PacBio (PACB) Preliminary Q4 Revenues Boosted by Revio Sales

Pacific Biosciences of California, Inc. PACB, popularly known as PacBio, recently announced preliminary revenues for fourth-quarter 2023. The robust preliminary results drove up the company’s shares by 0.1% in the pre-market trading session.

The company is expected to release fourth-quarter results in February.

Per the preliminary report, fourth-quarter 2023 total revenues are estimated to be $58.4 million, up 113% year over year. The Zacks Consensus Estimate of $54.1 million lies below the preliminary figure.

The company’s instrument revenues are expected to be $35.1 million (up 475.4% year over year), while the consumables revenues are anticipated to be $18.9 million (up 13.2% year over year). Preliminary service and other revenue for the fourth quarter of 2023 are expected to be $4.4 million, down 4.3% year over year.

Per management, approximately 67% of consumable revenues were generated from Revio in the fourth quarter for an annualized pull-through of approximately $385 thousand. PacBio shipped 44 Revio sequencing systems for revenues during fourth-quarter 2023, thereby bringing the Revio installed base to 173 systems as of Dec 31, 2023. This raises our optimism about the stock.

Per the preliminary report, full-year 2023 total revenues are estimated to be $200.5 million, up 56% from the comparable 2022 period. The Zacks Consensus Estimate of $196.3 million lies below the preliminary figure.

Full-year consumable revenues are expected to be $63.4 million. PacBio shipped 20 Sequel IIe systems for revenue for 2023, bringing the cumulative systems shipped to 532 as of Dec 31, 2023.

Guidance

PacBio expects to share 2024 guidance on its fourth-quarter earnings conference call in February.

A Brief Q4 Analysis

During the fourth quarter of 2023, PacBio announced that the GREGoR (Genomics Research to Elucidate the Genetics of Rare Diseases) consortium, in collaboration with the University of California Irvine, planned to sequence genomes utilizing HiFi technology to improve its understanding of genetics in rare disease. This looks promising for the stock.

Also, during the to-be-reported quarter, PacBio released SMRT Link 13.0 software on the Revio system, which includes the adaptive loading feature for consistent run performance, run preview for improved lab efficiency and expanded application support with functionality to sequence shorter and longer fragments of DNA. In October, the company began the shipment of Kinnex RNA kits, thus enabling scalable, cost-effective full-length RNA sequencing on Revio and Sequel IIe. PacBio has received orders from more than 70 customers through Dec 31, 2023. This raises our optimism about the stock.

At the time of the release of the preliminary fourth-quarter 2023 results, management stated that the launch of the Revio system for scalable, accurate, long-read sequencing and Onso enabled PacBio to reach more customers and achieve record financial results.

The company’s preliminary projection of robust improvement in revenues on the back of strength in its businesses lifts our confidence about the stock.

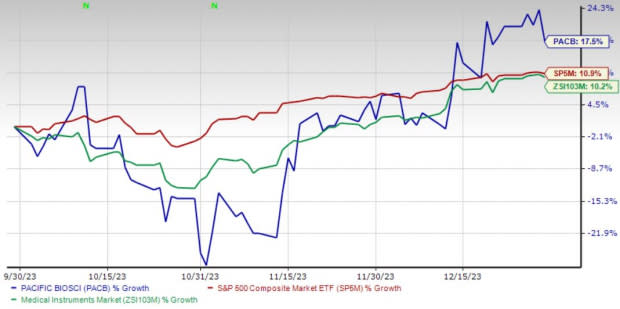

Price Performance

Shares of the company have gained 17.5% between Oct 1 and Dec 31, 2023, compared with the industry’s 10.2% rise and the S&P 500’s 10.9% growth.

Image Source: Zacks Investment Research

Zacks Rank & Key Picks

Currently, PacBio carries a Zacks Rank #3 (Hold).

Some better-ranked stocks in the broader medical space are DaVita Inc. DVA, Merit Medical Systems, Inc. MMSI and Integer Holdings Corporation ITGR.

DaVita, sporting a Zacks Rank #1 (Strong Buy), has an estimated long-term growth rate of 17.3%. DVA’s earnings surpassed estimates in each of the trailing four quarters, with the average surprise being 36.6%. You can see the complete list of today’s Zacks #1 Rank stocks here.

DaVita has gained 10.8% compared with the industry’s 11.9% rise between Oct 1 and Dec 31, 2023.

Merit Medical, carrying a Zacks Rank of 2 (Buy) at present, has an estimated long-term growth rate of 11.5%. MMSI’s earnings surpassed estimates in each of the trailing four quarters, with the average being 14.4%.

Merit Medical has gained 10.1% compared with the industry’s 2.1% rise between Oct 1 and Dec 31, 2023.

Integer Holdings, carrying a Zacks Rank of 2 at present, has an estimated long-term growth rate of 15.8%. ITGR’s earnings surpassed estimates in each of the trailing four quarters, with the average surprise being 11.9%.

Integer Holdings has gained 26.3% compared with the industry’s 10.2% rise between Oct 1 and Dec 31, 2023.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

DaVita Inc. (DVA) : Free Stock Analysis Report

Merit Medical Systems, Inc. (MMSI) : Free Stock Analysis Report

Pacific Biosciences of California, Inc. (PACB) : Free Stock Analysis Report

Integer Holdings Corporation (ITGR) : Free Stock Analysis Report