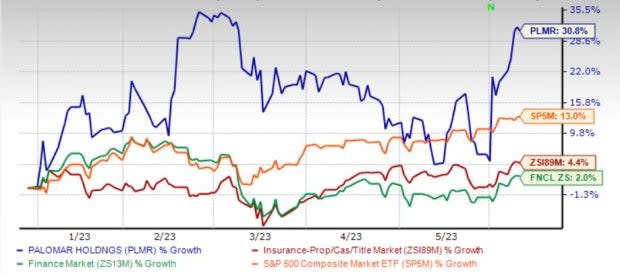

Palomar Holdings (PLMR) Gains 31% YTD: More Upside Left?

Palomar Holdings’ PLMR shares have gained 30.8% year to date, outperforming the industry’s increase of 4.4%. The Finance sector and the Zacks S&P 500 composite have risen 2% and 13%, respectively, in the same period. With a market capitalization of $1.5 billion, the average volume of shares traded in the last three months was 0.1. million.

Strong premium retention rates, new partnerships, rate increases and effective capital deployment continue to drive this Zacks Rank #3 (Hold) insurer.

Palomar’s trailing 12-month return on equity was 17.6%, which came ahead of the industry average of 6.9%. Return on equity, a profitability measure, reflects how effectively a company is utilizing its shareholders.

The company has a VGM Score of B. The Style Score rates stocks on the combined weighted styles, helping to identify those with the most attractive value, best growth and most promising momentum.

Image Source: Zacks Investment Research

Can PLMR Retain the Momentum?

The Zacks Consensus Estimate for Palomar’s 2023 earnings is pegged at $3.29 per share, indicating an increase of 18.8% on 15.8% higher revenues of $387.6 million. The Zacks Consensus Estimate for 2024 earnings is pegged at $3.89, indicating an increase of 18.2% on 22.1% higher revenues of $473.4 million.

It has a Growth Score of B. This score analyzes the growth prospect of a company.

New business generated with existing partners, strong premium retention rates for existing business , expansion of its products’ geographic and distribution footprint, and new partnerships have been driving the volume of policies written, which, in turn, drives premium growth. In September 2021, Palomar launched the fee-generating PLMR-FRONT to drive growth in the medium term. The managed premium from Palomar FRONT is expected to aid fee income growth in 2023.

Investment income witnessed a five-year CAGR (2017-2022) of 36.7%. High-quality fixed-income securities, a higher average balance of investments and an increase in fixed-income yields should help it retain the momentum.

Palomar’s revenues have increased at a five-year CAGR of (2017-2022) of 32.9% on the back of higher premiums, net investment income and commission and other income. High premium retention and strong renewal rates are likely to help retain the momentum going forward.

Palomar has been witnessing substantial improvement in the combined ratio of its P&C business over the past few years due to lower catastrophe events and improved loss ratio.

PLMR boasts a debt-free balance sheet with no exposure to the equity markets. As of Mar 31, 2023, $58.8 million remained under authorization.

Stocks to Consider

Some better-ranked stocks from the insurance industry are HCI Group HCI, RLI Corporation RLI and Kinsale Capital Group KNSL, each sporting a Zacks Rank #1 (Strong Buy) at present. You can see the complete list of today’s Zacks #1 Rank stocks here.

The Zacks Consensus Estimate for HCI Group’s 2023 and 2024 earnings indicates a year-over-year increase of 149.3% and 35.2%, respectively. HCI delivered a four-quarter average earnings surprise of 308.82%.

The consensus estimate for 2023 and 2024 earnings has moved up 22.7% and 14.1%, respectively, in the past seven days. Shares of HCI have gained 47.5% year to date.

RLI delivered a four-quarter average earnings surprise of 43.50%. Year to date, the insurer has lost 0.8%.

The Zacks Consensus Estimate for RLI’s 2023 earnings indicates a year-over-year increase of 4.1%.

Kinsale Capital delivered a four-quarter average earnings surprise of 14.77%. Year to date, the insurer has gained 35.4%.

The Zacks Consensus Estimate for KNSL’s 2023 and 2024 earnings indicates a year-over-year increase of 32.9% and 19.7%, respectively.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

RLI Corp. (RLI) : Free Stock Analysis Report

HCI Group, Inc. (HCI) : Free Stock Analysis Report

Kinsale Capital Group, Inc. (KNSL) : Free Stock Analysis Report

Palomar Holdings, Inc. (PLMR) : Free Stock Analysis Report