PacBio's (PACB) New Offering to Boost WGS Data Analysis

Pacific Biosciences of California, Inc. PACB, popularly known as PacBio, recently announced the availability of a complete, standardized computational method for HiFi whole genome sequencing (WGS) data analysis, the PacBio WGS Variant Pipeline. The PacBio WGS Variant Pipeline will be available via GitHub.

The single computational workflow is expected to integrate PacBio and third-party tools (including TRGT, Paraphase and Google DeepVariant) in an intuitive user interface, thereby offering customers a best practice for HiFi WGS analysis.

The latest availability is expected to significantly strengthen PacBio’s global sequencing business.

Significance of the Availability

Previously, PacBio customers would need to use multiple bioinformatic tools to analyze HiFi data. However, with the new PacBio WGS Variant Pipeline, PacBio will likely offer a streamlined and supported tool to access alignment, variant calling, joint calling and genome annotation data across Amazon Web Services, Google Cloud, Azure and on-premise high-performance computing solutions.

The new software pipeline will likely enable customers to resolve many different variant types and provide methylation and phasing data in a single bioinformatic solution. This is expected to make it the most complete human WGS secondary analysis pipeline currently available.

Per an expert familiar with the use of the new PacBio WGS Variant Pipeline, the product could be quickly adapted by running samples via the workflow to advance rare disease-focused research. The workflow being compatible with additional, optional tools to run in select samples is also promising, per the expert.

Per management, the latest offering will likely provide its customers with game-changing sequencers and deliver comprehensive analytical tools to interpret sequencing data. Management also feels that the PacBio WGS Variant Pipeline is currently the first and most comprehensive HiFi pipeline that integrates PacBio and third-party tools into a single, high-powered, bioinformatics solution. This is expected to aid its customers in realizing the full potential of PacBio’s Revio system and HiFi data.

Industry Prospects

Per a report by Grand View Research, the global WGS market was valued at $1,645.2 million in 2022 and is anticipated to expand at a CAGR of approximately 20.1% between 2023 and 2030. Factors like the growing prevalence of genetic disorders and mutations that lead to cancer progression and the possibility of identification and diagnosis of targeted diseases are expected to drive the market.

Given the market potential, the latest availability is expected to significantly strengthen PacBio’s global business.

Notable Developments

In August, PacBio announced a research collaboration with the University of Washington to study the capabilities of HiFi long-read WGS to increase diagnostic rates in pediatric patients with genetic conditions.

The same month, PacBio announced its second-quarter 2023 results, wherein it registered a robust increase in its overall top line, including strong Product and Instrument revenues. Solid geographical performances were also seen. Continued strong prospects in the Revio and Onso systems, with customers placing orders for these, looked promising for the stock.

Also, in August, PacBio entered into an agreement to acquire Apton Biosystems, Inc (Apton). As a combined organization, PacBio plans to integrate its Sequencing by Binding short-read chemistry into Apton’s high throughput instrument to offer a differentiated high throughput sequencer.

Price Performance

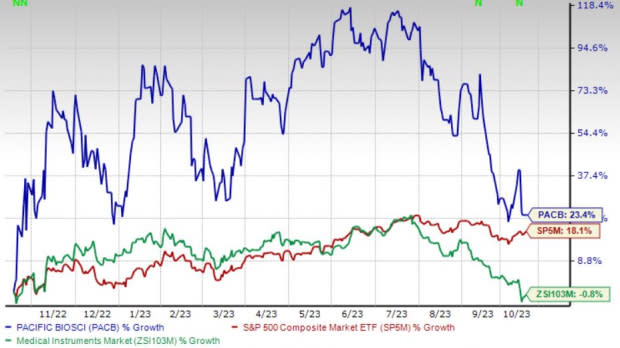

Shares of PacBio have gained 23.3% in the past year against the industry’s 0.8% decline. The S&P 500 has witnessed 18% growth in the said time frame.

Image Source: Zacks Investment Research

Zacks Rank & Stocks to Consider

Currently, PacBio carries a Zacks Rank #4 (Sell).

Some better-ranked stocks in the broader medical space are Cardinal Health, Inc. CAH, HealthEquity, Inc. HQY and McKesson Corporation MCK.

Cardinal Health, carrying a Zacks Rank #2 (Buy) at present, has an estimated long-term growth rate of 14.3%. CAH’s earnings surpassed estimates in all the trailing four quarters, with an average surprise of 16%. You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Cardinal Health has gained 31.1% compared with the industry’s 19.3% rise over the past year.

HealthEquity, carrying a Zacks Rank #2 at present, has an estimated long-term growth rate of 23.5%. HQY’s earnings surpassed estimates in all the trailing four quarters, with an average of 13%.

HealthEquity has gained 3.9% against the industry’s 8.4% decline over the past year.

McKesson, sporting a Zacks Rank #1 at present, has an estimated long-term growth rate of 10.7%. MCK’s earnings surpassed estimates in three of the trailing four quarters and missed once, the average surprise being 8.1%.

McKesson has gained 26.2% compared with the industry’s 19.3% rise over the past year.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Cardinal Health, Inc. (CAH) : Free Stock Analysis Report

McKesson Corporation (MCK) : Free Stock Analysis Report

Pacific Biosciences of California, Inc. (PACB) : Free Stock Analysis Report

HealthEquity, Inc. (HQY) : Free Stock Analysis Report