PACCAR Inc (PCAR) Reports Record Annual Revenues and Net Income for 2023

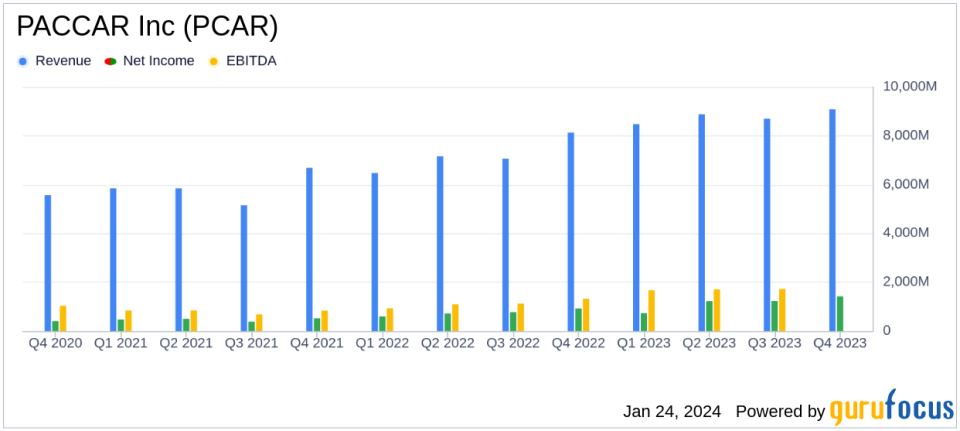

Annual Revenue: PACCAR Inc (NASDAQ:PCAR) achieved record revenues of $35.13 billion in 2023, a substantial increase from $28.82 billion in 2022.

Net Income: The company reported a record net income of $4.60 billion for the year, marking a significant rise from $3.01 billion in the previous year.

Quarterly Performance: Fourth-quarter revenues stood at $9.08 billion with net income reaching $1.42 billion, reflecting a 54% increase from Q4 2022.

PACCAR Parts: PACCAR Parts posted record annual pre-tax income of $1.70 billion with revenues hitting $6.41 billion.

Dividends: The company declared cash dividends of $4.24 per share in 2023, including an extra cash dividend of $3.20 per share.

Financial Services: PACCAR Financial Services reported a pretax profit of $540.3 million with total assets reaching $20.96 billion.

Capital and R&D Investments: PACCAR invested $1.11 billion in capital projects and research and development, focusing on next-generation product technologies.

On January 23, 2024, PACCAR Inc (NASDAQ:PCAR) released its 8-K filing, announcing a year of record-breaking financial performance. The company, a global leader in the design, manufacture, and customer support of high-quality light-, medium-, and heavy-duty trucks under the Kenworth, Peterbilt, and DAF nameplates, has demonstrated exceptional growth and profitability in the fiscal year 2023.

Company Overview

PACCAR is renowned for its premium truck brands Kenworth, Peterbilt, and DAF, which command significant market shares in North America and Europe. With a network of over 2,300 independent dealers, PACCAR not only manufactures trucks but also provides financial services and distributes truck parts integral to its business operations.

Financial Performance and Achievements

The company's financial achievements in 2023 are a testament to its robust business model and strategic initiatives. PACCAR's record annual revenues of $35.13 billion and net income of $4.60 billion, including a non-recurring charge, underscore the company's successful year. Excluding this charge, the adjusted net income stands at an impressive $5.05 billion. These results are attributed to record truck deliveries, high gross margins in Truck, Parts, and Other segments, and a strong performance by PACCAR Financial Services.

PACCAR's Truck, Parts, and Other segments reported net sales and revenues of $33.31 billion for the year, with a cost of sales and revenues at $26.89 billion. The Financial Services segment brought in revenues of $1.81 billion. The company's cash provided by operations was a healthy $4.19 billion, supporting its investment activities and dividend payments.

Challenges and Outlook

Despite the impressive results, PACCAR faces challenges, including a non-recurring charge related to civil litigation in Europe. Moreover, the company is navigating a dynamic global truck market, with Class 8 truck industry retail sales in the U.S. and Canada expected to range between 260,000-300,000 trucks in 2024. PACCAR's strategic investments in new technologies and facilities, such as the joint venture for battery cell manufacturing and the expansion of its parts distribution centers, are critical for sustaining growth and maintaining its competitive edge.

Analyst Commentary

"PACCAR's excellent results reflect record deliveries of premium quality DAF, Peterbilt and Kenworth trucks worldwide, record Truck, Parts and Other gross margins and strong financial services performance," said Preston Feight, chief executive officer.

"PACCAR has generated excellent shareholder returns and annual net income due to its industry-leading premium quality vehicles, and strong growth of its aftermarket parts sales," shared Mark Pigott, executive chairman.

Investor Considerations

For investors, PACCAR's consistent dividend payments, including a significant extra cash dividend, demonstrate the company's commitment to shareholder returns. The company's strategic focus on innovation, evidenced by its investments in clean diesel, battery-electric, hydrogen combustion, and fuel cell powertrains, positions it well for future industry shifts towards sustainable transportation.

Value investors may find PACCAR's strong balance sheet, with stockholders' equity of $15.88 billion, and its disciplined approach to capital allocation and R&D investments particularly appealing. The company's ability to achieve good annual results through various business cycles, as well as its robust aftermarket parts sales, further solidify its reputation as a resilient player in the Farm & Heavy Construction Machinery industry.

PACCAR's forward-looking initiatives, such as the joint venture battery factory and the showcase of electric and autonomous trucks at CES 2024, highlight its commitment to technological leadership and environmental sustainability, factors that are increasingly important to modern investors.

As PACCAR Inc (NASDAQ:PCAR) continues to navigate the evolving landscape of the truck manufacturing industry, its strong financial performance and strategic investments suggest a road ahead paved with potential for sustained growth and profitability.

Explore the complete 8-K earnings release (here) from PACCAR Inc for further details.

This article first appeared on GuruFocus.