A Pair of Stocks With Low Dividend Payout Ratios

A healthy dividend payout ratio is an important aspect of a companys future ability to grow its distributions. Companies with high payout ratios could see declining dividend growth in the future or, worse, a dividend cut.

For investors looking for secure income, companies with low payout ratios should be a focus. In this article, we will examine two companies with extremely low payout ratios that look well positioned to continue raising their dividends.

Dollar General

First up is Dollar General Corporation (NYSE:DG), a leading U.S. discount retailer with nearly 18,000 stores nationwide. The company provides a wide range of merchandise, including consumables, home products, apparel and seasonal items. Dollar General has a market capitalization of $51 billion and produced revenue of close to $34 billion in its last fiscal year.

Dollar General raised its dividend nearly 17% for the April 20 distribution earlier this year. The company now has a dividend growth streak of seven years. The dividend has a compound annual growth rate (CAGR) of 10.7% since inception in 2015, with the most recent raise being one of the largest.

The stock offers a yield of 0.8% at the moment, which is below the stocks five-year average yield of 1.1% and the average yield of 1.24% for the S&P 500 Index.

Dollar General distributed $1.62 of dividends per share in 2021. Wall Street analysts forecast that the company will earn $10.17 per share this year, giving Dollar General a projected payout ratio of just 16%. This is lower than the 20% average payout ratio that the company has seen since it began paying a dividend.

The companys annualized dividend stands at $1.68 today. Analysts believe that Dollar General will earn $11.30 per share next year, resulting in an expected payout ratio of 15%. In either case, the estimated payout ratios are extremely low even after a period which saw the dividend grow at a very high rate. This should allow for continued dividend growth.

Dollar General has been able to raise its dividend at a high rate and maintain a low payout ratio because earnings per share have had a CAGR of 18% since 2015, and because it started out with a low dividend.

Shares of Dollar General closed yesterdays trading session at $224.69, putting the stocks forward multiple at close to 22 times expected earnings for the year. According to Value Line, Dollar General has an average price-earnings ratio of close to 18 over the last decade.

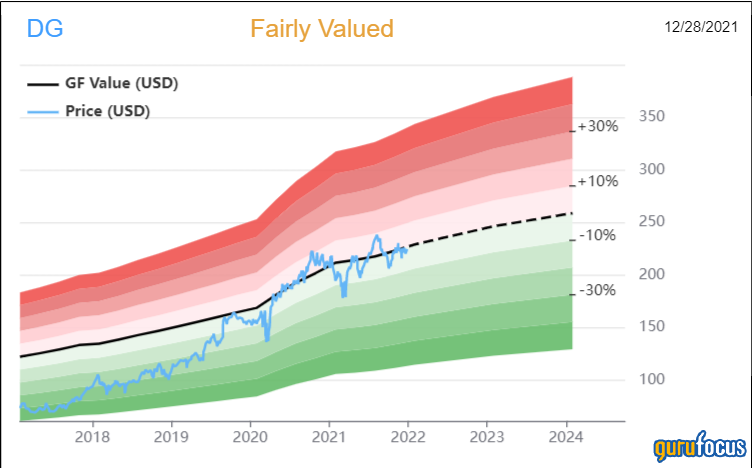

Dollar General might be overvalued on a historical basis, but it looks to be trading close to its intrinsic value, according to the GuruFocus Value chart.

Dollar General has a GF Value of $226.79, giving the stock a price-to-GF-Value ratio of 0.99. Shares are rated as fairly valued by GuruFocus.

Tyson

Tyson Foods, Inc. (NYSE:TSN) is a leading processor and marketer of chicken, beef and pork products. The companys end markets include grocery stores, wholesale clubs, restaurants and meat distributors. Tyson is valued at $31 billion and generated revenue of $47 billion in fiscal year 2021, which ended on Oct. 2.

Tyson raised its dividend 3.4% for the Dec. 15 payment, extending the companys dividend growth streak to 11 consecutive years. Dividend growth has been extremely high over the last decade, with a CAGR of close to 30% during this period of time. Growth has slowed somewhat recently, but the five-year CAGR is 16%.

The annualized dividend of 2.1% gives Tyson a yield of 2.1% today, which compares well to the stocks 10-year average yield of 1.6% and the average yield for the market index.

Shareholders received a total of $1.78 of dividends per share during fiscal year 2021. With the company earning $8.28 per share during the year, the resulting payout ratio was just 21%.

Investors should see at least $1.84 of dividends per share in fiscal year 2022. Analysts predict that Tyson will earn $7.27 for the year, giving Tyson a projected payout ratio of 25%. For context, Tyson has five- and 10-year average payout ratios of 23% and 18%, respectively. The expected payout ratio for the current fiscal year is slightly above the medium- and long-term averages, but only mildly so. This could be a reason for the lower than usual dividend increase this year.

Tysons payout ratio has been low over the long-term due in large part to its earnings growth rate of close to 13% over the last decade.

With shares closing Mondays trading session at $86.16, Tyson has a forward price-earnings ratio of 11.8. This is almost identical to the 10-year average multiple of 11.7 times earnings.

The GuruFocus Value chart shows that the stock has gotten slightly ahead of its intrinsic value.

Tyson has a GF Value of $79.19, equating to a price-to-GF-Value ratio of 1.08. Shares would need to retreat 7.3% to trade with the GF Value. Tyson receives a rating of fairly valued from GuruFocus.

Final thoughts

Dollar General and Tyson are two examples of companies with incredibly low dividend payout ratios. Dollar Generals is low despite a track record of double-digit increases, including the most recent raise. Tysons dividend growth rate has slowed, but the payout ratio stands at a very low level, so future dividend growth likely isnt in jeopardy. Both stocks appear to be trading close to fair value against their respective intrinsic values, but they could be appealing options to investors looking for secure income streams.

This article first appeared on GuruFocus.