Pacira (PCRX) Preliminary '23 Revenues Solid, Exparel Strong

Pacira BioSciences, Inc. PCRX reported preliminary total revenues (unaudited) of $675.0 million for 2023, up 1.2% from 2022. The Zacks Consensus Estimate for the same is $671.7 million.

Pacira’s top line comprises product sales and royalty revenues. The company recognizes product revenues from the sales of its three marketed drugs — Exparel, Zilretta and iovera.

Exparel net product sales came in at $538.1 million in 2023, up 0.3% from 2022, beating our model estimate of $535.4 million.

Exparel (bupivacaine liposome injectable suspension) is indicated in patients aged six years and older for single-dose infiltration to produce postsurgical local analgesia and in adults as an interscalene brachial plexus nerve block to produce postsurgical regional analgesia.

Zilretta product sales were $111.1 million, up 5.3% year over year and iovera net product sales came in at $19.7 million. Other revenues, including sales of bupivacaine liposome injectable suspension and royalties, were $6.1 million in 2023, down 32.9% year over year.

For the fourth quarter of 2023, net product sales of Exparel were $143.9 million, up 4.2% from the year-ago quarter. Sales beat the Zacks Consensus Estimate of $142 million and our model estimate of $141.2 million.

Zilretta product sales were $28.7 million, up 2.5% year over year and iovera net product sales of $6.0 million were up 30.4%.

Other revenues, including sales of bupivacaine liposome injectable suspension and royalties, were $2.6 million compared with $1.4 million in the year-ago quarter.

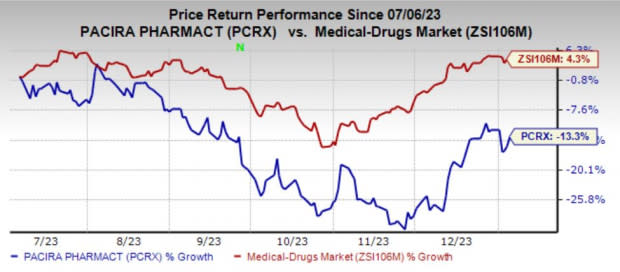

Shares of Pacira have lost 13.3% in the past six months against the industry’s 4.3% rise.

Image Source: Zacks Investment Research

The FDA recently approved Pacira’s supplemental new drug application for Exparel to expand the drug’s label to include administration in adults as an adductor canal block and a sciatic nerve block in the popliteal fossa.

Exparel’s performance has been strong since launch due to growth within existing accounts. Increasing acceptance by major hospitals and orthopedic centers, as it continues to be used in orthopedic procedures, has also boosted growth. The label expansion of Exparel in two new nerve block indications is positive.

The acquisition of Flexion Therapeutics, Inc. in November 2021 gave Pacira its second marketed product, Zilretta, which is indicated as the first and only extended-release, intra-articular therapy for osteoarthritis (“OA”) knee pain and was launched in the United States shortly thereafter.

Pacira is also currently looking to expand Zilretta’s indication to include treatment for OA pain in the shoulder.

Zacks Rank and Stocks to Consider

Pacira currently carries a Zacks Rank #3 (Hold).

Some better-ranked stocks in the healthcare sector are Entrada Therapeutics TRDA, Acadia Pharmaceuticals ACAD and Dynavax Technologies DVAX. TRDA and DVAX carry a Zacks Rank #1 (Strong Buy) each, while ACAD carries a Zacks Rank #2 (Buy) at present. You can see the complete list of today’s Zacks #1 Rank stocks here.

Entrada’s loss per share estimate for 2023 has narrowed from $2.07 to 9 cents in the past 60 days. The same for 2024 has narrowed from $2.35 to $2.04 during the same time frame.

Loss estimates for Acadia have narrowed to 33 cents from 41 cents for 2023 and earnings estimates for 2024 are currently pinned at $1.04 per share. ACADIA shares have gained 22.8% in the past six months.

Dynavax’s loss per share estimate for 2023 has narrowed from 23 cents to 12 cents in the past 90 days. The bottom-line estimate for 2024 has risen from 3 cents to 18 cents during the same period. Shares of DVAX have risen 16.6% in the past six months.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Dynavax Technologies Corporation (DVAX) : Free Stock Analysis Report

Pacira BioSciences, Inc. (PCRX) : Free Stock Analysis Report

ACADIA Pharmaceuticals Inc. (ACAD) : Free Stock Analysis Report

Entrada Therapeutics, Inc. (TRDA) : Free Stock Analysis Report