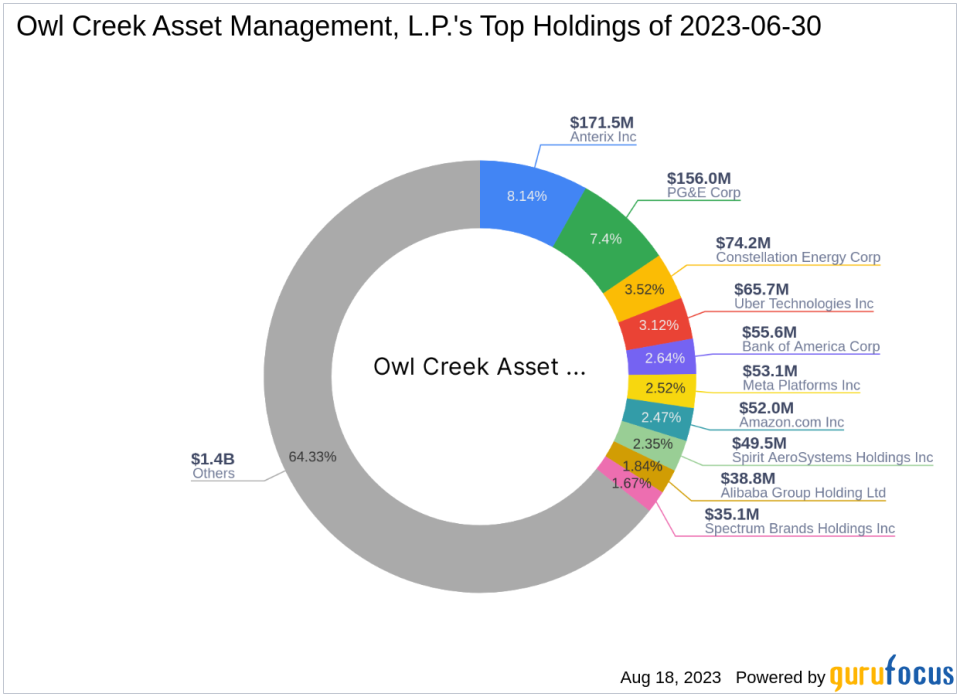

Located at 640 Fifth Avenue, New York, Owl Creek Asset Management, L.P. is a renowned investment firm with a diverse portfolio. The firm's investment philosophy is centered on identifying undervalued securities and investing in them for long-term growth. As of the transaction date, the firm's top holdings include Anterix Inc(NASDAQ:ATEX), Bank of America Corp(NYSE:BAC), PG&E Corp(NYSE:PCG), Uber Technologies Inc(NYSE:UBER), and Constellation Energy Corp(NASDAQ:CEG). The firm's equity stands at $2.11 billion, with a strong focus on the Financial Services and Communication Services sectors.

Profile of the Traded Company: 26 Capital Acquisition Corp

26 Capital Acquisition Corp, symbolized as ADER, is a US-based blank check company. With a market capitalization of $116.243 million, the company's current stock price stands at $11.28. The company's PE Percentage is 0.00, indicating that it is currently operating at a loss. Due to insufficient data, the company's GF Valuation cannot be evaluated.

Analysis of the Traded Stock

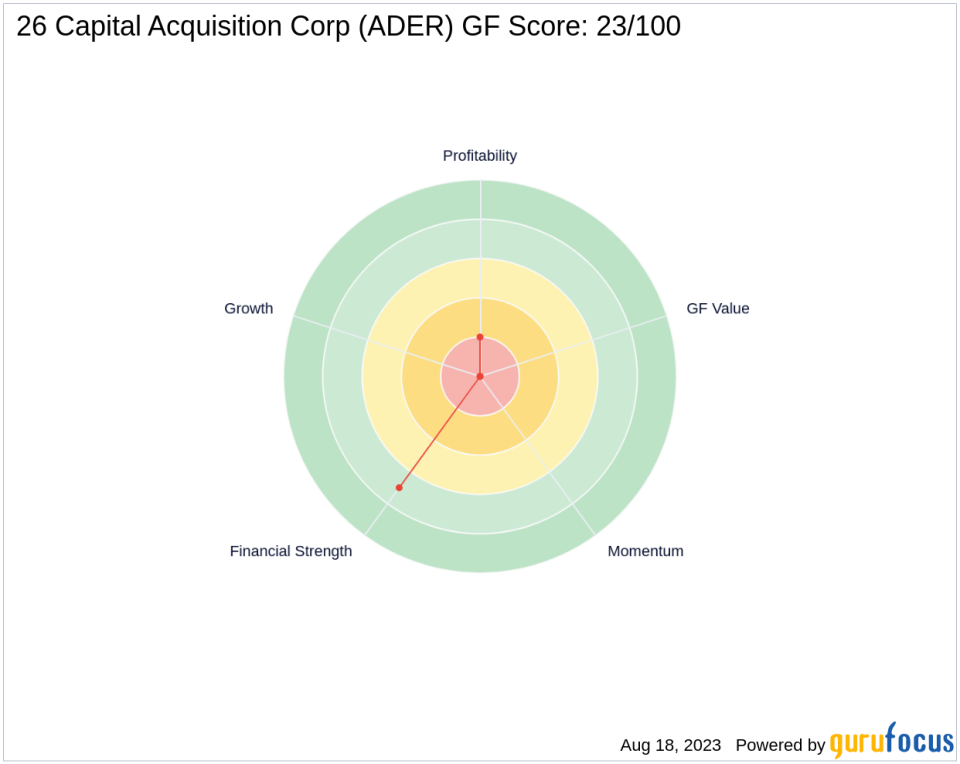

The traded stock, ADER, has a GF Score of 23/100, indicating a poor future performance potential. The stock's Financial Strength is ranked 7/10, while its Profitability Rank is 2/10. The stock's Growth Rank and GF Value Rank are both 0/10, indicating no growth and value data available. The stock's Momentum Rank is also 0/10, suggesting no momentum data available.

Financial Health of the Traded Company

26 Capital Acquisition Corp's low financial health is reflected in its Piotroski F-Score of 2. Despite this, the company does not have enough data to compute an Altman Z score. The company's Cash to Debt ratio is 0.02 yet is interest coverage is significantly high due to no interest expense.

Performance of the Traded Stock

Since the transaction, the stock's price has increased by 0.53%. The stock's Year-to-date price change ratio is 12.02%, and since its Initial Public Offering (IPO) on March 8, 2021, the stock has gained 13.94%.

Conclusion

In conclusion, Owl Creek Asset Management, L.P.'s recent transaction involving 26 Capital Acquisition Corp reflects the firm's dynamic investment strategy. Despite the reduction in its stake, the firm still holds a significant position in the company. The transaction's impact on the guru's portfolio was minimal, and the firm continues to maintain a diverse portfolio with a strong focus on the Financial Services and Communication Services sectors. The traded company, despite its current operating loss, shows a strong ability to cover its interest expenses, indicating potential for future growth.

This article first appeared on GuruFocus.