PacBio's (PACB) New Kits to Boost Its Revio Sequencing System

Pacific Biosciences of California PACB, popularly known as PacBio, recently announced two new high throughput library preparation kits and workflows, namely, HiFi Prep Kit 96 and HiFi Plex Prep Kit 96, optimized for its Revio sequencing system.

With these kits, PacBio is likely to offer customers automated, scalable, high-performance library preparation solutions with a 40% cost reduction and a 60% workflow time reduction.

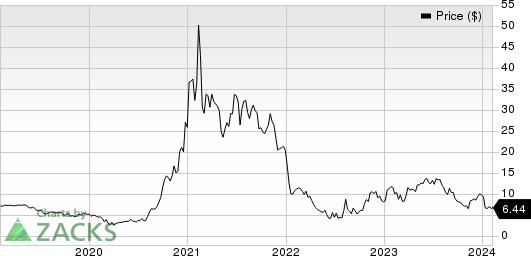

Price Performance

For the past six months, PACB’s shares have declined 46.1% against the industry’s rise of 1.5%. The S&P 500 increased 9.6% in the same time frame.

Image Source: Zacks Investment Research

More on the Kits

The new HiFi Prep Kit 96 and HiFi Plex Prep Kit 96 are made to make it easier for users to prepare, pool, and load samples by automating long-read sequencing workflow stages. These features make it one of the most affordable high-throughput long-read library preparation systems available by removing labor, time, and expense bottlenecks.

These new products will enable clients specializing in microbial, metagenome, and low-pass whole genome sequencing to take on large-scale projects with different budgetary constraints. In comparison to the previous generation of PacBio library preparation kits, clients will also benefit from a four-fold decrease in waste and packing with the new kit combinations.

The new HiFi library prep kits are anticipated to go on sale in the first quarter of 2024, with an early second-quarter delivery window. The Hamilton NGS STAR system will be the first platform to offer automated protocols.

With these new products, PacBio is set to strengthen its Revio sequencing system and help in long-read sequencing as a high-throughput genotyping tool.

Industry Prospects

Per a report by Grand View Research, the global long-read sequencing market size was valued at $455.1 million in 2022 and is expected to grow at 30.92% from 2023 to 2030.

The major factors driving the market growth include the rising prevalence of genetic diseases, such as cancers as well as chromosomal disorders, the increasing popularity of personalized medicine, and rising technological advancements resulting in the emergence of newer technologies, such as third-generation sequencing.

Notable Developments

In January 2024, PacBio announced PanDNA, a versatile Nanobind DNA extraction kit. With the addition of this new offering, the range of sample types appropriate for long-read sequencing is now greater and includes bacteria, cells, tissue, blood, plant nuclei, and insects.

In October 2023, the company announced the availability of a complete, standardized computational method for HiFi whole genome sequencing (WGS) data analysis, the PacBio WGS Variant Pipeline. This availability aims to significantly strengthen PacBio’s global sequencing business.

Pacific Biosciences of California, Inc. Price

Pacific Biosciences of California, Inc. price | Pacific Biosciences of California, Inc. Quote

Zacks Rank & Stocks to Consider

PACB carries a Zacks Rank #4 (Sell) at present.

Some better-ranked stocks to consider in the broader medical space are Universal Health Services UHS, Integer Holdings Corporation ITGR and Elevance Health, Inc ELV.

Universal Health Services, carrying a Zacks Rank #2 (Buy) at present, has an estimated growth rate of 4.4% for 2024. UHS’s earnings surpassed estimates in all the trailing four quarters, delivering an average surprise of 5.47%. You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

UHS’s shares have gained 1.9% in the past six months against the industry’s 5% decline.

Integer Holdings, presently carrying a Zacks Rank of 2, has an estimated long-term growth rate of 15.8%. ITGR’s earnings surpassed estimates in each of the trailing four quarters, delivering an average surprise of 11.9%.

Integer Holdings’ shares have rallied 43.5% in the past year against the industry’s 3.7% decline.

Elevance Health, carrying a Zacks Rank of 2, reported fourth-quarter 2023 adjusted EPS of $5.62, beating the Zacks Consensus Estimate by 1.3%. Revenues of $42.45 billion outpaced the consensus mark by 1.5%.

Elevance Health has a long-term estimated growth rate of 12%. ELV’s earnings surpassed estimates in all the trailing four quarters, the average surprise being 3.1%.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Universal Health Services, Inc. (UHS) : Free Stock Analysis Report

Pacific Biosciences of California, Inc. (PACB) : Free Stock Analysis Report

Integer Holdings Corporation (ITGR) : Free Stock Analysis Report

Elevance Health, Inc. (ELV) : Free Stock Analysis Report