Pacific Premier Bancorp Inc (PPBI) Reports Q4 2023 Results: Net Loss Amid Balance Sheet ...

Net Loss: Reported a net loss of $135.4 million, or $1.44 per diluted share.

Adjusted Net Income: Adjusted net income stood at $48.4 million, or $0.51 per diluted share.

Balance Sheet Repositioning: Sold $1.26 billion of available-for-sale securities, resulting in a net after-tax loss of $182.3 million.

Net Interest Margin: Expanded by 16 basis points to 3.28%.

Capital Ratios: Common equity tier 1 capital ratio was 14.32%, and total risk-based capital ratio was 17.29%.

Tangible Book Value: Increased by $0.33 to $20.22 per share compared to the previous quarter.

Dividend: Quarterly cash dividend maintained at $0.33 per share.

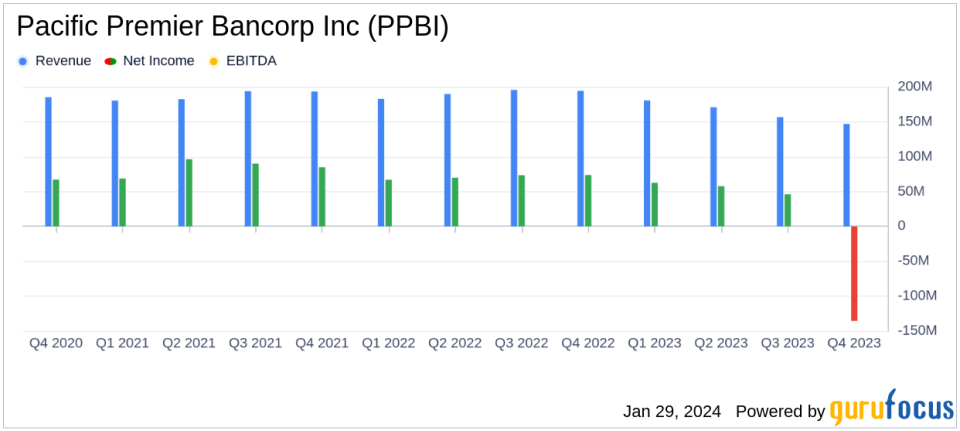

On January 29, 2024, Pacific Premier Bancorp Inc (NASDAQ:PPBI) released its 8-K filing, announcing financial results for the fourth quarter of 2023. The company reported a net loss of $135.4 million, or $1.44 per diluted share, compared to net income of $46.0 million, or $0.48 per diluted share, for the third quarter of 2023, and net income of $73.7 million, or $0.77 per diluted share, for the fourth quarter of 2022. Despite the reported net loss, the adjusted net income was $48.4 million, or $0.51 per diluted share, when excluding the significant loss from an investment securities repositioning transaction and an FDIC special assessment expense.

PPBI, through its subsidiaries, provides banking products and services, including cash management, electronic banking services, credit facilities, and retirement accounts. The bank's proactive repositioning of its securities portfolio was aimed at enhancing future earnings and providing additional liquidity in a challenging operating environment. This strategic move resulted in an expanded net interest margin of 16 basis points to 3.28% for the quarter.

The bank's cost of deposits increased to 1.56%, with the cost of non-maturity deposits at 1.02%. Non-maturity deposits accounted for 84.7% of total deposits. PPBI also reduced $617.0 million in higher-cost brokered certificates of deposit and $200.0 million in FHLB borrowings during the quarter. Asset quality remained strong, with total delinquency at 0.08% of loans held for investment and nonperforming assets to total assets at 0.13%.

Steven R. Gardner, Chairman, CEO, and President of PPBI, commented on the results:

"Our team delivered another solid quarter to close out 2023, an extraordinary year for the banking industry. During the fourth quarter, we proactively repositioned our securities portfolio to enhance our future earnings profile and provide additional liquidity as we navigate a challenging operating environment."

Despite the net loss, PPBI's financial achievements, such as the expansion of the net interest margin and the increase in tangible book value per share, are significant for the bank and the industry. These metrics indicate the bank's ability to generate income from its core business activities and its financial strength, respectively.

PPBI's balance sheet repositioning, although resulting in a short-term loss, is aimed at strengthening the bank's future earnings potential. The bank's solid capital ratios and liquidity position, coupled with disciplined risk management, position it well for the future. The maintained dividend also reflects the bank's commitment to shareholder value despite the current challenges.

As PPBI navigates through the evolving economic landscape, the bank's strategic actions and strong fundamentals may continue to be key drivers of its performance, offering insights for value investors and potential GuruFocus.com members interested in the banking sector.

Explore the complete 8-K earnings release (here) from Pacific Premier Bancorp Inc for further details.

This article first appeared on GuruFocus.