PACCAR (PCAR) Q1 Earnings & Sales Beat Estimates, Up Y/Y

PACCAR Inc. PCAR has reported earnings of $1.35 per share for first-quarter 2021, beating the Zacks Consensus Estimate of $1.27.

Higher-than-anticipated sales in the parts segment resulted in this outperformance. Precisely, the trucking giant recorded sales of $1,160.7 million in the segment, beating the consensus mark of $1,079 million. The bottom line also increased from the prior-year quarter’s earnings of $1.03 per share.

Consolidated revenues (including trucks and financial services) came in at $5.85 billion, up from the $5.16 billion recorded in the corresponding quarter of 2020. Also, sales from the Trucks, Parts and Others unit came in at $5,413.5 million, topping the consensus mark of $5,201 million.

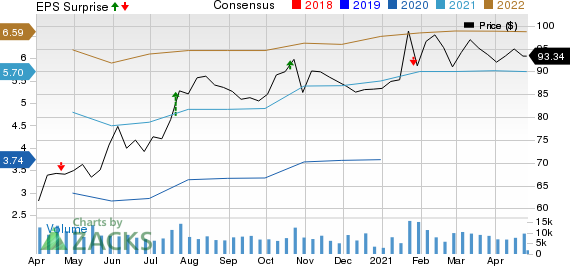

PACCAR Inc. Price, Consensus and EPS Surprise

PACCAR Inc. price-consensus-eps-surprise-chart | PACCAR Inc. Quote

Key Takeaways

Revenues from trucks segment totaled $4,233 million in the March-end quarter, higher than the prior-year quarter’s $3,757.6 million. The figure, however, lagged the consensus mark of $4,279 million. The segment’s pre-tax income came in at $269.5 million, up from the $183.1 million recorded in the year-ago period. The reported figure, nonetheless, missed the consensus mark of $275 million.

Revenues from the parts segment totaled $1,160.7 million in the reported quarter, higher than the year-earlier quarter’s $998.6 million. The segment’s pre-tax income came in at $251.3 million, up from the $214 million recorded in the year-ago period. The reported figure also topped the consensus mark of $227 million.

Revenues in the financial services segment increased to $432 million from the year-earlier quarter’s $383.7 million. Also, pre-tax income rose to $76.4 million from the $48.3 million recorded in the year-earlier period, beating the consensus mark of $64 million.

Selling, general and administrative expenses during first-quarter 2021 declined to $161.1 million from the prior-quarter’s $164 million. Research & Development (R&D) expenses came in at $80.1 million during the first quarter of 2021 compared with the year-earlier quarter’s $71 million.

PACCAR’s cash and marketable debt securities amounted to $4,651.1 million as of Mar 31, 2021, compared with $4834 million as of Dec 31, 2020.

For 2021, capex is projected at $575-$625 million, while R&D expenses are estimated in the $350-$375 million band. This present Zacks #3 (Hold) Ranked player shares space with other biggies including Ford F, General Motors GM and Tesla TSLA. You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Time to Invest in Legal Marijuana

If you’re looking for big gains, there couldn’t be a better time to get in on a young industry primed to skyrocket from $17.7 billion back in 2019 to an expected $73.6 billion by 2027.

After a clean sweep of 6 election referendums in 5 states, pot is now legal in 36 states plus D.C. Federal legalization is expected soon and that could be a still greater bonanza for investors. Even before the latest wave of legalization, Zacks Investment Research has recommended pot stocks that have shot up as high as +285.9%.

You’re invited to check out Zacks’ Marijuana Moneymakers: An Investor’s Guide. It features a timely Watch List of pot stocks and ETFs with exceptional growth potential.

Today, Download Marijuana Moneymakers FREE >>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Ford Motor Company (F) : Free Stock Analysis Report

PACCAR Inc. (PCAR) : Free Stock Analysis Report

General Motors Company (GM) : Free Stock Analysis Report

Tesla, Inc. (TSLA) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research