Do Pangaea Logistics Solutions' (NASDAQ:PANL) Earnings Warrant Your Attention?

The excitement of investing in a company that can reverse its fortunes is a big draw for some speculators, so even companies that have no revenue, no profit, and a record of falling short, can manage to find investors. But the reality is that when a company loses money each year, for long enough, its investors will usually take their share of those losses. Loss-making companies are always racing against time to reach financial sustainability, so investors in these companies may be taking on more risk than they should.

In contrast to all that, many investors prefer to focus on companies like Pangaea Logistics Solutions (NASDAQ:PANL), which has not only revenues, but also profits. While this doesn't necessarily speak to whether it's undervalued, the profitability of the business is enough to warrant some appreciation - especially if its growing.

View our latest analysis for Pangaea Logistics Solutions

How Fast Is Pangaea Logistics Solutions Growing Its Earnings Per Share?

Pangaea Logistics Solutions has undergone a massive growth in earnings per share over the last three years. So much so that this three year growth rate wouldn't be a fair assessment of the company's future. So it would be better to isolate the growth rate over the last year for our analysis. Impressively, Pangaea Logistics Solutions' EPS catapulted from US$0.92 to US$1.90, over the last year. Year on year growth of 106% is certainly a sight to behold. Shareholders will be hopeful that this is a sign of the company reaching an inflection point.

Top-line growth is a great indicator that growth is sustainable, and combined with a high earnings before interest and taxation (EBIT) margin, it's a great way for a company to maintain a competitive advantage in the market. The music to the ears of Pangaea Logistics Solutions shareholders is that EBIT margins have grown from 8.5% to 14% in the last 12 months and revenues are on an upwards trend as well. Both of which are great metrics to check off for potential growth.

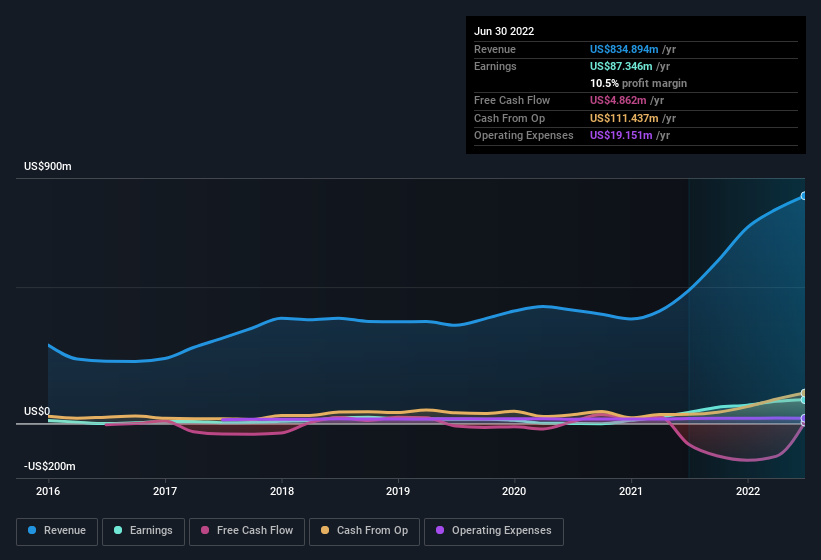

You can take a look at the company's revenue and earnings growth trend, in the chart below. For finer detail, click on the image.

Fortunately, we've got access to analyst forecasts of Pangaea Logistics Solutions' future profits. You can do your own forecasts without looking, or you can take a peek at what the professionals are predicting.

Are Pangaea Logistics Solutions Insiders Aligned With All Shareholders?

Insider interest in a company always sparks a bit of intrigue and many investors are on the lookout for companies where insiders are putting their money where their mouth is. This view is based on the possibility that stock purchases signal bullishness on behalf of the buyer. However, small purchases are not always indicative of conviction, and insiders don't always get it right.

Pangaea Logistics Solutions top brass are certainly in sync, not having sold any shares, over the last year. But the bigger deal is that the Lead Independent Director, Carl Boggild, paid US$100k to buy shares at an average price of US$4.68. Purchases like this clue us in to the to the faith management has in the business' future.

Along with the insider buying, another encouraging sign for Pangaea Logistics Solutions is that insiders, as a group, have a considerable shareholding. Indeed, they hold US$47m worth of its stock. This considerable investment should help drive long-term value in the business. As a percentage, this totals to 22% of the shares on issue for the business, an appreciable amount considering the market cap.

While insiders are apparently happy to hold and accumulate shares, that is just part of the big picture. That's because on our analysis the CEO, Mark Filanowski, is paid less than the median for similar sized companies. Our analysis has discovered that the median total compensation for the CEOs of companies like Pangaea Logistics Solutions with market caps between US$100m and US$400m is about US$1.8m.

The Pangaea Logistics Solutions CEO received US$995k in compensation for the year ending December 2021. That comes in below the average for similar sized companies and seems pretty reasonable. CEO remuneration levels are not the most important metric for investors, but when the pay is modest, that does support enhanced alignment between the CEO and the ordinary shareholders. Generally, arguments can be made that reasonable pay levels attest to good decision-making.

Is Pangaea Logistics Solutions Worth Keeping An Eye On?

Pangaea Logistics Solutions' earnings per share have been soaring, with growth rates sky high. The icing on the cake is that insiders own a large chunk of the company and one has even been buying more shares. This quick rundown suggests that the business may be of good quality, and also at an inflection point, so maybe Pangaea Logistics Solutions deserves timely attention. We should say that we've discovered 3 warning signs for Pangaea Logistics Solutions (2 make us uncomfortable!) that you should be aware of before investing here.

There are plenty of other companies that have insiders buying up shares. So if you like the sound of Pangaea Logistics Solutions, you'll probably love this free list of growing companies that insiders are buying.

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Join A Paid User Research Session

You’ll receive a US$30 Amazon Gift card for 1 hour of your time while helping us build better investing tools for the individual investors like yourself. Sign up here