Will Palantir Technologies Be a Trillion-Dollar Stock by 2035?

What's the most exclusive club on Wall Street? I'd argue it's the trillion-dollar club, a group of six stocks, each boasting a valuation above $1 trillion: Microsoft, Apple, Nvidia, Alphabet, Amazon, and Meta Platforms.

By 2035, the club will likely expand significantly, with companies across a broad range of sectors topping the $1 trillion mark. So, let's examine one that may have the potential to hit a valuation of $1 trillion by 2035: Palantir Technologies (NYSE: PLTR).

How Palantir stacks up today

Let's start with how large it is now to figure out how much Palantir's valuation could go. As of this writing, Palantir has a market cap of $51.6 billion. The company ranks as the 350-largest American company.

Needless to say, Palantir has a long way to go if it wants to crack the $1 trillion club. The company would need to grow nearly 2,000% or 20x by 2035. That works out to a Compound Annual Growth Rate (CAGR) of about 32%. Interestingly, Palantir has generated a CAGR of 31% since debuting via an Initial Public Offering (IPO) in 2020.

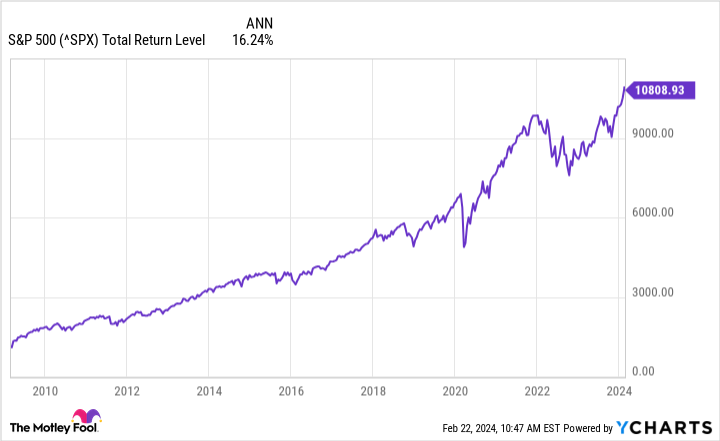

Such a growth level might seem unachievable for a longer time span. After all, if you look at a benchmark index, like the S&P 500, its lifetime total return CAGR, which stretches back over 70 years, is only 10%. Even if you choose shorter, more bullish periods, the S&P 500's CAGR improves but still falls well short of 30%.

For example, between March 2009 and today -- overall, a very bullish period in the stock market -- the S&P 500's CAGR is only 16%.

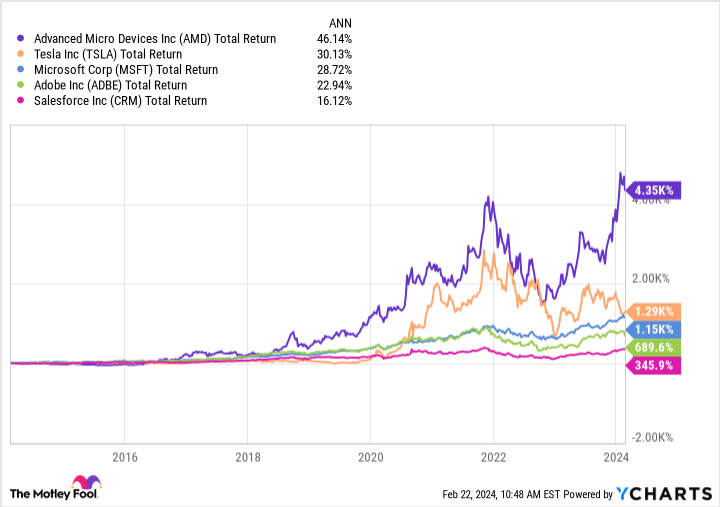

However, the S&P 500, like all stock market indexes, has less volatility than individual stocks. If we examine stocks one by one, it becomes clear that hitting and maintaining a 30% CAGR is possible.

As you can see in the chart below, Advanced Micro Devices, Microsoft, and Tesla all achieved a CAGR equal to or greater than 28% over the last decade. AMD, for one, has a 10-year CAGR of 46%. Many of these high-growth rates stem from the ever-growing demand for artificial intelligence (AI). However, Adobe and Salesforce (companies that more closely resemble Palantir due to their software-focused business models) have notched lower CAGRs of 23% and 16%, respectively. While that doesn't mean Palantir can't get to $1 trillion by 2035, it is worth noting that a 30% CAGR is hard to achieve and maintain -- even for well-performing companies.

Could Palantir's business support a $1 trillion valuation?

First things first: What does Palantir do?

In short, the company builds software platforms that help its customers grapple with their own data and realize practical efficiencies. More organizations than ever need this type of service, given how much data they generate on a daily basis.

Take the National Health Service (NHS) of the United Kingdom, for example. It's a massive system that serves over 56 million people overall, with close to 1.6 million patient interactions every day. Each of those interactions results in new data that must be recorded -- making on-the-spot analysis difficult. Administrators instead rely on top-down, after-the-fact analysis, which is costly and often yields few real-time improvements.

Yet, through the use of Palantir's software, the NHS has realized impressive results. For example, the inpatient waiting list at two London-based hospitals decreased by 28% after adopting Palantir's software. In addition, operating room utilization increased by 5.7%.

Now, as Palantir leverages AI to strengthen its software programs, there's more opportunity for its customer base to grow. However, only time will tell exactly how that growth will take shape over the next decade.

Will Palantir hit $1 trillion by 2035?

Despite its solid business model and popular software, it won't be easy for Palantir to crack the $1 trillion mark by 2035.

The company must continue to grow its revenue and customer base. As of its most recent quarter (the three months ending Dec. 31, 2023), Palantir grew its commercial revenue by 32% year-over-year. Similarly, its commercial customer count jumped 55% from a year earlier. Those gains in its commercial business, rather than its government-focused segment, where growth is slower, could support a 30% CAGR for the company. Moreover, as demand for AI-powered tools and big data analytics continues to ramp up, it's possible Palantir's growth rates could accelerate.

However, I'm not optimistic that the company will achieve a $1 trillion valuation in less than 11 years. While I still think Palantir is a great company and a solid investment, I don't think it has what it takes to cross the very high hurdle of $1 trillion by 2035. It would require consistent levels of explosive growth, which would be unrealistic for most companies.

At any rate, for long-term buy-and-hold investors, Palantir remains a stock worth considering.

Should you invest $1,000 in Palantir Technologies right now?

Before you buy stock in Palantir Technologies, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Palantir Technologies wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than tripled the return of S&P 500 since 2002*.

*Stock Advisor returns as of February 20, 2024

Suzanne Frey, an executive at Alphabet, is a member of The Motley Fool's board of directors. Randi Zuckerberg, a former director of market development and spokeswoman for Facebook and sister to Meta Platforms CEO Mark Zuckerberg, is a member of The Motley Fool's board of directors. John Mackey, former CEO of Whole Foods Market, an Amazon subsidiary, is a member of The Motley Fool's board of directors. Jake Lerch has positions in Adobe, Alphabet, Amazon, Nvidia, and Tesla. The Motley Fool has positions in and recommends Adobe, Advanced Micro Devices, Alphabet, Amazon, Apple, Meta Platforms, Microsoft, Nvidia, Palantir Technologies, Salesforce, and Tesla. The Motley Fool recommends the following options: long January 2026 $395 calls on Microsoft and short January 2026 $405 calls on Microsoft. The Motley Fool has a disclosure policy.

Will Palantir Technologies Be a Trillion-Dollar Stock by 2035? was originally published by The Motley Fool