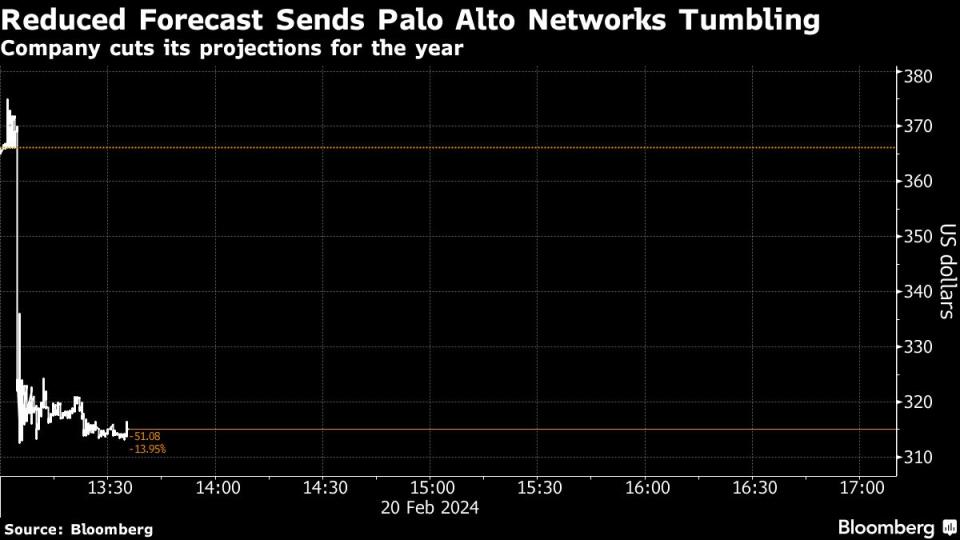

Palo Alto Networks Plunges by Most Ever After Cutting Outlook

(Bloomberg) -- Palo Alto Networks Inc. slid by the most ever after the cybersecurity company cut its annual revenue forecast, stoking concerns that customers are reining in spending despite an uptick in attacks.

Most Read from Bloomberg

BYD’s New $233,450 EV Supercar to Rival Ferrari, Lamborghini

Jack Ma-Backed Ant Outbids Citadel Securities for Credit Suisse’s China JV

Zelenskiy Says 31,000 Troops Killed as Ukraine Seeks US Aid Decision Within Month

Sales will be $7.95 billion to $8 billion this fiscal year, the company said in a statement Tuesday, falling below Wall Street’s expectations for $8.18 billion. It was a blow to investors who had sent the stock price soaring by nearly 120% over the past year on bets that new artificial intelligence-powered products and market-share gains would sustain growth.

Palo Alto Networks’ outlook has reignited fears across the industry that customers are dialing back spending, a concern that has weighed on cyber stocks over the past two years amid broader economic uncertainty. The top end of Palo Alto Networks’ sales forecast represents an increase of 16%, well below its 25%-plus growth rate of recent years.

The pullback came despite a series of high-profile cyberattacks against major corporations including Clorox Co., MGM Resorts International and Industrial & Commercial Bank of China Ltd., the world’s largest lender.

The stock fell as much as 27% to $267.12 a share in New York on Wednesday, the biggest decline since the company was listed in 2012. The news also weighed on shares of other cybersecurity companies, including Crowdstrike Holdings Inc., SentinelOne Inc. and Fortinet Inc. Palo Alto Networks had closed Tuesday up 24% since the start of the year, outperforming most tech stocks.

The company maintained its outlook for earnings and free cash flow for fiscal 2024, projections that Chief Financial Officer Dipak Golechha said reflected “disciplined execution on profitable growth.”

Chief Executive Officer Nikesh Arora echoed those remarks on a conference call, telling analysts that the company has been successfully executing its growth strategy. But he also said customers were facing “spending fatigue” in cybersecurity.

“This is new,” he said. Customers are finding that adding incremental products “is not necessarily driving a better security outcome for them.”

The Santa Clara, California-based company posted sales of $1.98 billion in the second quarter ended Jan. 31, up 19% from a year earlier. Analysts had estimated $1.97 billion. Product revenue grew more slowly than service and support sales, underscoring an ongoing shift at the company. Excluding some items, earnings amounted to $1.46 a share.

Palo Alto Networks’ billings — a metric closely watched by investors — will be as high as $10.2 billion this year, the company said. The top of its previous range was $10.8 billion. The company said it aims to generate $15 billion a year from what it calls next-generation security by fiscal year 2030.

Arora, the CEO, said customers are demanding more from security companies as hacks worsen. “We’re increasingly focusing on working with companies impacted by breaches,” he said.

Spending by federal customers was a little soft, he said, partly because one government program the company had planned for failed to materialize. “Once bitten, twice shy,” he said, saying the company would be cautious about that source of revenue in the future.

But Arora sees growth potential from artificial intelligence. Customers are asking for help protecting the “successful and responsible deployment of AI in their infrastructure,” he said.

Most Read from Bloomberg Businessweek

Elon Musk’s Vegas Tunnel Project Has Been Racking Up Safety Violations

Can the Masters of Hipster Cringe Conquer Hollywood With Wall Street Cash?

How Capital One’s $35 Billion Discover Merger Could Affect Consumers

©2024 Bloomberg L.P.