Packaged Food Stocks Q3 Earnings: Freshpet (NASDAQ:FRPT) Best of the Bunch

The end of an earnings season can be a great time to assess how companies are handling the current business environment and discover new stocks. Let’s take a look at how Freshpet (NASDAQ:FRPT) and the rest of the packaged food stocks fared in Q3.

As America industrialized and moved away from an agricultural economy, people faced more demands on their time. Packaged foods emerged as a solution offering convenience to the evolving American family, whether it be canned goods, prepared meals, or snacks. Today, Americans seek brands that are high in quality, reliable, and reasonably priced. Furthermore, there's a growing emphasis on health-conscious and sustainable food options. Packaged food stocks are considered resilient investments. People always need to eat, so these companies can enjoy consistent demand as long as they stay on top of changing consumer preferences.The industry spans from multinational corporations to smaller specialized firms and is subject to food safety and labeling regulations.

The 29 packaged food stocks we track reported a slower Q3; on average, revenues missed analyst consensus estimates by 2.2% while next quarter's revenue guidance was 10.9% below consensus. Inflation (despite slowing) has investors prioritizing near-term cash flows, but packaged food stocks held their ground better than others, with the share prices up 9.2% on average since the previous earnings results.

Best Q3: Freshpet (NASDAQ:FRPT)

Contrasting itself with the typical processed pet foods found throughout the industry, Freshpet (NASDAQ:FRPT) is a pet food company whose product portfolio includes natural meals and treats for dogs and cats.

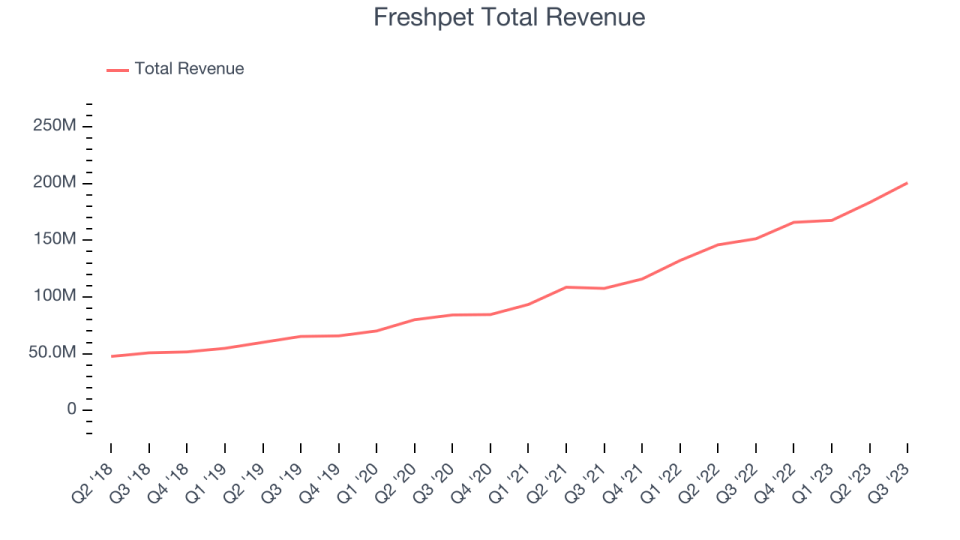

Freshpet reported revenues of $200.6 million, up 32.6% year on year, topping analyst expectations by 3.2%. It was a decent quarter for the company, with an impressive beat of analysts' earnings estimates.

"Fiscal year 2023 is shaping up to be the kind of year we had hoped it would – delivering strong top-line and bottom-line growth that puts us ahead of the pace needed to deliver our 2027 goals. As a result of our strong third quarter performance, we are raising our 2023 guidance today," commented Billy Cyr, Freshpet’s Chief Executive Officer.

Freshpet achieved the highest full-year guidance raise of the whole group. The stock is up 50.3% since the results and currently trades at $87.56.

Is now the time to buy Freshpet? Access our full analysis of the earnings results here, it's free.

Lamb Weston (NYSE:LW)

Best known for its Grown in Idaho brand, Lamb Weston (NYSE:LW) produces and distributes potato products such as frozen french fries and mashed potatoes.

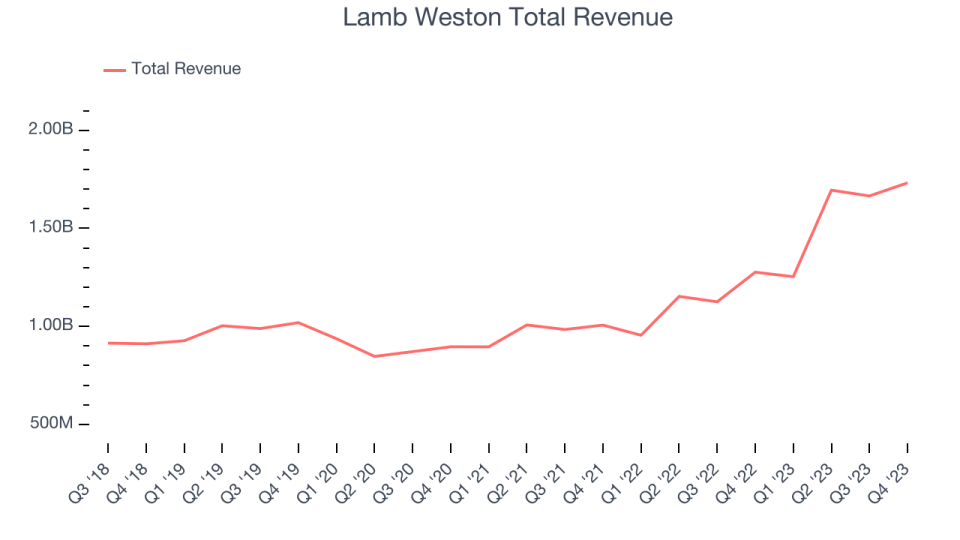

Lamb Weston reported revenues of $1.73 billion, up 35.7% year on year, outperforming analyst expectations by 1.9%. It was a decent quarter for the company, with a beat of analysts' revenue estimates. Looking forward, while revenue guidance was maintained from the previous outlook, EPS guidance was raised.

Lamb Weston delivered the fastest revenue growth among its peers. The stock is up 2.8% since the results and currently trades at $107.91.

Is now the time to buy Lamb Weston? Access our full analysis of the earnings results here, it's free.

Slowest Q3: Cal-Maine (NASDAQ:CALM)

Known for brands such as Egg-Land’s Best and Land O’ Lakes, Cal-Maine (NASDAQ:CALM) produces, packages, and distributes eggs.

Cal-Maine reported revenues of $523.2 million, down 34.7% year on year, falling short of analyst expectations by 0.4%. It was a weak quarter for the company, with a miss of analysts' revenue and EPS estimates.

In addition, the egg industry saw outbreaks of highly pathogenic avian influenza (HPAI) in November 2023. Cal-Maine wasn't spared, and it was forced to depopulate approximately 1.5 million laying hens, or 3.3% of its total flock.

Cal-Maine had the slowest revenue growth in the group. The stock is down 0.9% since the results and currently trades at $54.41.

Read our full analysis of Cal-Maine's results here.

J. M. Smucker (NYSE:SJM)

Best known for its fruit jams and spreads, J.M Smucker (NYSE:SJM) is a packaged foods company whose products span peanut butter to coffee to pet food.

J. M. Smucker reported revenues of $1.94 billion, down 12.1% year on year, falling short of analyst expectations by 0.3%. It was a slower quarter for the company, with a miss of analysts' revenue estimates.

The stock is up 16.5% since the results and currently trades at $130.98.

Read our full, actionable report on J. M. Smucker here, it's free.

Join Paid Stock Investor Research

Help us make StockStory more helpful to investors like yourself. Join our paid user research session and receive a $50 Amazon gift card for your opinions. Sign up here.

The author has no position in any of the stocks mentioned