Pacific Biosciences of California Inc (PACB) Reports Substantial Revenue Growth Amidst Widening ...

Revenue Growth: PACB's revenue soared by 113% in Q4 and 56% for the fiscal year 2023.

Instrument Sales: Instrument revenue increased significantly, driven by the shipment of 44 RevioTM sequencing systems in Q4.

Gross Margin: Gross margin declined year-over-year, reflecting inventory reserves and loss on purchase commitments.

Net Loss: Despite revenue growth, PACB reported a net loss of $82.0 million in Q4 and $306.7 million for the fiscal year.

Liquidity Position: Cash, cash equivalents, and investments totaled $631.4 million at the end of 2023.

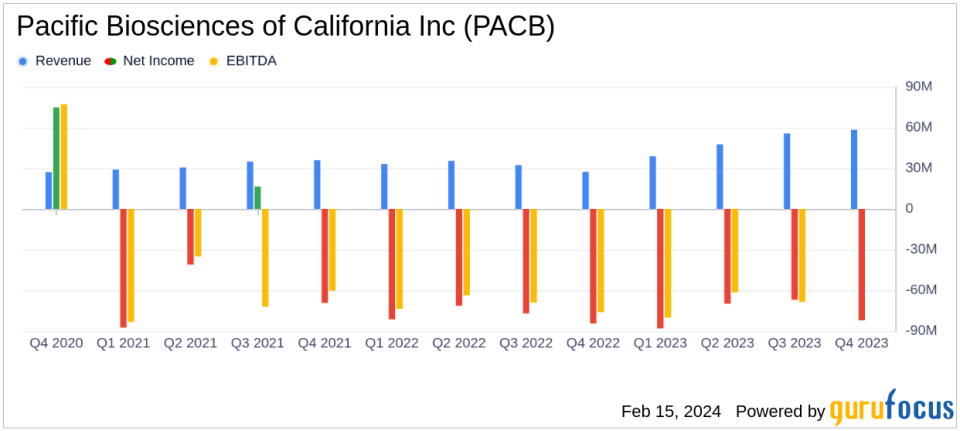

Pacific Biosciences of California Inc (NASDAQ:PACB), a leader in the biotechnology sector specializing in sequencing systems for biological research, released its 8-K filing on February 15, 2024, detailing its financial results for the fourth quarter and fiscal year ended December 31, 2023. The company, which primarily serves the North American market followed by Asia and Europe, reported a remarkable 113% increase in quarterly revenue, reaching $58.4 million, and a 56% increase for the fiscal year, totaling $200.5 million.

Financial Performance and Challenges

The surge in revenue was largely attributed to instrument sales, which jumped to $35.1 million in the fourth quarter from $6.1 million in the prior-year period. This growth was driven by the shipment of 44 RevioTM sequencing systems. However, the company's gross margin saw a decline, dropping to 16% in Q4 2023 from 19% in Q4 2022, primarily due to a higher-than-anticipated decline in demand for Sequel II and IIe systems as customers transitioned to the newer Revio platform.

Operating expenses saw a slight increase to $97.1 million in Q4 2023, up from $92.2 million in the same period last year. The net loss for the quarter was $82.0 million, a slight improvement from the net loss of $84.4 million in Q4 2022. For the full fiscal year, the net loss was $306.7 million compared to $314.2 million in the previous year. The company's liquidity remains strong, with cash, cash equivalents, and investments totaling $631.4 million at the end of 2023, although this was down from $772.3 million at the end of 2022.

Strategic Developments and Management Commentary

Amidst these financials, PACB has made strategic moves to strengthen its market position. The creation of the HiFi Solves consortium and the release of new software and kits for the Revio system highlight the company's commitment to innovation and customer support. President and CEO Christian Henry commented on the company's trajectory, stating:

"Our team successfully executed its goals in 2023 and launched PacBio on a trajectory this company has never seen before. We continue to build solutions across the workflow, allowing our customers to further scale on HiFi, and we are encouraged to see how researchers are already making discoveries and shifting paradigms with the power and economics of Revio and the extraordinary accuracy of Onso."

Analysis of Financial Health

While the revenue growth is a positive sign, the declining gross margin and the net loss indicate that PACB is still navigating through the challenges of market shifts and product transitions. The company's ability to manage operating expenses and improve gross margins will be critical in achieving profitability. The investments in research and partnerships, as highlighted by the CEO, suggest a focus on long-term growth and market leadership in the sequencing industry.

In conclusion, Pacific Biosciences of California Inc (NASDAQ:PACB) has demonstrated significant revenue growth and strategic advancements in the fiscal year 2023. However, the company faces challenges in improving profitability and managing the transition to new product offerings. Investors and stakeholders will be watching closely to see if the company's strategic initiatives will lead to improved financial performance in the coming years.

For a detailed analysis of PACB's financial results and strategic direction, investors are encouraged to review the full 8-K filing.

Explore the complete 8-K earnings release (here) from Pacific Biosciences of California Inc for further details.

This article first appeared on GuruFocus.