Paccar Is Reaching New Highs With Best-in-Class Operating Performance

Paccar Inc. (NASDAQ:PCAR) announced robust fourth-quarter operating results on Jan. 23, surpassing analysts' expectations. Over the past year, its share price has surged by approximately 37%, surpassing $99.60 per share at the time of writing and outperforming the S&P 500's return of 20.67%. After the stock achieved all-time highs, I estimate it is fairly valued.

Growing revenue and profits over time

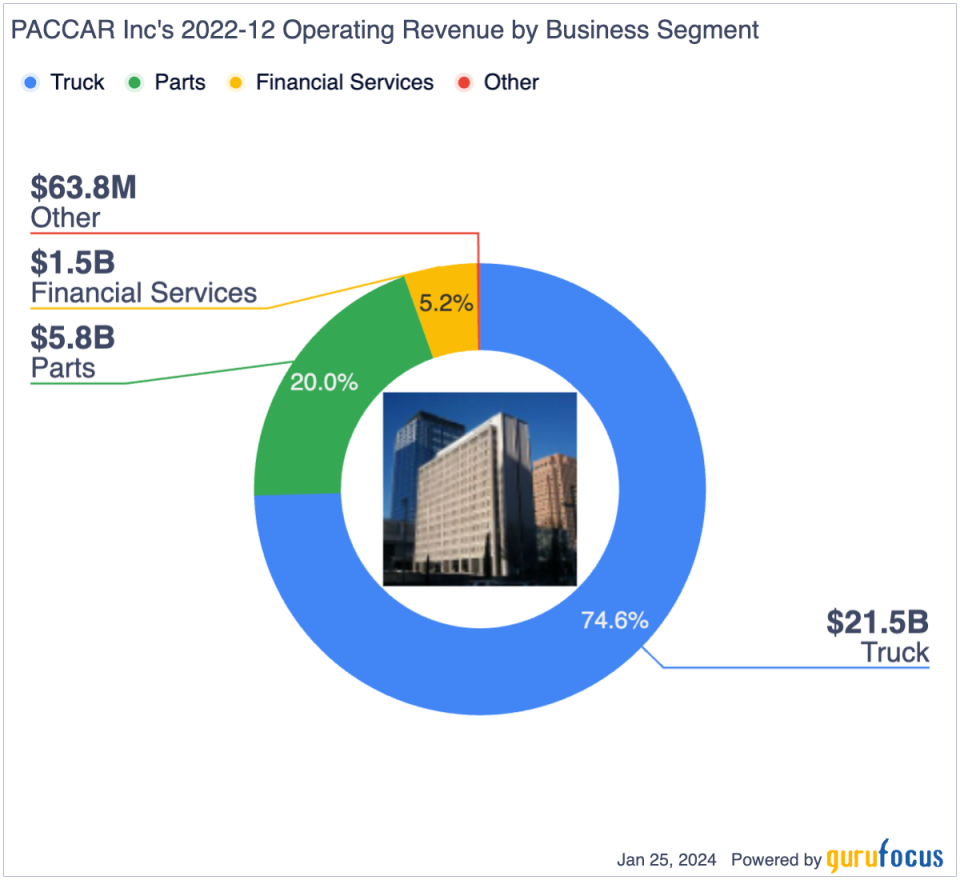

The company operates as a global designer, manufacturer and distributor of a diverse range of commercial trucks. It is structured into three primary business segments: Trucks, Parts and Financial Services. The Trucks segment is the largest revenue contributor, generating $21.5 billion, which accounted for 74.60% of the total revenue in 2022. The Parts segment follows closely behind, delivering $5.8 billion in revenue and representing 20% of total sales. The Financial Services segment constitutes the smallest part of the business with revenue of $1.5 billion, or 5.20% of total sales for 2022.

The Financial Services segment is the most profitable, with a pre-tax margin exceeding 39%. This success is attributed to the company's robust finance and leasing portfolio, which includes 233,000 trucks and retailers and boasts over $21 billion in assets. The Parts segment, known for distributing aftermarket parts via a vast global network of more than 2,300 dealerships, ranked second in profitability, with a pre-tax margin of 24.90%. Despite generating the most revenue, the Trucks segment is the least profitable, with a pre-tax margin of just 8.80%.

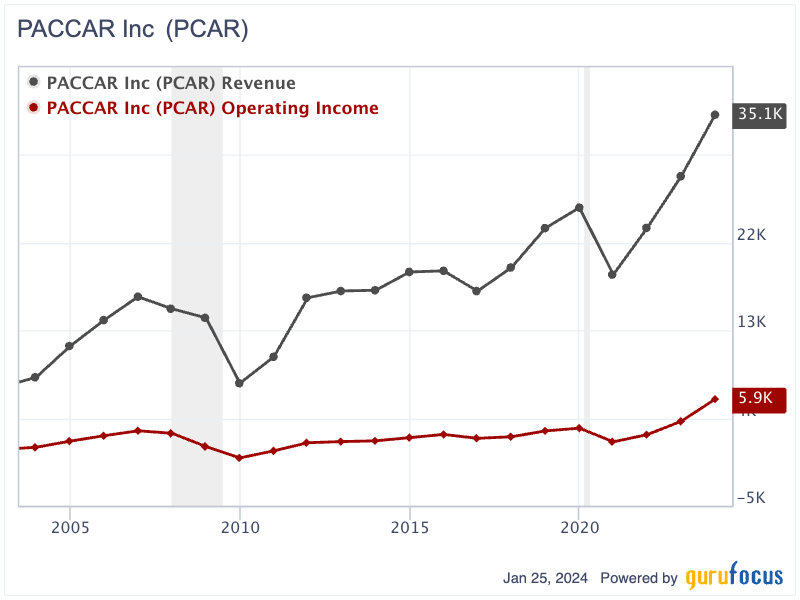

As a key player in the commercial truck industry, Paccar's business is closely linked to economic conditions. When the economic outlook is negative, there tends to be a decline in demand for its products. In contrast, a positive economic outlook can significantly boost truck demand, increasing the company's sales. Despite the cyclical nature of its business, PAaccar has demonstrated the growing trend in revenue and operating profit over the years. Over the past two decades, its revenue has seen an upward trajectory, rising from $7.22 billion in 2002 to $35.10 billion in 2023. Similarly, its operating income has increased from $794.20 million to approximately $5.95 billion within the same timeframe.

Since 2002, Paccar has recorded sales declines in only five years, notably during the global recession from 2007 to 2009, in 2016 and during the Covid-19 pandemic in 2020. Reflecting these challenging periods, operating income also declined. Post-2020, however, the company has seen a remarkable recovery, with revenue and operating income increasing by 87.4% and 278.7%, respectively.

Best-in-class operating performance

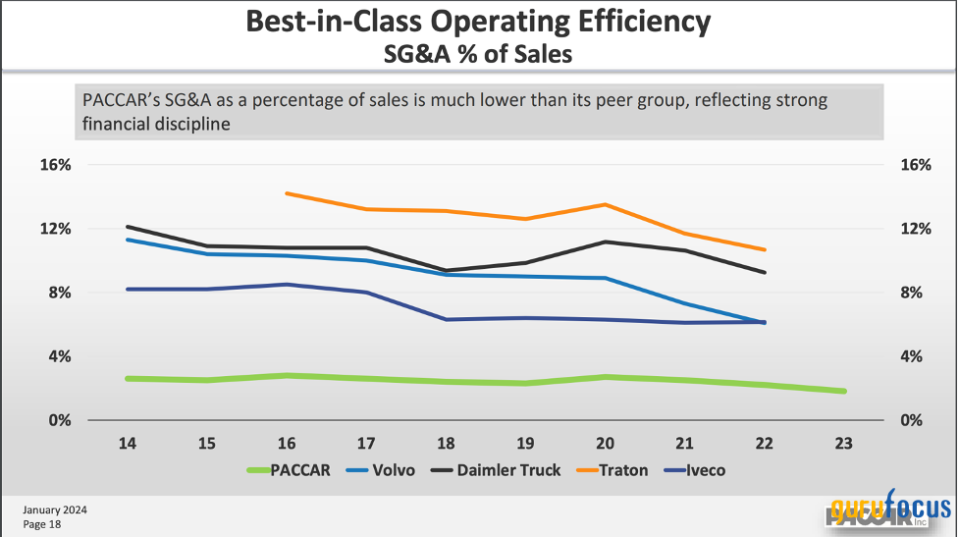

Paccar stands out as a top performer in the commercial truck industry, boasting the highest margins and superior operating efficiency. This success is primarily attributed to the company's adoption of lean manufacturing and Six Sigma principles in its production and operations. Compared to its competitors, including Volvo (VLVLY), Daimler Truck (DTGHF), Traton (TRATF) and Iveco (IVCGF), Paccar has demonstrated effective cost management. As a percentage of revenue, its selling, general and administrative expenses have consistently been the lowest, fluctuating between 2% and 3%. This starkly contrasts to its peers, where SG&A expenses consume a larger portion of revenue. Volvo and Iveco's SG&A expenses hover around 6%, Daimler Truck's are approximately 9% and Traton has the highest with nearly 11% of revenue for SG&A. This comparison highlights Paccar's efficiency in managing its overhead costs relative to its industry counterparts.

Source: Paccar's presentation

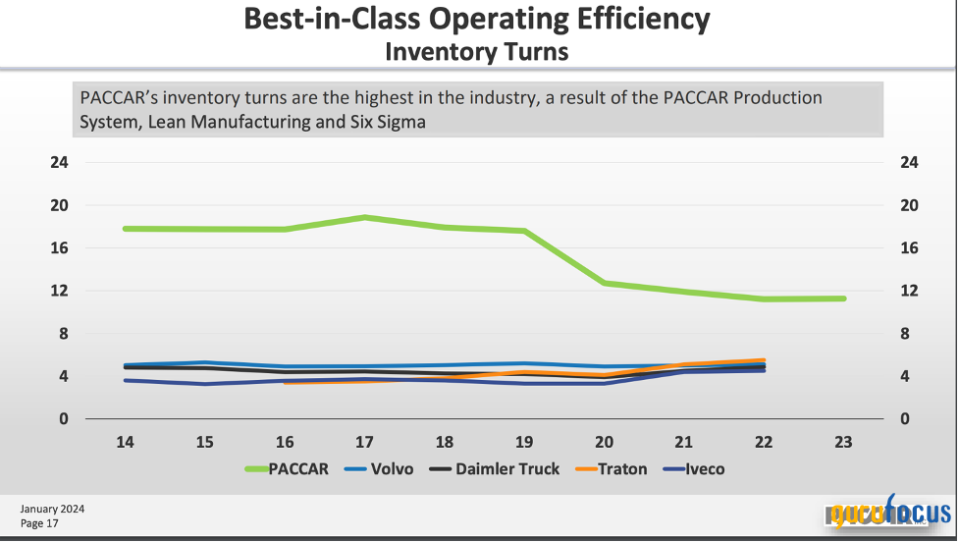

Moreover, the company distinguishes itself from competitors with an exceptionally high inventory turnover rate of 12 times. This rate is significantly higher than its peers, who generally report inventory turnovers in the range of 4 to 7 times. This disparity not only underscores PACCAR's operational efficiency, but also implies a competitive edge in reducing holding costs and enhancing responsiveness to evolving market trends and shifting customer preferences.

Source: Paccar's presentation

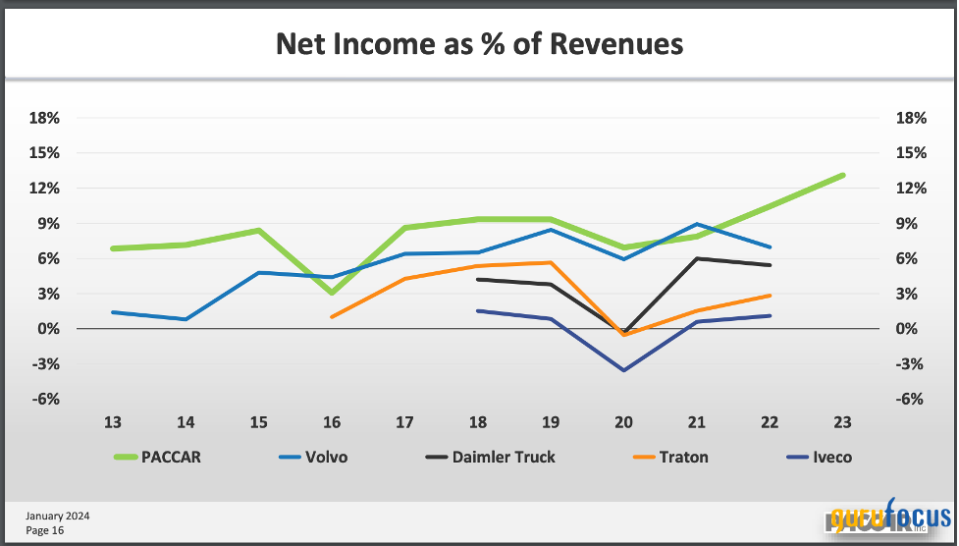

With growing revenue, effective cost management and high inventory turnover, Paccar has consistently outperformed its peers in terms of profit margin over the past decade. Notably, after the Covid-19 pandemic, the company's profit margin significantly increased, reaching 13% in 2023. This figure notably surpasses that of Volvo and Daimler Truck, which both approximately achieved a 6% profit margin. Among these five companies, Traton and Iveco have the lowest margins at 3% and just over 1%, respectively.

Source: Paccar's presentation

Commitment to returning cash to shareholders

Paccar has a long tradition of rewarding its shareholders through dividend payments and share buybacks. The company boasts a remarkable track record of 85 consecutive years of profitability and has consistently paid dividends since 1941 without interruption. Its history of returning cash to shareholders, encompassing both dividends and share buybacks, has seen fluctuations but demonstrates a compound annual growth rate of 12%. Notably, its dividend's 10-year annualized growth rate has reached 7%. In 2023, Paccar declared a dividend of $4.24 per share, which included an additional cash dividend of $3.20 per share. At the current share price of $101 per share, shareholders are getting decent dividend yield at 4.20%.

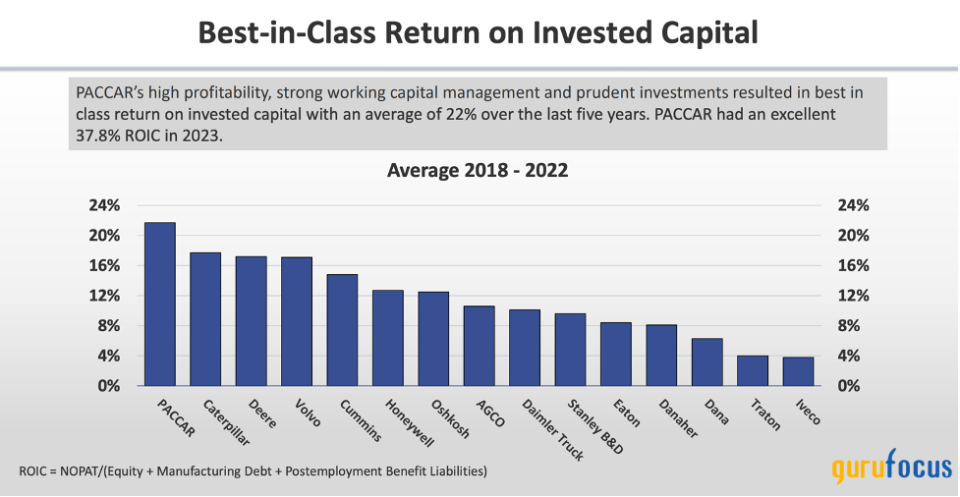

Investors are also notably impressed by Paccar's exceptional return on invested capital. Over the past five years, the company has maintained an average return on invested capital of 22%. In 2023, its ROIC impressively rose to 37.8%, significantly outperforming its competitors. Volvo's ROIC stood at 17%, Daimler Truck's was around 10%, while Traton and Iveco both hovered at nearly 4%.

Source: Paccar's presentation

Paccar is fairly valued now

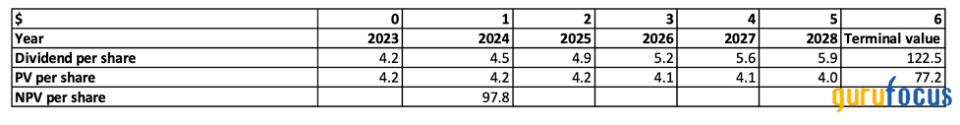

Let's calculate Paccar's intrinsic value per share using the two-stage dividend discount model. Assuming the company continues to increase its dividend payments by 7% annually for the next five years, similar to its annual dividend growth rate over the past 10 years, the dividend growth rate would decelerate to 3% afterward. By applying a discount rate of 8%, Paccar's intrinsic value can be determined as follows:

Source: Author's table

By applying the dividend discount model, the estimated intrinsic value of Paccar is approximately $98 per share. This is close to its current trading price of $101 per share. Based on this analysis, it can be concluded that the company is reasonably valued at its current market price.

Key takeaway

Paccar can be considered a solid investment, combining strong financial results, operational efficiency and a consistent commitment to shareholder value. The company's resilience in economic cycles, coupled with its top performance in the commercial truck industry, is reflected in its current valuation. Paccar represents a balanced investment opportunity in the commercial trucking sector, marked by stability and the potential for sustained success.

This article first appeared on GuruFocus.