The simple paradox at the heart of Warren Buffett’s investment strategy

In a new interview, investor Tom Russo on Friday captured the simple paradox at the heart of Berkshire Hathaway CEO Warren Buffett’s investment strategy.

Buffett has “the capacity to do nothing and the willingness to do everything,” Russo says. “That combination is terribly powerful.”

“At Berkshire, unless there’s something to do, they can do absolutely nothing,” says Russo, who manages about $12 billion in assets as managing member of Gardner Russo & Gardner LLC and general partner to Semper Vic partners.

Russo made the comments to Yahoo Finance editor-in-chief Andy Serwer at a U.S.-China forum on Friday hosted by the publication. Attendees gathered on the eve of the 2019 Berkshire Hathaway Shareholders Meeting, which Yahoo Finance will broadcast live on Saturday starting at 9:45 a.m.

[Click here for coverage of the 2019 Berkshire Hathaway Shareholders Meeting.]

Russo praised Buffett, a value investor, for exercising restraint toward companies after he acquires them.

“The most important point about Berkshire is the commitment the company makes when it buys a business entirely and does not try to change them,” Russo says.

“Everyone knows you can sell a business to private equity, but private equity wants money back over a short time,” he adds. “You don’t want a private equity firm quickly involved in destroying what made it great.”

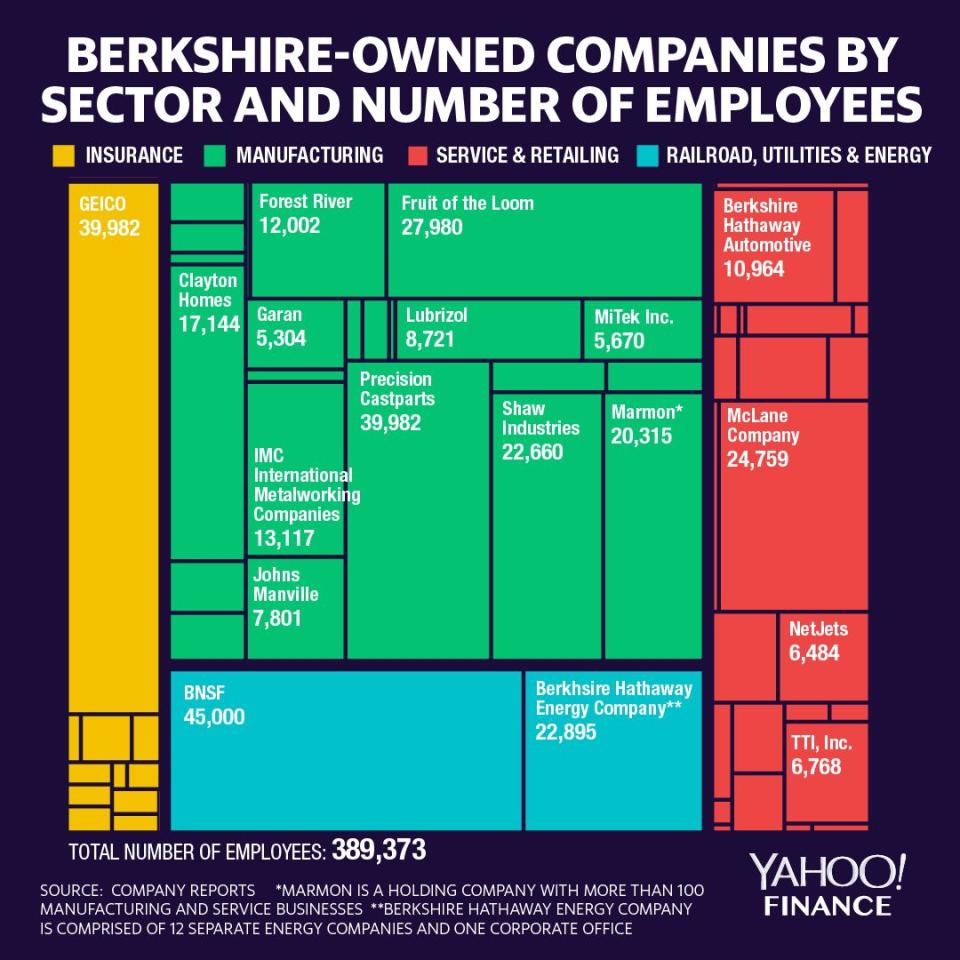

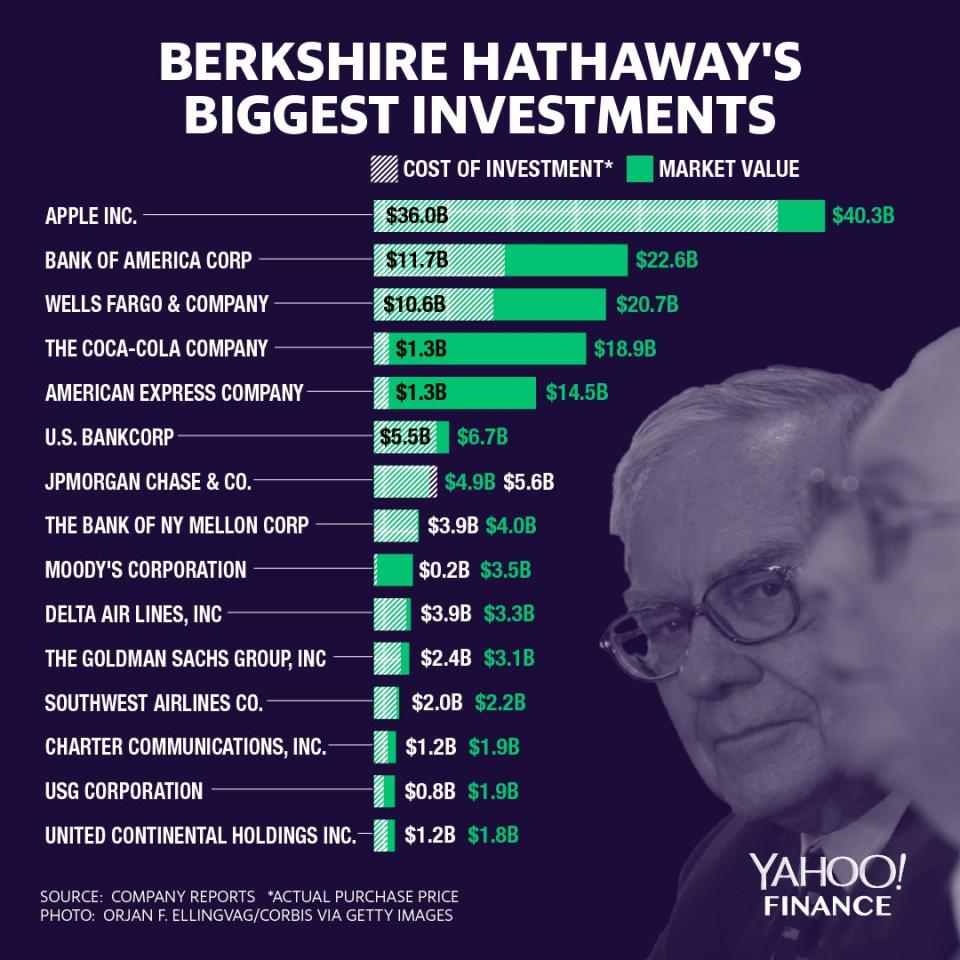

Since 1965, Buffett has run Berkshire Hathaway, which owns over 60 companies, like Geico and Dairy Queen, plus minority stakes in Apple and Coca-Cola, among others.

The observation about Buffett’s mix of unpredictability and restraint was exemplified early Friday, when the Oracle of Omaha surprised many onlookers with the revelation that Berkshire Hathaway had purchased stock in Amazon.

Buffett holds a net worth of $82.5 billion, and has vowed to give away nearly all of it.

Andy Serwer is editor-in-chief of Yahoo Finance.

Read more:

The splintering internet means trouble for Facebook, Twitter, and Google

Google and Facebook should 'work with regulators,’ says longtime Obama adviser Valerie Jarrett

Follow Yahoo Finance on Twitter, Facebook, Instagram, Flipboard, SmartNews, LinkedIn, YouTube, and reddit.