PacWest Bancorp Just Missed Earnings With A Surprise Loss - Here Are Analysts Latest Forecasts

Shareholders might have noticed that PacWest Bancorp (NASDAQ:PACW) filed its quarterly result this time last week. The early response was not positive, with shares down 4.7% to US$16.09 in the past week. The results don't look great, especially considering that the analysts had been forecasting a profit and PacWest Bancorp delivered a statutory loss ofUS$12.23 per share. Revenues of US$281m did beat expectations by 4.7% though. The analysts typically update their forecasts at each earnings report, and we can judge from their estimates whether their view of the company has changed or if there are any new concerns to be aware of. We thought readers would find it interesting to see the analysts latest (statutory) post-earnings forecasts for next year.

See our latest analysis for PacWest Bancorp

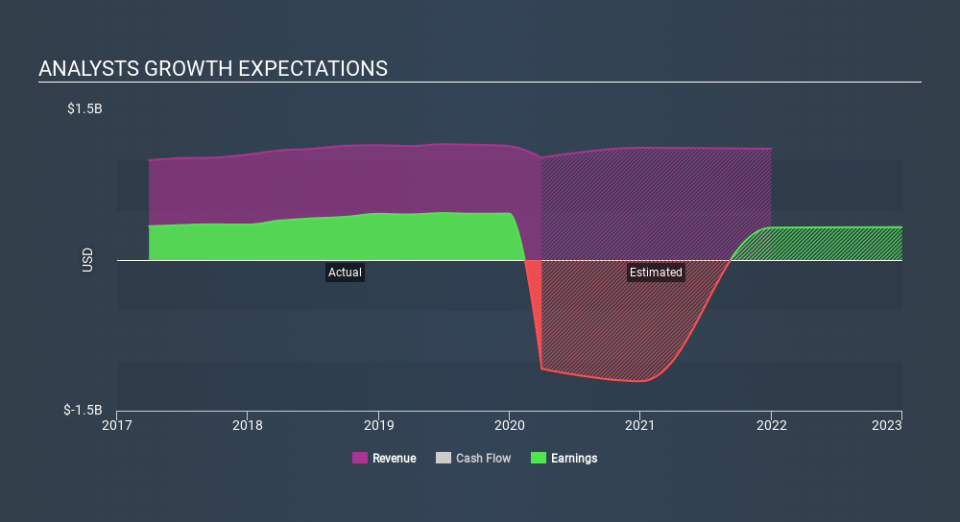

Taking into account the latest results, the most recent consensus for PacWest Bancorp from eleven analysts is for revenues of US$1.12b in 2020 which, if met, would be a notable 9.6% increase on its sales over the past 12 months. Statutory losses are expected to reduce, shrinking 13% from last year to US$10.35. In the lead-up to this report, the analysts had been modelling revenues of US$1.05b and earnings per share (EPS) of US$2.81 in 2020. Yet despite a small increase to revenues, the analysts are now forecasting a loss instead of a profit, which looks like a reduction in sentiment after the latest results.

It will come as no surprise that expanding losses caused the consensus price target to fall 16% to US$22.35 with the analysts implicitly ranking ongoing losses as a greater concern than growing revenues. It could also be instructive to look at the range of analyst estimates, to evaluate how different the outlier opinions are from the mean. Currently, the most bullish analyst values PacWest Bancorp at US$27.00 per share, while the most bearish prices it at US$19.00. Analysts definitely have varying views on the business, but the spread of estimates is not wide enough in our view to suggest that extreme outcomes could await PacWest Bancorp shareholders.

Looking at the bigger picture now, one of the ways we can make sense of these forecasts is to see how they measure up against both past performance and industry growth estimates. It's clear from the latest estimates that PacWest Bancorp's rate of growth is expected to accelerate meaningfully, with the forecast 9.6% revenue growth noticeably faster than its historical growth of 6.7%p.a. over the past five years. By contrast, our data suggests that other companies (with analyst coverage) in a similar industry are forecast to grow their revenue at 2.9% per year. It seems obvious that, while the growth outlook is brighter than the recent past, the analysts also expect PacWest Bancorp to grow faster than the wider industry.

The Bottom Line

The biggest low-light for us was that the forecasts for PacWest Bancorp dropped from profits to a loss next year. Pleasantly, they also upgraded their revenue estimates, and their forecasts suggest the business is expected to grow faster than the wider industry. The consensus price target fell measurably, with the analysts seemingly not reassured by the latest results, leading to a lower estimate of PacWest Bancorp's future valuation.

With that in mind, we wouldn't be too quick to come to a conclusion on PacWest Bancorp. Long-term earnings power is much more important than next year's profits. We have forecasts for PacWest Bancorp going out to 2021, and you can see them free on our platform here.

And what about risks? Every company has them, and we've spotted 2 warning signs for PacWest Bancorp you should know about.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Thank you for reading.