Pangaea Logistics Solutions Ltd. (PANL) Reports Mixed Year-End Results Amid Market Challenges

Net Income: $26.3 million for the full year, with Q4 at $1.1 million.

Adjusted Net Income: $31.4 million for the full year, reflecting $7.4 million in Q4.

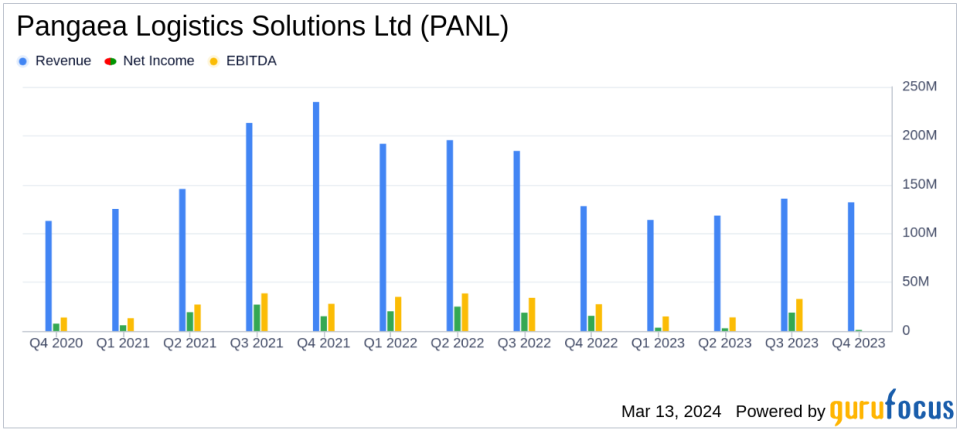

Revenue: $499.3 million for the full year, with Q4 contributing $131.9 million.

Adjusted EBITDA: $79.7 million for the full year, $19.7 million for Q4.

TCE Rates: Average of $15,849 per day for the full year, outperforming industry indices.

Debt Management: Net debt to trailing twelve-month Adjusted EBITDA ratio increased to 2.12x.

Dividends: Quarterly cash dividend of $0.10 per common share announced.

Pangaea Logistics Solutions Ltd. (NASDAQ:PANL) released its 8-K filing on March 13, 2024, revealing its financial results for the three months and year ended December 31, 2023. The company, known for its comprehensive maritime logistics solutions, faced a challenging market environment but managed to report a net income of $26.3 million for the full year, with $1.1 million in the fourth quarter. Adjusted net income attributable to PANL was $31.4 million for the year, reflecting a robust $7.4 million in the final quarter.

PANL's revenue for the year stood at $499.3 million, with the fourth quarter contributing $131.9 million. Despite a decline in Time Charter Equivalent (TCE) rates by 35.1% year-over-year, the company's average TCE rate of $15,849 per day for the full year exceeded the average Baltic Panamax and Supramax indices by approximately 39%, showcasing the effectiveness of its specialized fleet and long-term contracts of affreightment (COAs).

Financial Highlights and Challenges

The company's Adjusted EBITDA for the full year was $79.7 million, with the fourth quarter contributing $19.7 million. However, the Adjusted EBITDA margin decreased to 16.0% for the full year from 20.1% in the previous year, reflecting the impact of lower market rates and fewer shipping days. The ratio of net debt to trailing twelve-month Adjusted EBITDA increased to 2.12x, up from 1.25x in the prior-year period, indicating a rise in leverage. PANL also completed the sale of the Supramax Bulk Trident for $9.8 million as part of its fleet management strategy.

Management's Perspective

"We continued to execute on our premium-rate, cargo-centric strategy throughout the year, culminating in a strong fourth quarter operating performance," stated Mark Filanowski, Chief Executive Officer of Pangaea Logistics Solutions. "While the fourth quarter is generally a slower period for Pangaea as we complete the peak Arctic trade season, ongoing geopolitical trade disruptions have led to increased demand for our solutions outside of our traditional trade routes, contributing to increased shipping days in the period compared to the prior year."

CEO Filanowski also highlighted the company's ability to outperform industry indices and its focus on shareholder value creation through strategic investments and capital returns. Looking ahead, PANL aims to prioritize growth in its fleet and logistics capabilities while maintaining a stable return of capital program.

Strategic and Operational Updates

Pangaea remains committed to enhancing its dry bulk logistics and transportation services, with a focus on high ice class dry bulk fleet operations and expanding its marine port terminal operations. The company's fleet utilization remained strong, with 24 owned vessels fully utilized and supplemented by chartered-in vessels to support cargo commitments. PANL's strategic fleet management included the sale of older assets and the acquisition of new port and terminal operations to drive premium TCE rates and support client requirements.

For investors and stakeholders, the company's financial resilience in the face of market volatility and its strategic initiatives to adapt to changing demand dynamics are key indicators of its potential for sustained performance. Pangaea's focus on specialized shipping solutions and its proactive approach to fleet and logistics management position it well to navigate the complexities of the maritime logistics industry.

For a detailed discussion of PANL's financial results, management will host a conference call on March 14, 2024. Interested parties can find presentation materials and call-in information in the Investor Relations section of the company's website.

For more in-depth analysis and updates on Pangaea Logistics Solutions Ltd. (NASDAQ:PANL) and other value investment opportunities, visit GuruFocus.com.

Explore the complete 8-K earnings release (here) from Pangaea Logistics Solutions Ltd for further details.

This article first appeared on GuruFocus.