Park Aerospace Corp (PKE): A Comprehensive Analysis of its Dividend Performance

Understanding the Dividend History, Yield, and Growth Rates of Park Aerospace Corp

Park Aerospace Corp (NYSE:PKE) recently announced a dividend of $0.13 per share, payable on November 3, 2023. The ex-dividend date is set for September 29, 2023. With investors eagerly awaiting this upcoming payment, it's an opportune time to delve into Park Aerospace Corp's dividend history, yield, and growth rates. This analysis, based on data from GuruFocus, aims to provide a comprehensive review of the company's dividend performance and evaluate its sustainability.

Overview of Park Aerospace Corp

Warning! GuruFocus has detected 4 Warning Sign with PKE. Click here to check it out.

This Powerful Chart Made Peter Lynch 29% A Year For 13 Years

How to calculate the intrinsic value of a stock?

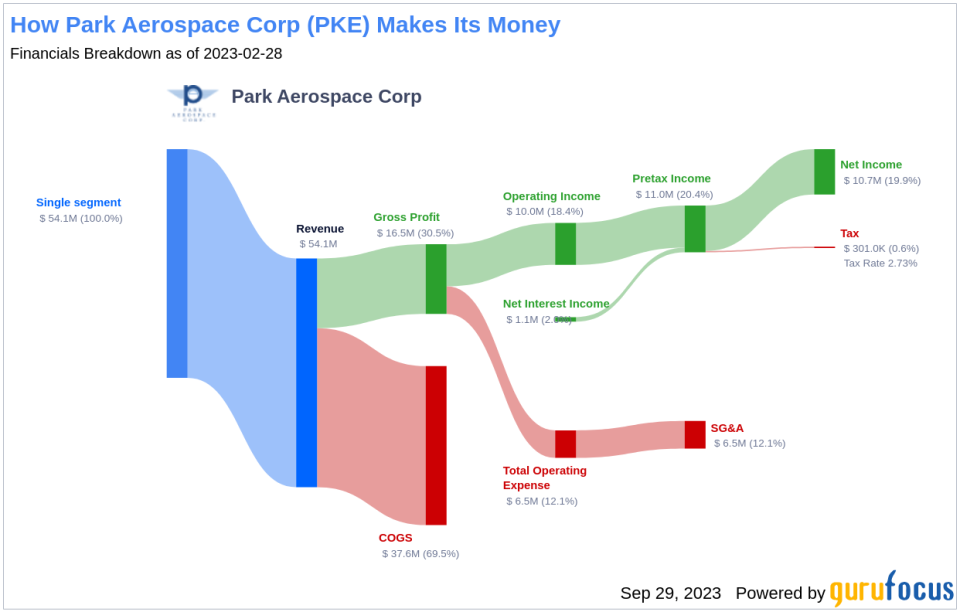

Park Aerospace Corp designs, develops, and manufactures engineered, Advanced composite materials and composite structures and assemblies, and low-volume tooling for the aerospace markets. It also provides prototype tooling for such structures and assemblies. The company's sole business segment is Aerospace. Geographically, the majority of its revenue is derived from North America, with a presence in Asia and Europe. Its offerings include Advanced Composite Prepregs for Aircraft Structures and Interiors, Sigma Strut, and Alpha Strut.

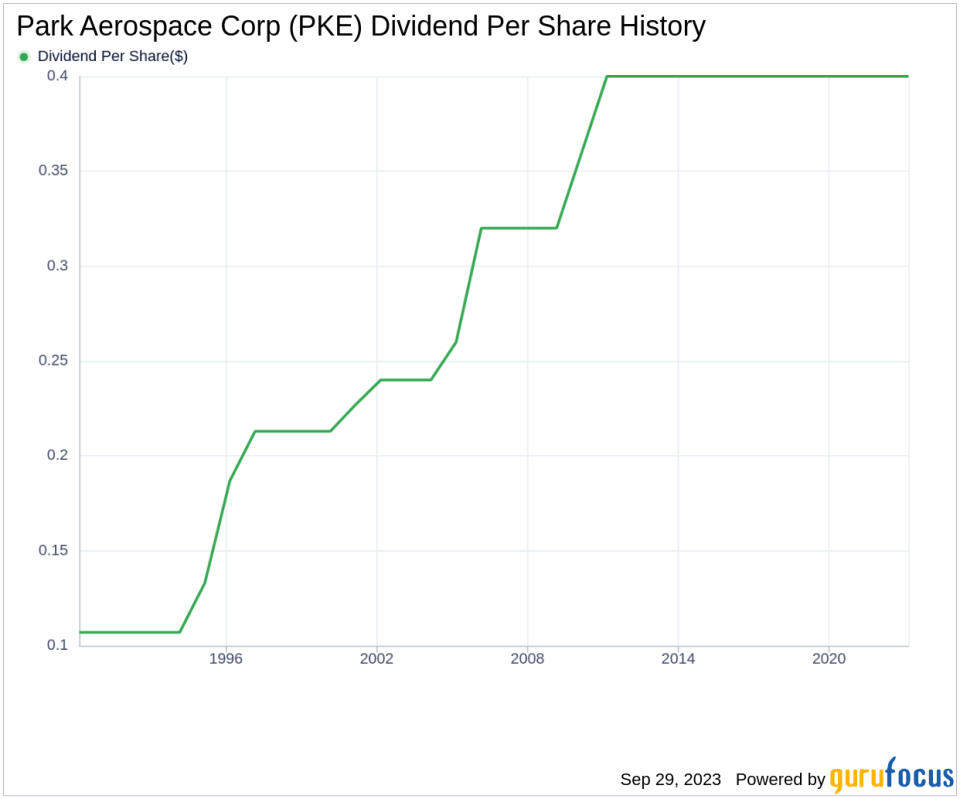

Exploring Park Aerospace Corp's Dividend History

Park Aerospace Corp has maintained a consistent dividend payment record since 1985, with dividends currently distributed on a quarterly basis. The company has increased its dividend each year since 1998, earning it the status of a dividend aristocrat, a distinguished title bestowed upon companies that have increased their dividend each year for at least the past 25 years.

Understanding Park Aerospace Corp's Dividend Yield and Growth

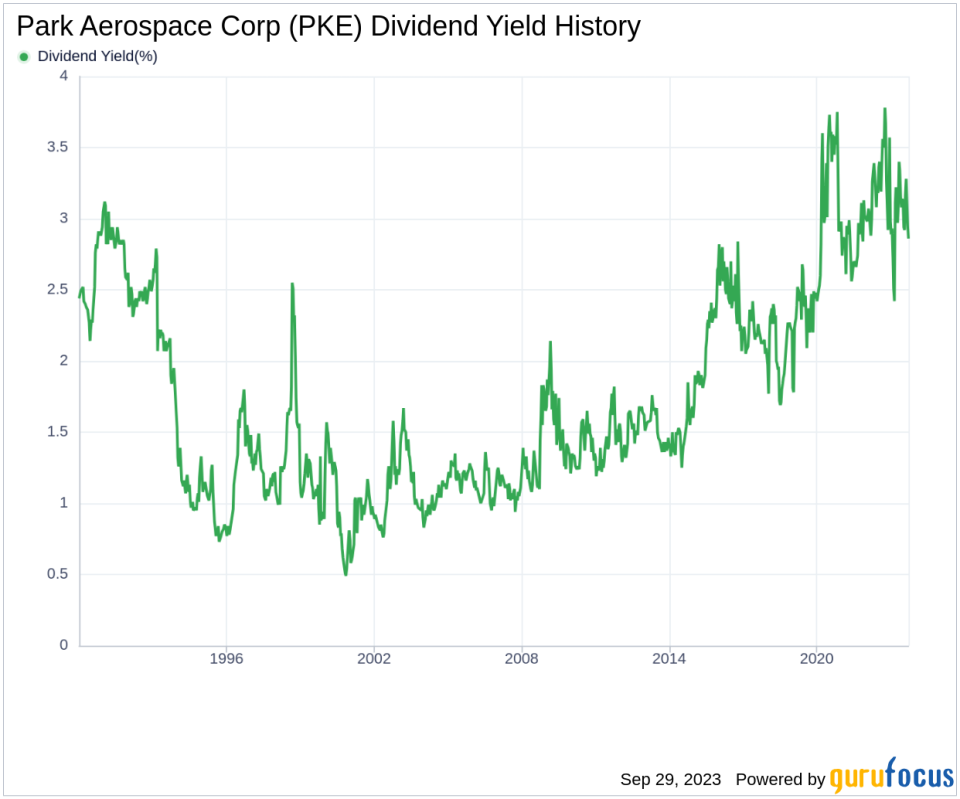

As of today, Park Aerospace Corp has a 12-month trailing dividend yield of 2.85% and a 12-month forward dividend yield of 3.17%. This suggests an expected increase in dividend payments over the next 12 months. Based on its dividend yield and five-year growth rate, the 5-year yield on cost of Park Aerospace Corp stock is approximately 2.85% as of today.

Evaluating the Sustainability of Park Aerospace Corp's Dividend

The sustainability of a company's dividend can be evaluated by its payout ratio. The dividend payout ratio provides insight into the portion of earnings the company distributes as dividends. A lower ratio suggests the company retains a significant part of its earnings, ensuring funds for future growth and unexpected downturns. As of May 31, 2023, Park Aerospace Corp's dividend payout ratio is 0.82, which may indicate a potential sustainability issue with the company's dividend.

Park Aerospace Corp's profitability rank is 8 out of 10 as of May 31, 2023, suggesting good profitability prospects. The company has reported net profit in 9 out of the past 10 years.

Assessing Park Aerospace Corp's Growth Metrics

Park Aerospace Corp's growth rank of 8 out of 10 suggests a positive growth trajectory relative to its competitors. However, its revenue per share, combined with the 3-year revenue growth rate, indicates a growth rate that underperforms approximately 66.92% of global competitors. Furthermore, the company's 3-year EPS growth rate and 5-year EBITDA growth rate also underperform a significant portion of global competitors.

Conclusion

While Park Aerospace Corp has a strong history of consistent and increasing dividends, its current payout ratio and growth metrics raise questions about the sustainability of its dividend in the long term. Investors should consider these factors when evaluating the company's future dividend prospects.

GuruFocus Premium users can screen for high-dividend yield stocks using the High Dividend Yield Screener.

This article first appeared on GuruFocus.