Oxford Industries Inc (OXM) Earnings: Mixed Results Amidst Macroeconomic Challenges

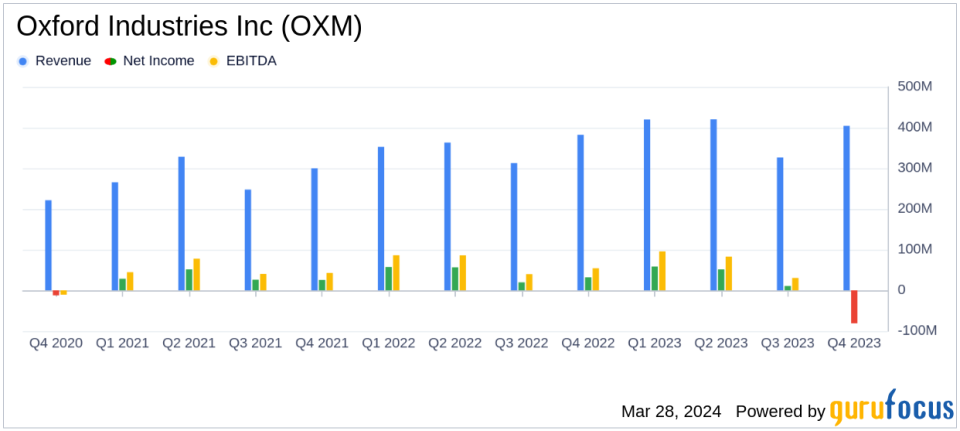

Revenue: Full-year sales rose 11% to $1.57 billion, aligning with analyst projections of $1.57 billion.

Net Income: GAAP net income decreased to $60.7 million, impacted by noncash impairment charges.

Earnings Per Share (EPS): GAAP EPS fell to $3.82, significantly below the estimated $3.579 due to impairment charges. Adjusted EPS was $10.15.

Dividend: Announced a 3% increase in quarterly dividend to $0.67 per share.

Outlook: Fiscal 2024 guidance anticipates revenues between $1.630 billion to $1.670 billion, with GAAP EPS of $8.80 to $9.20 and adjusted EPS of $9.30 to $9.70.

Oxford Industries Inc (NYSE:OXM), the distinguished apparel company behind brands like Tommy Bahama and Lilly Pulitzer, released its 8-K filing on March 28, 2024, revealing a mixed financial performance for the fiscal year ended February 3, 2024. Despite achieving an 11% increase in annual sales, reaching $1.57 billion and aligning with analyst estimates, the company faced a significant decrease in GAAP EPS, which fell to $3.82 from the previous year's $10.19. This decline was primarily due to noncash impairment charges totaling $114 million, or $5.32 per share, largely associated with the Johnny Was reporting unit.

Oxford Industries Inc's portfolio includes the Tommy Bahama brand, known for its men's and women's sportswear, and Lilly Pulitzer, which offers upscale women's and girl's dresses and sportswear. The company's revenue is predominantly generated from the Tommy Bahama division, which saw a modest 2% increase in sales for the fiscal year.

Financial Highlights and Challenges

The company's financial achievements include a robust cash flow from operations, amounting to $244 million, allowing significant investments in growth and acquisitions, shareholder returns through dividends, share repurchases, and near elimination of outstanding debt. However, the impairment charges, reflective of a challenging macroeconomic environment with cautious consumer spending and elevated interest rates, led to a stark decrease in GAAP net earnings.

Key Financial Metrics

Adjusted EPS, which excludes non-operating or discrete gains and charges, decreased by 7% to $10.15, compared to $10.88 in fiscal 2022, indicating underlying operational strength despite the reported GAAP EPS decline. Gross margin improved slightly to 63.4% on a GAAP basis and 64.0% on an adjusted basis for the fiscal year, compared to 63.0% and 63.5% respectively in the prior year. Selling, general and administrative (SG&A) expenses rose to $821 million due to the inclusion of Johnny Was' SG&A and other costs associated with supporting sales growth.

"Fiscal 2023 was highlighted by the second strongest earnings year in our 82-year history," said Tom Chubb, Chairman and CEO. He also emphasized the company's strong balance sheet and cash flows, which position it well for future investments and growth despite near-term earnings pressure.

Oxford Industries Inc's outlook for fiscal 2024 includes expected net sales between $1.630 billion and $1.670 billion, with GAAP EPS between $8.80 and $9.20, and adjusted EPS between $9.30 and $9.70. The company anticipates a return to a normalized effective tax rate after benefiting from certain favorable discrete items in fiscal 2023.

Investor Considerations

For value investors and potential GuruFocus.com members, Oxford Industries Inc's ability to navigate a complex macroeconomic landscape while maintaining a strong balance sheet and cash flow is noteworthy. The company's commitment to shareholder returns through consistent dividends, which have been paid every quarter since 1960, and its strategic investments for future growth may offer long-term value despite the short-term earnings volatility.

Investors should also consider the company's proactive management of inventory levels and the planned capital expenditures, particularly the significant investment in a new distribution center to enhance direct-to-consumer capabilities, which is expected to complete in fiscal 2025.

Overall, Oxford Industries Inc's latest earnings report presents a picture of resilience and strategic planning in the face of economic headwinds, with a focus on sustaining brand strength and long-term growth.

Explore the complete 8-K earnings release (here) from Oxford Industries Inc for further details.

This article first appeared on GuruFocus.