Is Pactiv Evergreen (PTVE) Modestly Undervalued? A Comprehensive Analysis of Its Market Value

On September 19, 2023, Pactiv Evergreen Inc (NASDAQ:PTVE) recorded a daily gain of 3.6%, contributing to a three-month gain of 16.75%. Despite the recent upward trend, the company reported a Loss Per Share of $0.41. This raises an intriguing question: Is Pactiv Evergreen's stock modestly undervalued? The following analysis aims to answer this question by examining the company's valuation in detail.

Company Overview

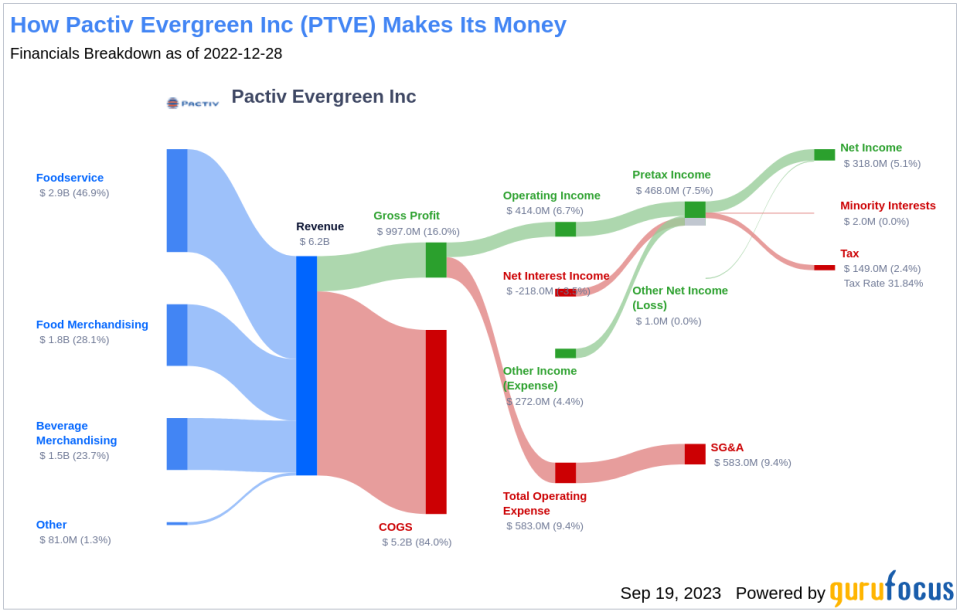

Pactiv Evergreen Inc, primarily operating in the United States, is a leading manufacturer and distributor of fresh foodservice and food merchandising products and fresh beverage cartons. The company operates in three segments: Foodservice, Food Merchandising, and Beverage Merchandising. These segments produce a wide range of products, including food containers, drinkware, tableware, ready-to-eat food containers, trays for meat and poultry, molded fiber egg cartons, and other related products.

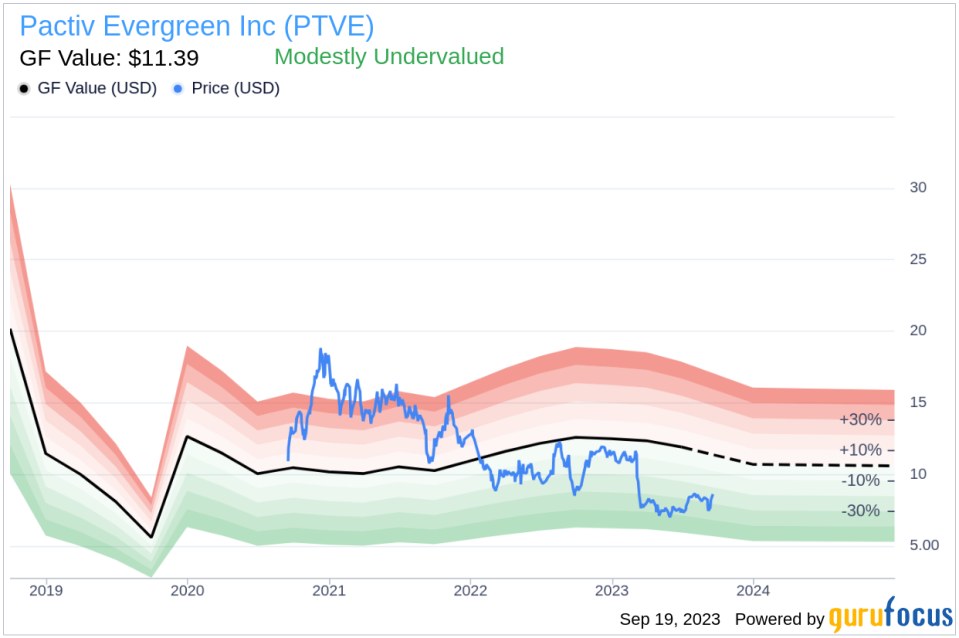

The company's stock price stands at $8.63, while its intrinsic value, as estimated by the GF Value, is $11.39. This discrepancy suggests that Pactiv Evergreen's stock might be modestly undervalued.

Understanding the GF Value

The GF Value is a unique valuation method that estimates a stock's intrinsic value. It is based on historical trading multiples, an internal adjustment factor reflecting the company's past performance and growth, and future business performance estimates. The GF Value Line on our summary page provides an overview of the fair value that the stock should ideally trade at.

According to our GF Value estimation, Pactiv Evergreen's stock appears to be modestly undervalued. This suggests that the long-term return of its stock is likely to be higher than its business growth.

Link: These companies may deliver higher future returns at reduced risk.

Evaluating Pactiv Evergreen's Financial Strength

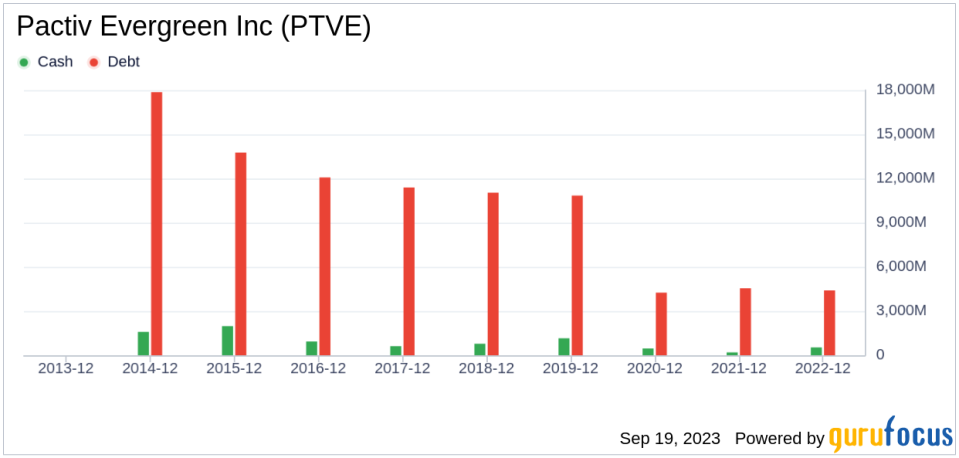

Investing in companies with low financial strength could lead to permanent capital loss. Therefore, it's crucial to examine a company's financial strength before deciding to buy shares. Pactiv Evergreen has a cash-to-debt ratio of 0.07, ranking worse than 83.38% of companies in the Packaging & Containers industry. GuruFocus ranks Pactiv Evergreen's financial strength as 4 out of 10, indicating a relatively poor balance sheet.

Assessing Profitability and Growth

Companies with consistent profitability over the long term offer less risk for investors. Pactiv Evergreen has been profitable 7 over the past 10 years. However, its operating margin of 1.63% ranks worse than 75.94% of companies in the Packaging & Containers industry. Overall, GuruFocus ranks Pactiv Evergreen's profitability at 5 out of 10, indicating fair profitability.

Long-term stock performance is closely correlated with growth. Pactiv Evergreen's average annual revenue growth is 5.6%, ranking worse than 57.02% of companies in the industry. Its 3-year average EBITDA growth is 3.4%, which also ranks worse than 57.23% of companies in the industry.

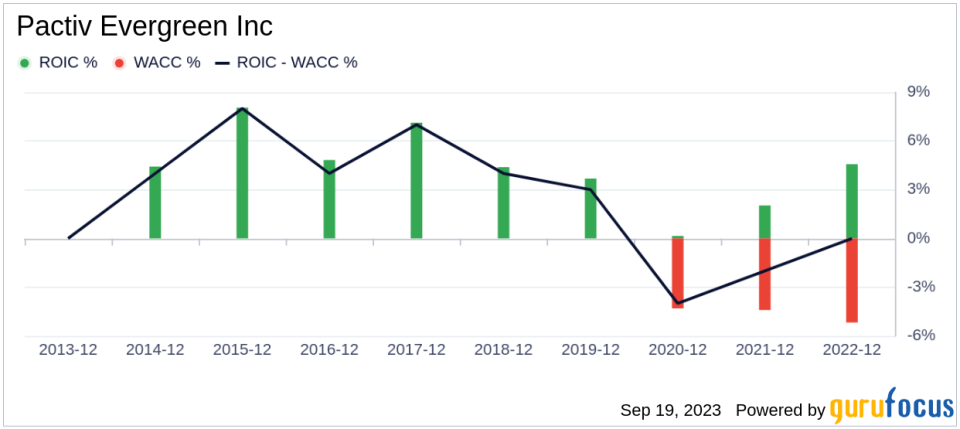

ROIC vs WACC

Another profitability indicator is the comparison between a company's return on invested capital (ROIC) and its weighted cost of capital (WACC). If the ROIC is higher than the WACC, it indicates that the company is creating value for shareholders. Over the past 12 months, Pactiv Evergreen's ROIC was 3.88, while its WACC came in at 6.46.

Conclusion

In conclusion, Pactiv Evergreen's stock shows signs of being modestly undervalued. While the company's financial condition is poor and its profitability is fair, its growth ranks worse than 57.23% of companies in the Packaging & Containers industry. To learn more about Pactiv Evergreen's stock, you can check out its 30-Year Financials here.

To find high-quality companies that may deliver above-average returns, consider checking out the GuruFocus High Quality Low Capex Screener.

This article first appeared on GuruFocus.