Paramount Group Inc (PGRE) Faces Net Loss Amid Real Estate Challenges

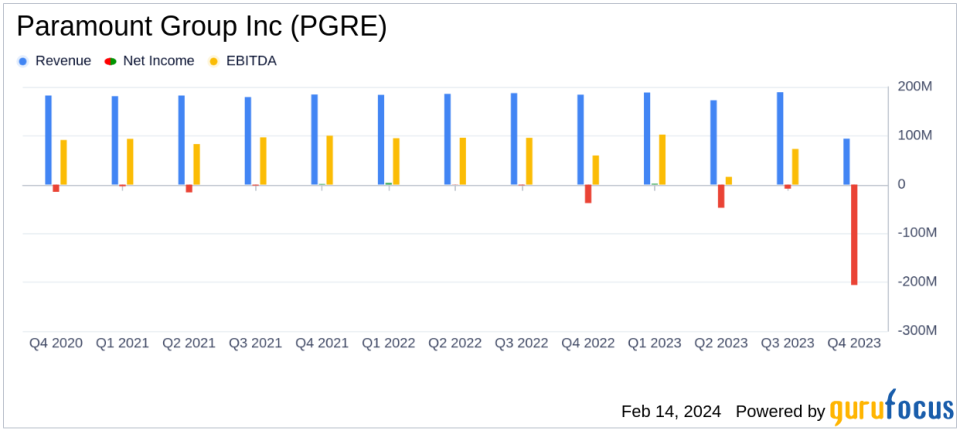

Net Loss: Paramount Group Inc (NYSE:PGRE) reported a significant net loss of $205.6 million for Q4 2023.

Core FFO: Core Funds from Operations (Core FFO) decreased to $46.1 million, reflecting challenges in the real estate sector.

Same Store NOI: Same Store Net Operating Income (NOI) saw a decrease of 7.2% in Q4 2023 compared to the prior year.

Leasing Activity: The company leased 173,770 square feet in Q4, with negative mark-to-markets on second generation space.

Dividend: A Q4 cash dividend of $0.035 per common share was declared and paid in January 2024.

On February 14, 2024, Paramount Group Inc (NYSE:PGRE), a real estate investment trust specializing in Class A office properties in New York City and San Francisco, released its 8-K filing. The company reported a net loss attributable to common stockholders of $205.6 million, or $0.95 per diluted share, for the quarter ended December 31, 2023. This loss includes significant non-cash real estate impairment losses on unconsolidated joint ventures and losses on consolidated real estate related fund investments. The results contrast sharply with the net loss of $37.9 million, or $0.17 per diluted share, for the same period in the previous year.

Financial Performance and Challenges

Paramount Group Inc (NYSE:PGRE)'s performance in the fourth quarter of 2023 was marked by several challenges. The reported net loss was significantly impacted by non-cash real estate impairment losses amounting to $185.0 million. Additionally, the company experienced a decrease in Core FFO attributable to common stockholders to $46.1 million, or $0.21 per diluted share, compared to $54.4 million, or $0.25 per diluted share, in the previous year. This decline in Core FFO is a critical metric for REITs as it reflects the cash flow available for distribution to shareholders.

The company also reported an 8.0% decrease in Same Store Cash NOI and a 7.2% decrease in Same Store NOI for the quarter, compared to the same period in the prior year. These decreases are significant as NOI is a measure of the operating performance of a company's properties, and a decline may indicate reduced profitability and potential challenges in maintaining occupancy and rental rates.

Leasing and Portfolio Operations

During the quarter, Paramount Group Inc (NYSE:PGRE) leased 173,770 square feet, with a weighted average initial rent of $80.17 per square foot. However, the mark-to-markets on second generation space were negative, with a 2.5% decrease on a GAAP basis and a 7.5% decrease on a cash basis. The company's leasing activity is crucial as it directly affects revenue generation and occupancy rates, which are key drivers of value for REIT investors.

Furthermore, the company declared and paid a fourth quarter cash dividend of $0.035 per common share, demonstrating its commitment to providing returns to shareholders despite the reported net loss.

Balance Sheet and Liquidity

Paramount Group Inc (NYSE:PGRE) reported total assets of $8.006 billion as of December 31, 2023, with cash and cash equivalents of $428.2 million. The company's balance sheet strength and liquidity are essential for its ability to manage debt obligations, invest in property acquisitions, and fund operations.

Outlook and Analysis

The company's performance in the fourth quarter reflects the broader challenges faced by the office real estate sector, including market volatility and the impact of economic conditions on tenant demand. Paramount Group Inc (NYSE:PGRE)'s ability to navigate these challenges and its strategic actions, such as the modification and extension of the mortgage loan at One Market Plaza, will be critical in determining its future performance and value proposition to investors.

For a detailed analysis of Paramount Group Inc (NYSE:PGRE)'s financial results and to stay informed on the latest developments in the real estate investment trust industry, visit GuruFocus.com.

Explore the complete 8-K earnings release (here) from Paramount Group Inc for further details.

This article first appeared on GuruFocus.