PACCAR Inc's Dividend Analysis

Assessing PACCAR Inc's Dividend Sustainability and Growth Prospects

PACCAR Inc (NASDAQ:PCAR) recently announced a dividend of $0.27 per share, payable on 2023-12-06, with the ex-dividend date set for 2023-11-14. As investors look forward to this upcoming payment, the spotlight also shines on the company's dividend history, yield, and growth rates. Using the data from GuruFocus, let's look into PACCAR Inc's dividend performance and assess its sustainability.

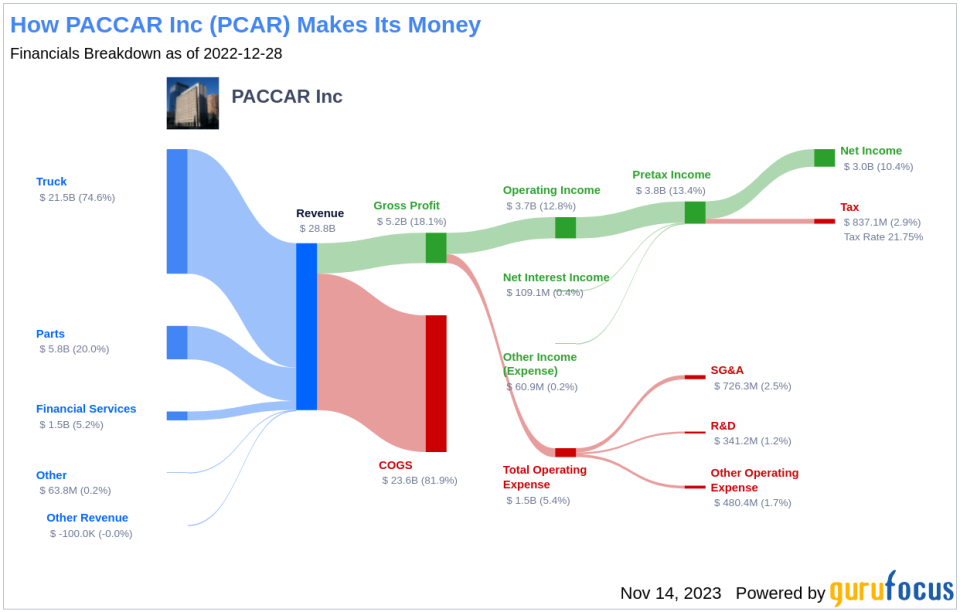

What Does PACCAR Inc Do?

This Powerful Chart Made Peter Lynch 29% A Year For 13 Years

How to calculate the intrinsic value of a stock?

PACCAR Inc is a global leader in the design and manufacture of premium trucks through its renowned brands Kenworth, Peterbilt, and DAF. The company boasts a significant presence, selling its vehicles through an extensive network of over 2,300 independent dealers across key markets such as North America, Europe, and Australia. PACCAR Inc also provides financial services including retail and wholesale financing solutions to facilitate customer and dealer transactions. With a strong foothold in the trucking industry, PACCAR Inc captures about 30% of the Class 8 market share in North America and 17% in the European heavy-duty segment.

A Glimpse at PACCAR Inc's Dividend History

PACCAR Inc has established a commendable track record of consistent dividend payments since 1985, showcasing a commitment to returning value to shareholders. The company has not only maintained these payments but has also increased its dividend annually since 2010, earning the status of a dividend achiever. This accolade is reserved for companies that have consistently raised their dividends for at least 13 consecutive years.

Below is a chart illustrating the annual Dividends Per Share to track historical trends.

Breaking Down PACCAR Inc's Dividend Yield and Growth

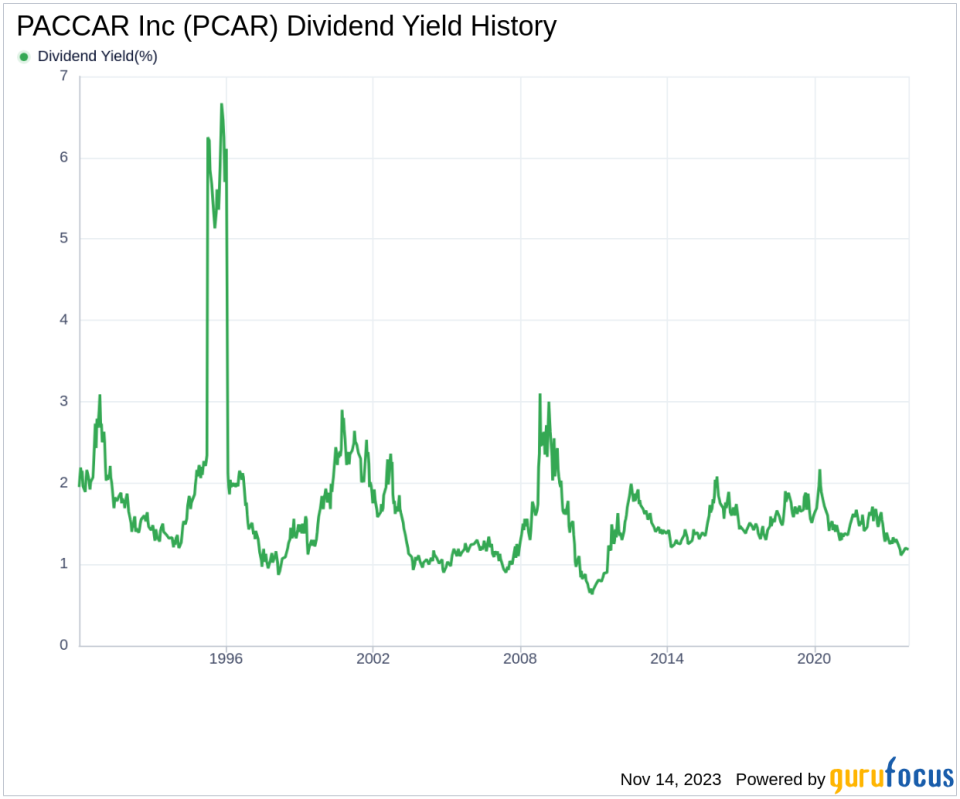

PACCAR Inc currently exhibits a trailing 12-month dividend yield of 1.14% and a forward dividend yield of 1.17%. This forward-looking metric indicates an anticipated increase in dividend payments over the next year, reflecting positive investor sentiment.

However, when compared to the industry, PACCAR Inc's dividend yield is relatively modest, positioned near a 10-year low and trailing behind 77.69% of its global competitors in the Farm & Heavy Construction Machinery sector. This could suggest that PACCAR Inc's dividend yield might not be the primary draw for income-focused investors.

Over the past three years, PACCAR Inc's dividend has grown at an annual rate of 2.80%. This growth rate expands to 6.80% over a five-year span and stands at 6.50% when viewed over the last decade. Consequently, the 5-year yield on cost for PACCAR Inc stock is approximately 1.58%.

The Sustainability Question: Payout Ratio and Profitability

Dividend sustainability is a critical factor for investors, and the dividend payout ratio is a key indicator in this regard. PACCAR Inc's payout ratio stands at a modest 0.13 as of 2023-09-30, suggesting that the company retains a substantial portion of its earnings for growth and to cushion against economic downturns.

Further bolstering confidence in PACCAR Inc's dividend is the company's strong profitability rank of 8 out of 10. This rank, combined with a decade-long track record of positive net income, underscores the company's robust financial health and its ability to sustain dividend payments.

Growth Metrics: The Future Outlook

PACCAR Inc's growth rank of 8 out of 10 is indicative of a favorable growth trajectory relative to its peers. Despite this, the company's 3-year revenue growth rate of 3.90% per year slightly lags behind 56.65% of global competitors, signaling room for improvement in revenue expansion.

The company's 3-year EPS growth rate of 8.30% per year also trails 55.42% of global competitors. Additionally, PACCAR Inc's 5-year EBITDA growth rate of 7.20% underperforms compared to 48.28% of its global counterparts. These figures suggest that while the company is growing, it faces stiff competition in scaling its financial performance.

Engaging Conclusion: Dividend Considerations for Value Investors

In conclusion, PACCAR Inc's disciplined approach to dividend payments, combined with a conservative payout ratio and strong profitability, paints a picture of a company committed to shareholder returns. However, its moderate dividend yield and growth rates, alongside mixed performance in growth metrics, suggest that value investors should weigh these factors carefully against their investment criteria. As the company navigates the competitive landscape of the heavy machinery industry, will its strategic initiatives and market position enable it to enhance shareholder value further? This question remains central to the investment thesis surrounding PACCAR Inc's dividends.

GuruFocus Premium users can screen for high-dividend yield stocks using the High Dividend Yield Screener.

This article, generated by GuruFocus, is designed to provide general insights and is not tailored financial advice. Our commentary is rooted in historical data and analyst projections, utilizing an impartial methodology, and is not intended to serve as specific investment guidance. It does not formulate a recommendation to purchase or divest any stock and does not consider individual investment objectives or financial circumstances. Our objective is to deliver long-term, fundamental data-driven analysis. Be aware that our analysis might not incorporate the most recent, price-sensitive company announcements or qualitative information. GuruFocus holds no position in the stocks mentioned herein.

This article first appeared on GuruFocus.