Palomar (PLMR) Q2 Earnings Top Estimates, Revenues Rise Y/Y

Palomar Holdings, Inc. PLMR reported second-quarter 2021 operating income of 51 cents per share, beating the Zacks Consensus Estimate by 2%. The bottom line declined 1.9% year over year.

Palomar witnessed improved premiums and net investment income, partially offset by higher expenses.

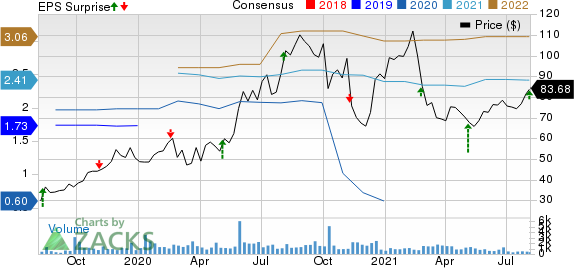

Palomar Holdings, Inc. Price, Consensus and EPS Surprise

Palomar Holdings, Inc. price-consensus-eps-surprise-chart | Palomar Holdings, Inc. Quote

Behind the Headlines

Total revenues improved 35.7% year over year to $57 million, mainly attributable to higher premiums, net investment income, and commission and other income. The top line beat the Zacks Consensus Estimate by 2.2%.

Gross written premiums increased 54.4% year over year to $129.4 million. Net written premiums surged 45.1% year over year to $77.8 million.

Net investment income increased 3.8% year over year to $2.2 million, driven by higher average balance of investments, partially offset by lower yields on invested assets.

Palomar witnessed underwriting income of $13 million, up 4.9% year over year. Results were impacted by $3.9 million of additional reinsurance charges from winter storm Uri.

Total expenses of $42.2 million increased 51.6% year over year due to higher losses and loss adjustment expenses, acquisition and underwriting expenses. Loss ratio deteriorated 320 basis points (bps) to 13.3.

Adjusted combined ratio, excluding catastrophe losses, deteriorated 870 bps year over year to 73.8.

Financial Update

Cash and cash equivalents decreased 25.7% from the 2020-end level to about $24.9 million at second quarter 2021-end.

Shareholder equity increased 3.6% from 2020-end to $376.7 million.

Annualized adjusted return on equity was 14.1% for the reported quarter, contracting 230 bps year over year.

2021 View Reaffirmed

Palomar estimates adjusted net income between $64 million and $69 million.

Zacks Rank

Palomar currently carries a Zacks Rank #4 (Sell).

You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Performance of Other Insurers

Of the insurance industry players that have reported second-quarter results so far, The Travelers Companies TRV, The Progressive Corporation PGR and RLI Corporation RLI beat the Zacks Consensus Estimate for earnings.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

RLI Corp. (RLI) : Free Stock Analysis Report

The Travelers Companies, Inc. (TRV) : Free Stock Analysis Report

The Progressive Corporation (PGR) : Free Stock Analysis Report

Palomar Holdings, Inc. (PLMR) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research