Packaging Corp of America (PKG) Navigates Market Challenges with Resilient 2023 Performance

Net Income: PKG reported a net income of $189 million for Q4 and $765 million for the full year of 2023.

Earnings Per Share (EPS): Q4 EPS stood at $2.10, with full-year EPS at $8.48, or $8.70 excluding special items.

Net Sales: Net sales reached $1.94 billion in Q4 2023, a slight decrease from $1.98 billion in Q4 2022.

Operational Highlights: Packaging segment shipments increased by 5.1% per day in Q4, with containerboard production at 1,213,000 tons.

Capital Spending: PKG invested $141.1 million in capital expenditures in Q4, focusing on operational improvements and conversions.

Liquidity Position: The company ended the year with $1.2 billion in cash, cash equivalents, and marketable debt securities.

On January 24, 2024, Packaging Corp of America (NYSE:PKG) released its 8-K filing, detailing its financial results for the fourth quarter and full year of 2023. As a leading manufacturer in the containerboard and corrugated packaging industry, PKG's performance is a significant indicator of the sector's health and resilience, especially in the face of economic headwinds.

Financial Performance Overview

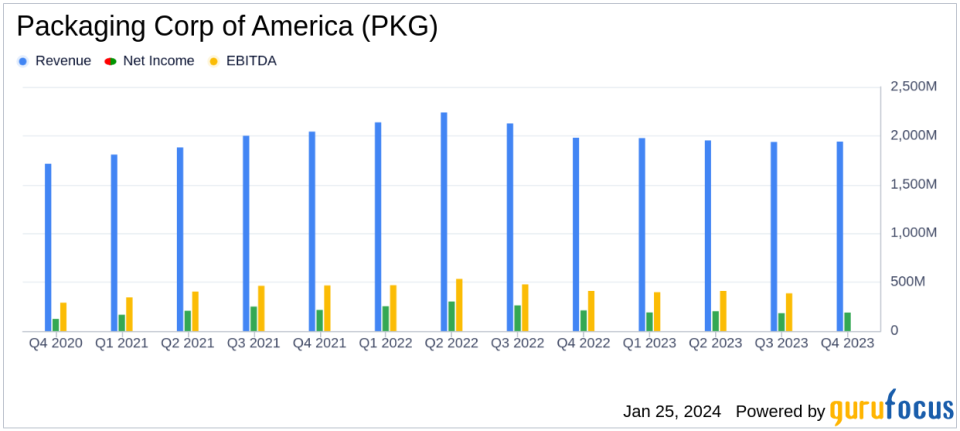

PKG reported a net income of $189 million, or $2.10 per share, for the fourth quarter of 2023, and a net income of $192 million, or $2.13 per share, excluding special items. This represents a decrease from the fourth quarter of 2022, where net income was $211.7 million, or $2.31 per share. For the full year, net income was $765 million, or $8.48 per share, and $784 million, or $8.70 per share excluding special items, down from $1,029.8 million, or $11.03 per share in 2022. Net sales for the year were $7.8 billion, compared to $8.5 billion in the previous year.

Segment Performance and Challenges

The decrease in earnings per share in the fourth quarter of 2023 compared to the same period in 2022 was primarily due to lower prices and mix in both the Packaging and Paper segments, as well as higher depreciation expenses. However, these were partially offset by higher volume in the Packaging segment, lower operating and converting costs, and lower scheduled maintenance outage expenses.

In the Packaging segment, shipments per day were up 5.1%, with total corrugated products shipments increasing by 6.9% compared to the fourth quarter of 2022. Containerboard production reached 1,213,000 tons, with inventory levels rising slightly from the previous year. The Paper segment, however, saw a decrease in sales volume compared to both the fourth quarter of 2022 and the third quarter of 2023.

Management Commentary

"Throughout the quarter, demand in the Packaging segment was stronger than our expectations. The higher volume along with the operational benefits of our capital spending program and continued emphasis on cost management and process efficiencies across our manufacturing and converting facilities drove operating and converting costs lower as well," said Mark W. Kowlzan, Chairman and CEO of PKG.

"Looking ahead as we move from the fourth and into the first quarter, in our Packaging segment, we expect higher total corrugated products shipments from continued strong demand," Kowlzan continued, outlining expectations for the upcoming quarter, including the impact of scheduled maintenance and conversion activities.

Capital Allocation and Liquidity

PKG's capital spending for the fourth quarter was $141.1 million, focused on enhancing operational efficiency and the conversion of paper-to-containerboard production capabilities. The company's strong liquidity position, with over $1.2 billion in cash, cash equivalents, and marketable debt securities, provides a solid foundation for continued investment and strategic initiatives.

Looking Forward

PKG anticipates the first quarter of 2024 to bring earnings of $1.54 per share, excluding special items. The company expects to face higher costs for recycled fiber and energy, as well as seasonal increases in labor and benefits costs. Despite these challenges, PKG remains focused on managing its operations efficiently to navigate the dynamic market conditions.

As a key player in the North American paper and packaging industry, PKG's performance is closely watched by investors and industry analysts. The company's ability to maintain profitability and operational efficiency in a challenging market environment demonstrates the resilience of its business model and the effectiveness of its strategic initiatives.

For more detailed financial information and the full earnings report, investors and interested parties are encouraged to review the complete 8-K filing.

Explore the complete 8-K earnings release (here) from Packaging Corp of America for further details.

This article first appeared on GuruFocus.