Park-Ohio Holdings Corp Reports Record Annual Sales and Strong Earnings Growth in 2023

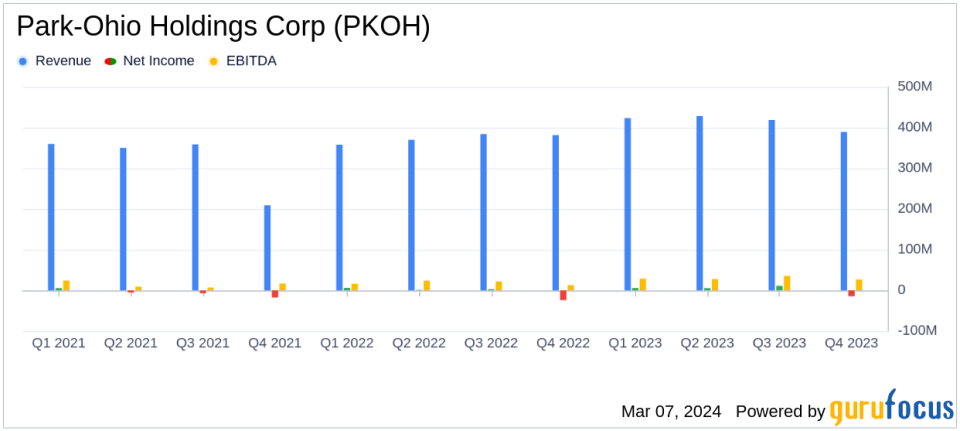

Net Sales: Record annual net sales of $1.7 billion, up 11% from 2022.

GAAP EPS: Full-year GAAP EPS from continuing operations at $2.72, a significant increase from $0.83 in 2022.

Adjusted EPS: Adjusted EPS from continuing operations rose to $3.07, up 74% compared to the previous year.

EBITDA: EBITDA from continuing operations improved by 33% to $134 million in 2023.

Free Cash Flow: Strong annual free cash flow of $25 million, reflecting robust operational efficiency.

Q4 Performance: Q4 net sales from continuing operations increased by 2% year-over-year to $389 million, despite UAW strike impacts.

2024 Outlook: Mid-single digit revenue growth expected, with continued demand driving improvements in EPS and EBITDA.

On March 5, 2024, Park-Ohio Holdings Corp (NASDAQ:PKOH) released its 8-K filing, announcing its financial results for the fourth quarter and full year 2023. The company, a key player in industrial supply chain logistics and diversified manufacturing, operates across the United States, Asia, Europe, Canada, Mexico, and other regions. Its Supply Technologies segment, a major revenue contributor, provides comprehensive supply management services.

Financial Highlights and Challenges

Park-Ohio's performance in 2023 was marked by record net sales in each of its business segments, demonstrating the company's resilience and strategic positioning in the market. The full-year net sales reached $1.7 billion, an 11% increase from the previous year, with gross margin expanding by more than 200 basis points. This growth was achieved despite challenges, including a United Auto Workers (UAW) strike that negatively impacted fourth-quarter results, reducing net sales and EPS by approximately $25 million and $0.20 per diluted share, respectively.

The company's profitability also saw a significant uptick, with GAAP EPS from continuing operations climbing to $2.72 per diluted share, up from $0.83 in the prior year. Adjusted EPS from continuing operations surged by 74% to $3.07 per diluted share. These improvements underscore the importance of Park-Ohio's operational efficiency and its ability to navigate market disruptions.

Segment Performance and Liquidity

Within its segments, the Supply Technologies division experienced a 7% increase in full-year net sales, despite a slight decrease in the fourth quarter due to the UAW strike. The Assembly Components segment reported a 10% increase in full-year net sales, while the Engineered Products segment saw an impressive 19% increase, driven by strong demand in capital equipment and forged and machined products businesses.

As of December 31, 2023, Park-Ohio's liquidity stood at $166 million, including cash on hand and unused borrowing availability. The company's strong cash flow management is evident in its operating cash flows of $53.4 million and free cash flow of $25.2 million for the year.

Strategic Moves and Outlook

The company completed the sale of its Aluminum Products business, which is expected to enhance its financial position by reducing outstanding indebtedness. Looking ahead to 2024, Park-Ohio anticipates mid-single digit revenue growth, driven by strong demand in its Supply Technologies and Engineered Products segments, and expects further improvements in EPS and EBITDA.

In a strategic move to bolster its global induction business, Park-Ohio acquired EMA Indutec GmbH, a leading manufacturer of induction heating equipment. This acquisition is expected to be immediately accretive to margins and contribute over $30 million in revenues over the next twelve months.

Matthew V. Crawford, Chairman and Chief Executive Officer, expressed confidence in the company's ability to build on its 2023 progress and drive further profitability and cash flow improvements in 2024.

Investor Considerations

Value investors may find Park-Ohio's record sales and robust earnings growth particularly appealing, as they reflect the company's ability to deliver strong financial performance even in the face of industry challenges. The company's strategic divestitures and acquisitions, along with its positive outlook for 2024, suggest a proactive approach to growth and operational excellence.

For a more detailed analysis of Park-Ohio's financial results, including income statements, balance sheets, and cash flow statements, investors are encouraged to review the full 8-K filing.

Interested parties can join the conference call reviewing Park-Ohios fourth quarter and full year 2023 results, which will be broadcast live over the Internet on March 6, at 10:00 am Eastern Time.

Explore the complete 8-K earnings release (here) from Park-Ohio Holdings Corp for further details.

This article first appeared on GuruFocus.