Papa John's (PZZA) Q4 Earnings Miss, Revenues Beat Estimates

Papa John’s International, Inc. PZZA posted mixed fourth-quarter 2017 results, wherein earnings missed the Zacks Consensus Estimate while revenues beat the same.

Adjusted earnings of 65 cents per share missed the consensus estimate of 68 cents by 4.4%. The bottom line also fell 6% from the year-ago quarter due to weak operating results.

Revenues of $467.6 million surpassed the consensus estimate of $461.9 million by 1.2% and increased 6.4% year over year. The upside was driven by higher International sales owing to 2.6% growth in comps and higher North America commissary sales on increased commodity prices. Foreign currency also favorably impacted the quarter’s revenues.

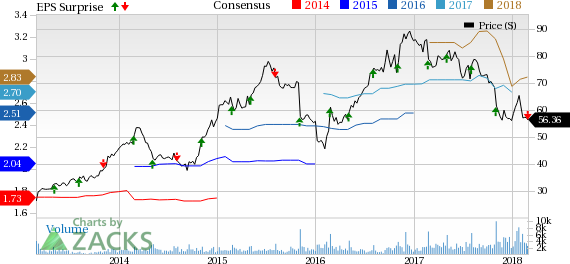

Papa John's International, Inc. Price, Consensus and EPS Surprise

Papa John's International, Inc. Price, Consensus and EPS Surprise | Papa John's International, Inc. Quote

However, when adjusted for one extra week in 2017, revenues for the fourth quarter decreased 0.7%, primarily on lower company-owned restaurant sales. A challenging sales environment in the U.S. restaurant space has been affecting the company for quite some time and reflected in the top-line results. Also, labor costs coupled with increased operating costs from digital initiatives and marketing expenses have put substantial pressure on the company’s bottom line, which is expected to linger in 2018, as reflected in the company’s 2018 outlook.

Given management’s weak EPS guidance for 2018, shares of Papa John’s fell 7.6% in after-hours trading on Feb 27. Also, the company’s shares have lost 28.9% in the past year underperforming the industry’s gain of 7.9%.

Let’s delve deeper into the numbers.

Global Restaurant Sales & Comps

Global restaurant sales growth of 9.9% in the fourth quarter was higher than the last quarter’s rise of 4.4% and the year-ago quarter’s growth of 5.3%. Excluding foreign currency impact, global restaurant sales growth was 9.6%, higher than the prior quarter and the year-ago quarter’s growth of 5% and 7%, respectively.

Domestic company-owned restaurant comps were down 4.7% in fourth-quarter 2017, compared with comps growth of 4.8% in the year-ago quarter.

Comps for North America franchised restaurants fell 3.5%, comparing unfavorably with comps growth of 3.4% in the fourth quarter of 2016. Comps at system-wide North American restaurants were down 3.9%, comparing unfavorably with 3.8% comps growth in the year-ago quarter.

Comps at system-wide international restaurants increased 2.6%, lower than comps growth of 5.6% a year ago and 5.3% in the preceding quarter.

Operating Highlights

Total operating margin was 7.8% in the quarter, a decrease of 390 basis points (bps) from the year-ago quarter. Total costs and expenses amounted $429.3 million in the quarter, up 7.8% from the prior-year quarter.

Net income declined 12.6% year over year to $28.5 million.

Balance Sheet

As of Dec 31, 2017, cash and cash equivalents totaled $22.3 million, compared with $15.6 million as of Dec 25, 2016. Long-term debt was $446.6 million at the end of 2017 compared with $299.8 million at the end of 2016.

Inventories at the end of 2017 increased to $30.6 million from $25.1 million in the year-ago period. Cash flow totaled $82.4 million as of Dec 31, 2017, compared with $94.7 million as of Dec 25, 2016.

In 2017, the company repurchased 2,960 shares at a cost of $209.6 million. Management declared fourth-quarter dividend of 225 cents per common share which was paid on February 23, 2018 to shareholders of record at the close of business on February 12, 2018.

2018 Guidance

Management expects GAAP EPS in the range of $2.40 to $2.60. Adjusted earnings are expected to decline in the range of 4.5% to 12% year-over-year, due to lower operating results, primarily from expected pressure on Domestic restaurants’ sales, higher delivery and insurance costs for the company-owned restaurants, and higher costs for technology and marketing investments.

North America comps are expected in the range of negative 3% to flat. International comps are anticipated to grow in the band of 3% to 5%.

Capital expenditures of $45-$55 million are expected in 2018, whereas Total Debt/EBITDA is expected between 3x to 3.5x.

Zacks Rank & Peer Releases

Papa John’s carries a Zacks Rank #3 (Hold). You can see the complete list of today’s Zacks #1 (Strong Buy) Rank stocks here.

Chipotle Mexican Grill CMG posted mixed fourth-quarter 2017 results, with adjusted earnings of $1.34 per share, surpassing the consensus estimate of $1.32 by 1.5%. Earnings also grew 143.6% year over year on lower costs and higher revenues.

McDonald's MCD reported fourth-quarter 2017 adjusted earnings per share of $1.71, beating the consensus mark of $1.59 by 7.5%. Earnings improved 19% from the year-ago quarter (16% in constant currency). The upside reflects strong operating performance and G&A savings.

Domino’s DPZ fourth-quarter 2017 earnings matched the Zacks Consensus Estimate while revenues missed the same. Adjusted earnings came in at $1.94 per share and improved 31.1% year over year on higher net income and lower share count as a result of share repurchases.

Wall Street’s Next Amazon

Zacks EVP Kevin Matras believes this familiar stock has only just begun its climb to become one of the greatest investments of all time. It’s a once-in-a-generation opportunity to invest in pure genius.

Click for details >>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Chipotle Mexican Grill, Inc. (CMG) : Free Stock Analysis Report

Domino's Pizza Inc (DPZ) : Free Stock Analysis Report

McDonald's Corporation (MCD) : Free Stock Analysis Report

Papa John's International, Inc. (PZZA) : Free Stock Analysis Report

To read this article on Zacks.com click here.