Pactiv Evergreen Inc. (PTVE) Reports Q4 and Full Year 2023 Financial Results

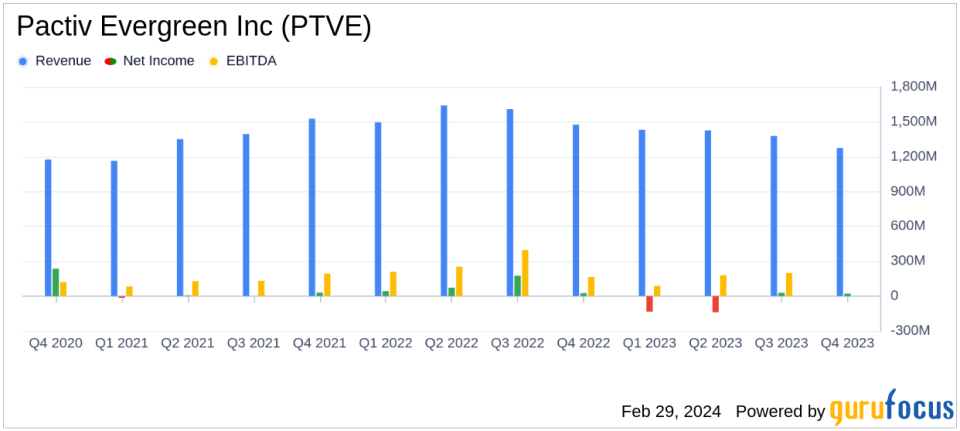

Total Net Revenues: $1,274 million in Q4 2023, down 14% YOY and 8% sequentially.

Net Income: $22 million in Q4 2023, compared to $27 million in Q4 2022.

Adjusted EBITDA: $207 million in Q4 2023, up from $167 million in Q4 2022.

Diluted EPS: $0.12 in Q4 2023, down from $0.15 in Q4 2022.

Adjusted EPS: $0.33 in Q4 2023, up from $0.17 in Q4 2022.

Debt Reduction: Reduced total debt by $550 million in 2023.

Footprint Optimization: Expected to save $35 million by 2026 with a restructuring plan.

On February 29, 2024, Pactiv Evergreen Inc (NASDAQ:PTVE) released its 8-K filing, detailing its financial performance for the fourth quarter and full year of 2023. The company, a leading manufacturer and distributor of fresh foodservice and food merchandising products and fresh beverage cartons, faced a challenging year with a decline in net revenues and net income, but managed to improve its Adjusted EBITDA and Adjusted EPS year-over-year (YOY).

Pactiv Evergreen operates primarily in the United States and is divided into three segments: Foodservice, Food Merchandising, and Beverage Merchandising. The company's diverse product range includes food containers, drinkware, and beverage cartons, many of which are made with recycled or renewable materials.

Performance and Challenges

The company's total net revenues for Q4 2023 were $1,274 million, a 14% decrease compared to the same quarter in the previous year. The full-year revenues also saw an 11% decline, totaling $5,510 million. The net income from continuing operations for Q4 was $22 million, down from $27 million in Q4 2022, and the company reported a net loss from continuing operations of $222 million for the full year, a stark contrast to the net income of $319 million in the prior year.

Despite these challenges, PTVE achieved a higher Adjusted EBITDA of $207 million in Q4 2023, up from $167 million in Q4 2022, and an increase in full-year Adjusted EBITDA to $840 million from $785 million in the prior year. Adjusted EPS for Q4 was also up, reaching $0.33 compared to $0.17 in the same quarter of the previous year.

The company's financial achievements are significant in the context of the Packaging & Containers industry, where managing costs and maintaining profitability are crucial. PTVE's efforts to reduce its total debt by $550 million enhance its ability to invest in strategic opportunities and navigate economic volatility.

Financial Highlights and Strategic Initiatives

PTVE's leadership highlighted the company's commitment to operational excellence and profitable growth, which helped offset the headwinds encountered throughout the year. President and CEO Michael King emphasized the company's agility and discipline, which allowed it to exceed financial goals and deliver for customers. CFO Jon Baksht noted the consistent improvement in the company's profitability profile and the reduction in total debt, positioning PTVE for profitable growth in 2024.

"This was a pivotal year for Pactiv Evergreen. The Companys commitment to operational excellence and profitable growth helped offset the headwinds we encountered throughout the year. Our teams demonstrated agility and discipline, allowing the Company to exceed its financial goals while also delivering for customers." - Michael King, President and CEO of Pactiv Evergreen.

PTVE also announced a restructuring plan to optimize its manufacturing and warehousing footprint, expected to result in estimated run rate cost savings of $35 million by 2026. The company plans to incur capital expenditures of $40 million to $45 million primarily during 2024 and 2025 to execute this plan.

Outlook and Investor Relations

Looking ahead to 2024, PTVE aims to continue its transformational journey by focusing on operational excellence and executing its footprint optimization plan. The company provides 2024 Adjusted EBITDA guidance in the range of $850 million to $870 million, with between $160 million and $170 million for the first quarter.

Investors and analysts can access more details on PTVE's financial performance and strategic initiatives during the conference call and webcast presentation scheduled for March 1, 2024.

For a comprehensive understanding of PTVE's financial position and future prospects, investors are encouraged to review the full 8-K filing and stay informed on the company's ongoing efforts to navigate market challenges and capitalize on growth opportunities.

Explore the complete 8-K earnings release (here) from Pactiv Evergreen Inc for further details.

This article first appeared on GuruFocus.