PAR Technology Corp (PAR) Reports Mixed Fiscal 2023 Results Amid Revenue Growth and Net Loss ...

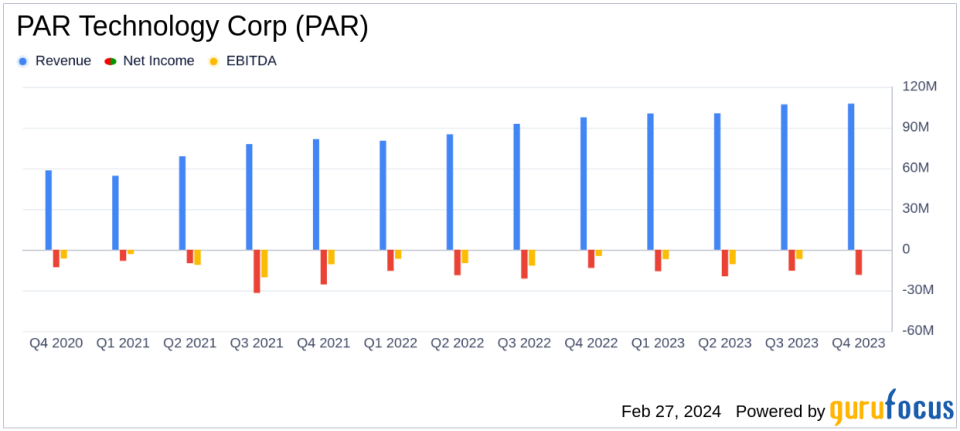

Revenue Growth: Total annual revenues rose by 16.9% year-over-year, with subscription service revenues up by 25.7%.

Net Loss: Annual net loss widened slightly to $69.8 million compared to $69.3 million in the previous year.

Adjusted EBITDA: Full-year adjusted EBITDA showed a larger loss of $25.8 million, compared to a loss of $18.8 million in 2022.

Annual Recurring Revenue (ARR): ARR increased by 22.8% to $136.9 million in Q4 '23 from $111.4 million in Q4 '22.

Balance Sheet: Cash and cash equivalents decreased to $37.4 million from $70.3 million year-over-year.

On February 27, 2024, PAR Technology Corp (NYSE:PAR) released its 8-K filing, announcing its fourth quarter and full year 2023 results. The company, which provides management technology solutions to the restaurant and retail industries, as well as government sector intelligence and surveillance solutions, reported a 10.3% increase in total quarterly revenues year-over-year, and a 16.9% increase in total annual revenues.

Financial Performance and Challenges

Despite the revenue growth, PAR Technology faced challenges as its net loss for the fourth quarter of 2023 widened to $18.6 million, or $0.67 net loss per share, compared to a net loss of $13.5 million, or $0.50 net loss per share for the same period in 2022. The full year net loss also increased marginally to $69.8 million, or $2.53 net loss per share, from $69.3 million, or $2.55 net loss per share in the previous year. The company's EBITDA and adjusted EBITDA both reflected larger losses in 2023 compared to 2022, indicating increased operational costs and investments that have yet to yield proportional financial returns.

The importance of these performance metrics lies in their reflection of the company's ability to manage its growth strategy while containing costs. The widening net loss and declining EBITDA suggest that PAR Technology is investing heavily in its expansion, particularly in its subscription services, which could pose risks if not managed alongside a path to profitability.

Financial Achievements and Industry Significance

PAR Technology's increase in ARR is a significant achievement, as it indicates a growing base of predictable, recurring revenue, which is highly valued in the software industry. The company's ability to secure new customer wins, including notable brands such as Burger King and Hooters of America, demonstrates the appeal and competitiveness of its offerings in the market.

CEO Savneet Singh expressed confidence in the company's direction, stating, "We are pleased to cap off the year with strong fourth quarter results as our subscription services revenue and ARR growth continues to drive our performance." Singh's commentary underscores the strategic focus on building a robust subscription-based revenue model, which is crucial for long-term sustainability in the software sector.

Key Financial Details

PAR Technology's balance sheet shows a decrease in cash and cash equivalents, from $70.3 million at the end of 2022 to $37.4 million at the end of 2023. This reduction could be attributed to the company's investments in growth and may impact its financial flexibility in the short term. The company's total assets decreased to $802.6 million from $854.9 million year-over-year, while total liabilities decreased slightly to $469.5 million from $479.7 million.

"Our Q4 performance marked the end of an exciting year for PAR as we delivered on our vision for the digital restaurant," said Singh. "We have begun the new year with improved visibility, clear new business opportunities and a resilient end market."

PAR Technology's earnings report indicates a company in the midst of a growth phase, investing in its future while facing the challenges of managing costs and achieving profitability. The company's focus on expanding its subscription services and securing key customer wins positions it well in the competitive software industry, but investors will be watching closely for signs of sustainable profitability in the coming quarters.

For a more detailed analysis of PAR Technology Corp's financial results and future prospects, visit GuruFocus.com.

Explore the complete 8-K earnings release (here) from PAR Technology Corp for further details.

This article first appeared on GuruFocus.