Palantir Technologies Looks Deeply Undervalued

Software intelligence company Palantir Technologies Inc. (NYSE:PLTR) looks very undervalued currently given its underlying growth and powerful free cash flow. It could be worth at least 30% more.

Palantir's value is rooted in its strong growth. The company reported on Feb. 5 that its fourth-quarter 2023 revenue was up 20% year over year and was even 9% higher than the prior quarter.

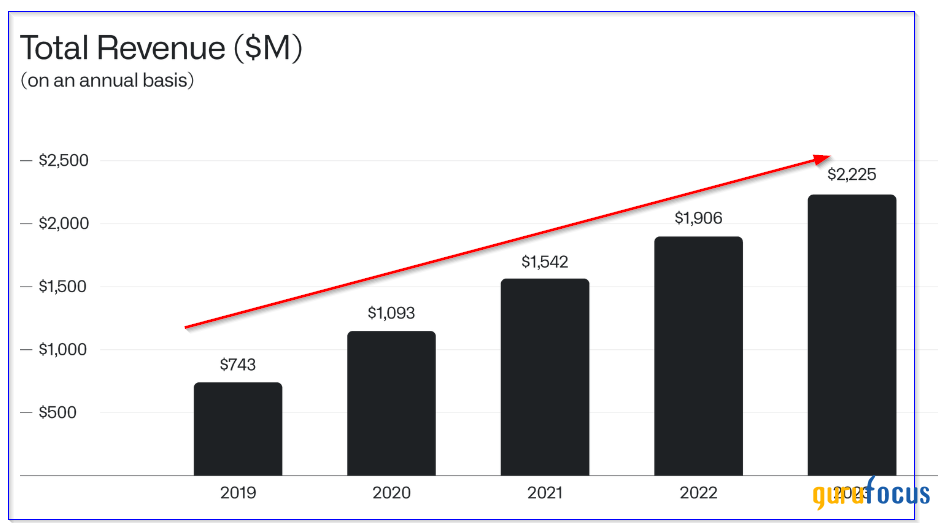

Moreover, the company showed strong growth in 2023, up 17% over the prior year. Palantir has also delivered good continuous growth, as seen in the chart below.

Source: CEO letter Feb 5, 2024

For example, since 2020, the company has more than doubled sales. Sales are up 103.50% from $1.09 billion to $2.23 billion in that period. That represents a compounded average annual growth rate of 26.70% annually for the past three years.

Most of the company's clients are government agencies, especially federal intelligence agencies. Palantir's 10-K annual report says that 55% of its sales were from government sources and 45% from commercial clients. But the CEO's recent letter makes it clear he expects that growth is surging from its commercial clients, including potential artificial intelligence clients.

For example, its U.S. commercial revenue rose 36.40% in 2023 to $457 million and was up 70% year over year in the fourth quarter alone. One reason is that Palantir can now set up data integration and analytical software programs with a client's existing systems in hours rather than weeks and months.

Moreover, its Artificial Intelligence Program is not only quickly gaining customers and is not only its fourth principal software platform (in addition to Gotham, Foundry and Apollo), but CEO Alex Karp said in his letter to shareholders it is the future of the company.

This is because its government and commercial clients must integrate large language models and related AI software programs with their existing systems. Palantir's AIP not only helps with this LLM integration, but also allows integration with its other software platforms that clients may be using.

The bottom line is that analysts continue to see huge sales growth going forward. For example, the average forecast of analysts surveyed shows revenue growing to $2.68 billion in 2024, up 20.40% from $2.23 billion in 2023. And for 2025, they predict $3.23 billion in sales, up $1 billion or 45% from 2023.

Strong profits and free cash flow

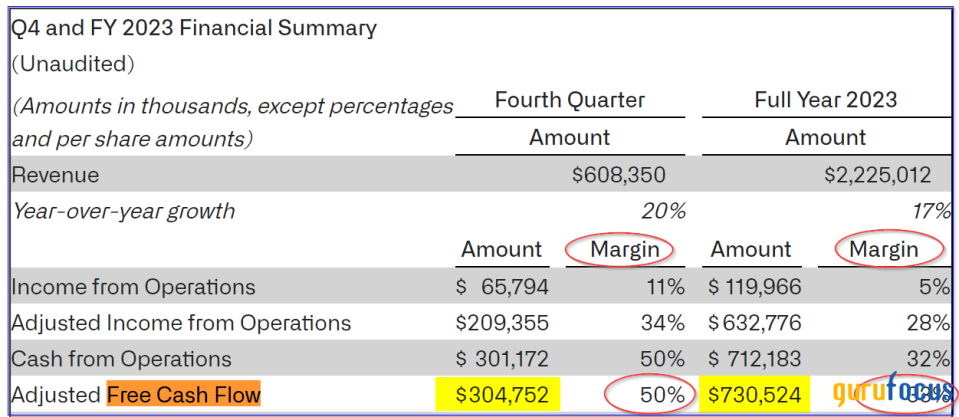

Palantir is already very profitable and this growth could make it even more valuable. Its adjusted income from operations in the fourth quarter was $209.35 million, or 34% of its $608.35 million in quarterly revenue.

Source: Q4 Earnings Release

More importantly, its adjusted free cash flow was $304.75 million, which represented 50% of the quarterly revenue. And for full-year 2023, its adjusted free cash flow margin was 32.8.% (i.e., $730.50 million on $2.23 billion in sales).

That is a very high FCF margin, among the highest of large software companies. For example, Microsoft (NASDAQ:MSFT) generated 30% free cash flow margins during 2023, based on $67.50 billion in FCF on $227.60 billion in sales. Oracle Corp. (NYSE:ORCL) recently reported its trailing 12-month FCF was $12.25 billion on $52.50 billion in sales or an FCF margin of 23.30%.

FCF forecast

This implies Palantir may generate a good deal of free cash flow this year. For example, using analysts' forecasts referred to earlier works out to an average next 12 months run rate of revenue of almost $3 billion (i.e., $2.96 billion is the average of analysts' $2.68 billion sales forecast for 2024 and $3.23 billion for 2025).

So applying its 2023 adjusted free cash flow margin of 32.80% to this NTM $2.96 billion revenue forecast produces a FCF estimate of $971 million.

In fact, Palantir itself gave a forecast that it would make between $800 million and $1 billion in adjusted FCF during 2024.

But if the company keeps making 50% FCF margins as during the fourth quarter, it is possible it could generate substantially more free cash flow. That could push the stock much higher.

Using FCF yield metrics to value Palantir

One way to value Palantir is to assume it pays out all its free cash flow as a dividend. If that occurred, the stock would likely have at least a 1.50% dividend yield. This is known as an FCF yield metric to value a stock.

The FCF yield at Meta Platforms (NASDAQ:META), which just announced its first-ever dividend, is much lower (i.e., valued higher). Meta's stock has a 0.43% dividend yield.

And look at Microsoft's FCF yield. Last year, it generated $67.50 billion in free cash flow and the stock has a market value of $3.16 trillion. That means its FCF yield is now 2.13%. This is the same as multiplying FCF by 46.80.

Palantir has a higher FCF margin than Microsoft (i.e., 50% versus 30%), so it could theoretically be valued at least 50% more.

Setting a price target

Valuing Palantir's stock 50% more than Microsoft means using a 70 times free cash flow multiple versus 46.80 at Microsoft. This is the same as using a 1.42% FCF yield (i.e., the inverse of 70 times).

So using a $1 billion in adjusted FCF estimate for Palantir means the stock could be worth $70 billion. That is 29.60% more than its present market cap of $54 billion.

And remember the $1 billion forecast is based on a 33.80% FCF margin (i.e., $1 billion/$2.96 billion in NTM sales). If Palantir generates a 50% free cash flow margin in the next 12 months (NTM), it could make $1.48 billion in adjusted FCF. So using a multiple of 70 (or a 1.42% FCF yield) implies the market cap could rise to $103.60 billion. That is 92% higher than the current $54 billion market cap.

Therefore, the stock could be worth 30% more at $30.71 per share (i.e., 1.29 x $23.70). That could take up to one year to occur. On the upper end, the stock could be worth 92% more, or $45.50 per share.

The bottom line is Palantir looks substantially undervalued based on its powerful free cash flow margins.

This article first appeared on GuruFocus.