Can Papa John's Assistance Program Revive Franchise Sales?

Apart from witnessing a consistent decline in revenue trends, Papa John’s International, Inc. PZZA has been under the spotlight of negative publicity recently, after its ex-CEO, John Schnatter was publicly denounced for using racist term.

In order to revive its brand image and reinvigorate growth, the company recently announced an assistance program for its U.S. and Canada franchisees. The program is expected to offer advice on the sales and operating challenges that Papa John’s franchisees are facing, with full support from the Company’s Franchise Advisory Council (FAC) and Papa John’s Franchise Association (PJFA). Under the assistance program, the company plans to reduce royalties, food-service pricing and online fees throughout the current year. The company is also arranging funds for its franchises to implement marketing and reimaging initiatives. Papa John’s expects the program to help revive its franchisee sales which were negatively impacted by the unfortunate remarks of the ex-CEO.

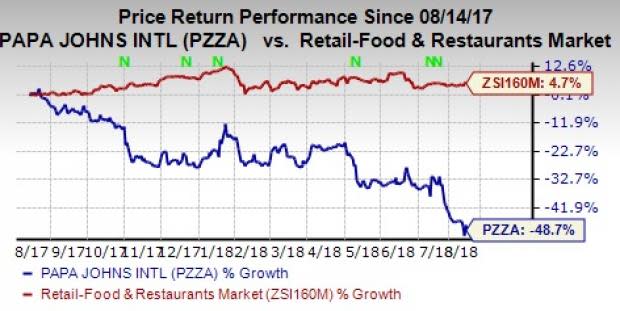

Notably, a look at Papa John’s price trend reveals that the stock had an unimpressive run on the bourses in the past year. Shares of the company have lost 48.7% against the industry’s collective gain of 4.7% during the same time frame.

Efforts to Revive North America Sales & Strengthen Franchise Relations

The move is expected to aid the company’s North American franchises, which is facing a dismal sales trend of late. In fact, in the second quarter of 2018, revenues declined 6.2% on a year-over-year basis, primarily due to a decline in North America commissary sales on weak volumes. Comps at North America franchised restaurants fell 7.2% in the last-reported quarter, comparing unfavorably with comps growth of 2.3% in the second quarter of 2017. Comps at system-wide North American franchised restaurants decreased 5.7% compared with 1.1% comps growth in the year-ago quarter.

Meanwhile, Papa John’s is deeply committed in developing and maintaining a strong franchise system. The company is continually striving to eliminate barriers to expansion in existing international markets and identify market opportunities. Except for 35 company-owned restaurants in Beijing and North China, all of Papa John’s international restaurants are currently franchised. Over the next several years, the company plans to increase its international units, a large part of which is going to be franchised.

We believe, re-franchising a large chunk of its system reduces the company’s capital requirements and facilitates earnings per share growth and ROE expansion. Alongside, free cash flow continues to grow, allowing reinvestment for increasing brand recognition and shareholder return.

Zacks Rank & Stocks to Consider

Papa John’s currently carries a Zacks Rank #5 (Strong Sell). Some better-ranked stocks in the restaurant space are BJ’s Restaurants BJRI, Carrols Restaurant TAST and Darden DRI. While BJ’s Restaurants sports a Zacks Rank #1 (Strong Buy), Carrols and Darden carry a Zacks Rank #2 (Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

BJ’s Restaurants, Carrols and Darden’s earnings for 2018 are projected to increase 50.4%, 80% and 14.4%, respectively.

Wall Street’s Next Amazon

Zacks EVP Kevin Matras believes this familiar stock has only just begun its climb to become one of the greatest investments of all time. It’s a once-in-a-generation opportunity to invest in pure genius.

Click for details >>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

BJ's Restaurants, Inc. (BJRI) : Free Stock Analysis Report

Darden Restaurants, Inc. (DRI) : Free Stock Analysis Report

Papa John's International, Inc. (PZZA) : Free Stock Analysis Report

Carrols Restaurant Group, Inc. (TAST) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research