Palantir's AI Dominance Is Shaping Its Future

Palantir Technologies Inc. (NYSE:PLTR) is a beacon of innovation and strategic growth, marking its presence with consistent performance and forward-looking initiatives.

Beyond the metrics of a single quarter, the company's journey reflects a robust market strategy, operational excellence and a visionary approach to customer engagement.

With a deep commitment to technological advancement and strategic defense partnerships, Palantir is shaping the future of artificial intelliegence and defense, charting a course toward sustained growth and industry leadership.

Revenue skyrockets, marking a strategic triumph in market expansion and operational mastery

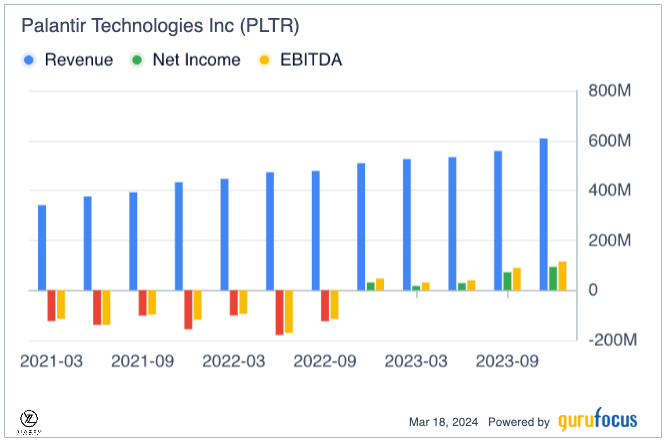

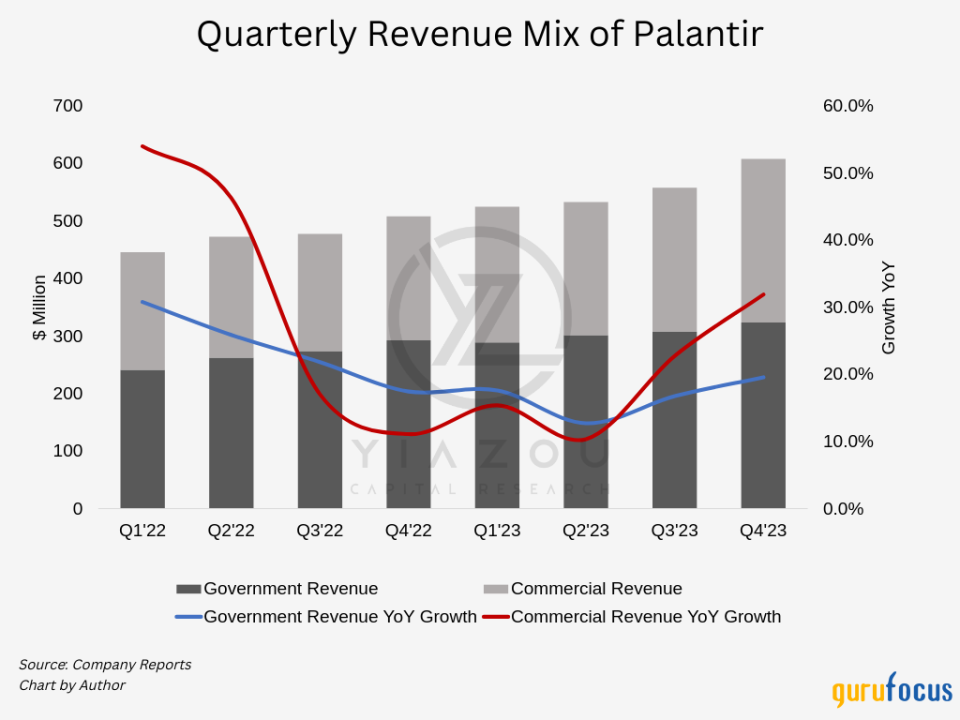

Palantir's revenue surged to $608.40 million in the fourth quarter, a substantial 20% year-over-year increase from $508.60 million a year ago. This growth was mainly driven by the company's revamped go-to-market strategy and piloting approach, resulting in significantly compressed sales cycles and an accelerated new customer acquisition rate.

During the quarter, commercial revenue exhibited impressive strength, growing 32% year over year to $284 million, while government revenue maintained steady growth at 11%, totaling $324 million.

Additionally, Palantir showed excellence on the operational front. With a strategic focus on high-margin contracts and increased adoption of its platforms, the company marked the fifth consecutive quarter of expanding adjusted operating margins. Adjusted income from operations soared to $209 million, representing a robust 34% margin.

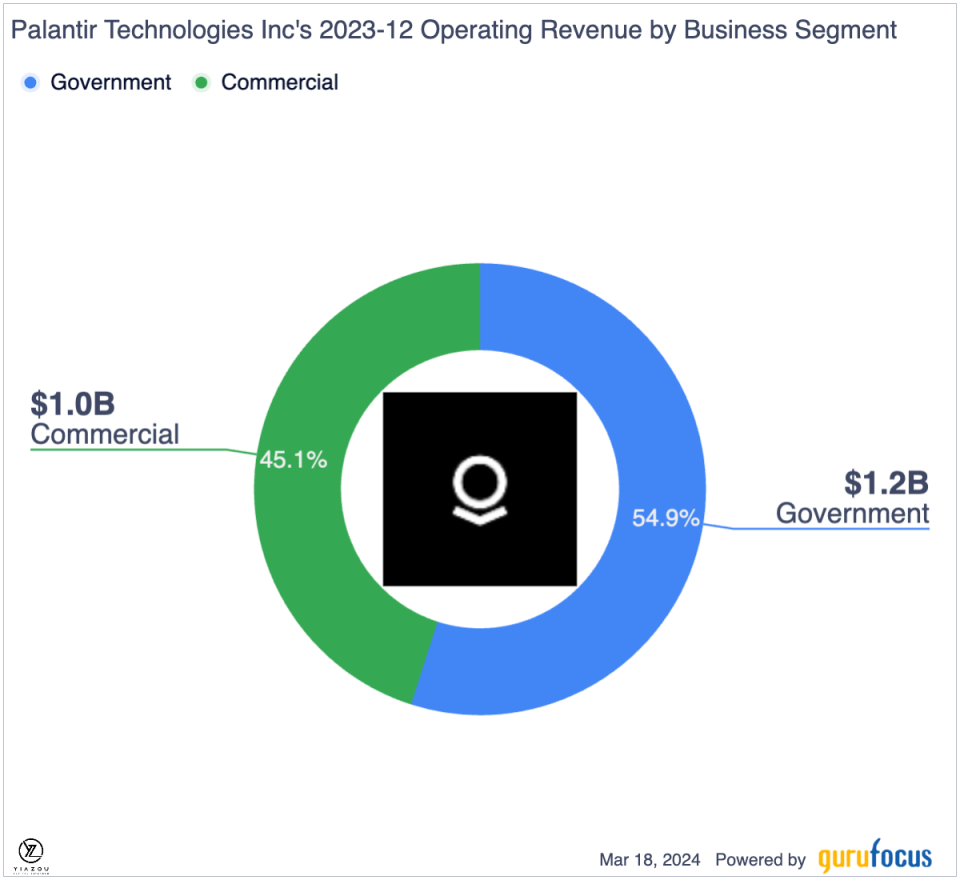

Revenue grew by 17% year over year to $2.23 billion in fiscal 2023. Commercial revenue played a pivotal role, contributing significantly with a total of $1 billion and an impressive 20% growth rate. The U.S. commercial segment exhibited remarkable strength, surging 36% to $457 million.

With the benefit of scale and optimization in platforms and operations, Palantir concluded the year with a notable accomplishment: it achieved $120 million in GAAP income from operations, a significant turnaround from the previous year's loss of $161 million.

Looking ahead to the first quarter of 2024, management anticipates revenue to hover around $612 million to $616 million, accompanied by an expected adjusted income from operations ranging from $196 million to $200 million.

Finally, Palantir's guidance for the whole year is $2.65 billion to $2.67 billion. For the U.S. commercial segment, upward growth of at least 40% is expected, with adjusted income from operations pegged at $834 million to 850 million. This, yet again, spotlights the strong momentum in revenue and operational efficiencies at Palantir.

The Titan contract: A leap toward tactical superiority

The recent buzz around Palantir centers on its potential win of a substantial $178 million contract with the U.S. Army to advance into phase 3 of the Tactical Intelligence Targeting Access Node (TITAN) project.

This initiative is not just a mere contract, but a significant leap toward redefining tactical ground stations by integrating terrestrial and space sensor data for precision targeting and battlefield planning.

Palantir's collaborative synergy with leading defense contractors like Anduril, Northrop Grumman (NYSE:NOC), L3Harris (NYSE:LHX), Sierra Nevada and Strategic Technology Consulting underscores a collective ambition to enhance the U.S. Army's tactical operations.

As a next-generation deep-sensing capability platform, TITAN leverages AI and machine learning to provide shooters with support beyond line-of-sight targeting, marking a monumental step in software-defined warfare.

Therefore, the transition to phase 3, underscored by the development of 10 TITAN prototypes, reflects a significant endorsement of Palantir's capabilities in delivering AI-enabled solutions to the frontlines.

Lastly, it further solidifies its partnership with the Army and leads a team of innovative partners toward pioneering the next generation of defense capabilities.

Solidifying GAAP profitability amidst AI and data analytics surge, paving the way for unprecedented growth

Palantir has consistently reported positive GAAP operating profit over the last three quarters, attributed to more moderate operating expenses. If this trend persists, it will add extra momentum for an even more robust expansion.

Meanwhile, the company has more potential to utilize operating leverage on the back of the AIP platform. Palantir's improved scale opportunities and profitability lend the company substantial growth potential.

Beyond its strategic military engagements, Palantir's financial performance narrates a story of resilience and strategic growth. The company's exceptional performance in the fourth quarter, marked by 20% year-over-year revenue growth and a striking 70% increase in its U.S. commercial business, is a testament to its robust operational framework and AI and data analytics momentum.

Palantir's achievement of five consecutive quarters of GAAP profitability, with a notable $210 million of GAAP net income in 2023, highlights its business model's efficiency and adeptness at balancing operational expansion with financial health. The expansion of its adjusted operating margin to 34% in the fourth quarter illustrates its business' strong unit economics and sets a precedent for sustained profitability and strategic investments, particularly in its AI-driven initiatives.

As Palantir gears up to escalate investment in AI preparedness, the company remains committed to calibrating expense growth below revenue growth, ensuring the continued delivery of GAAP profitability and operational excellence. This financial stewardship, combined with strategic investments in technology and partnerships, positions Palantir uniquely at the crossroads of technological innovation and financial robustness.

Pioneering the future with AIP to capture the $225 billion market

Palantir is gearing up to make substantial strides in the rapidly growing AI market, which is projected to reach $225 billion by 2027. With its innovative AIP, the company is poised to boost its net margins and revenue significantly. AIP offers advanced data analysis tools that work across various data types, from streaming to structured and unstructured formats. Hence, AIP is a versatile asset for organizations looking to enhance decision-making and operational efficiency.

Additionally, AIP has shown promise in the energy sector in practical applications by analyzing usage patterns to predict demand peaks and help consumers optimize energy consumption. Its integration capabilities with other Palantir products like Foundry and Gotham further augment its utility, offering sophisticated AI and machine learning applications for various data analysis needs. This includes everything from deep learning analytics to real-time defense and law enforcement threat detection.

According to the head of U.S. digital banking, Branson Knowles, Palantir is actively pursuing growth and customer expansion through a series of strategic moves, including a significant partnership with Ukraine to clear landmines using digital tools, ambitious financial targets for 2024 and plans to enhance its global government clientele. The company is innovating its approach to market penetration with a new "bootcamp" strategy for client acquisition and launching a new product to provide insight into its operations.

Highlighting its commitment to making AI more accessible and impactful, Palantir hosted over 500 bootcamps in October 2023. CEO Alex Karp emphasized AIP's efficiency and capability of delivering solutions in hoursa task that traditionally takes months or years with other platforms. By drawing on its extensive industry experience, Palantir's AIP is set to rival other AI tools like Amazon's (NASDAQ:AMZN) augmented AI and Google's (NASDAQ:GOOG) cloud AI, offering customized, industry-specific products.

Finally, Palantir's foray into AI aims to enrich its existing product lineup and tap into the commercial market with new offerings. This strategic expansion underscores its vision to harness AI's potential for broader audience engagement while elevating its core technologies. Therefore, AIP represents a pivotal chapter in Palantir's growth story, marking a significant leap toward redefining the future of data analytics and AI applications.

Takeaway

The potential advancement in the TITAN project highlights Palantir's role in military innovation through AI, while its sustained GAAP profitability underscores a successful operational and financial strategy. With its focus on the burgeoning AI market, underscored by the AIP, Palantir is set to capture significant market share and continue its trajectory toward industry leadership and expansive growth.

This article first appeared on GuruFocus.