Is Parke Bancorp, Inc. (NASDAQ:PKBK) An Attractive Dividend Stock?

Could Parke Bancorp, Inc. (NASDAQ:PKBK) be an attractive dividend share to own for the long haul? Investors are often drawn to strong companies with the idea of reinvesting the dividends. Yet sometimes, investors buy a popular dividend stock because of its yield, and then lose money if the company's dividend doesn't live up to expectations.

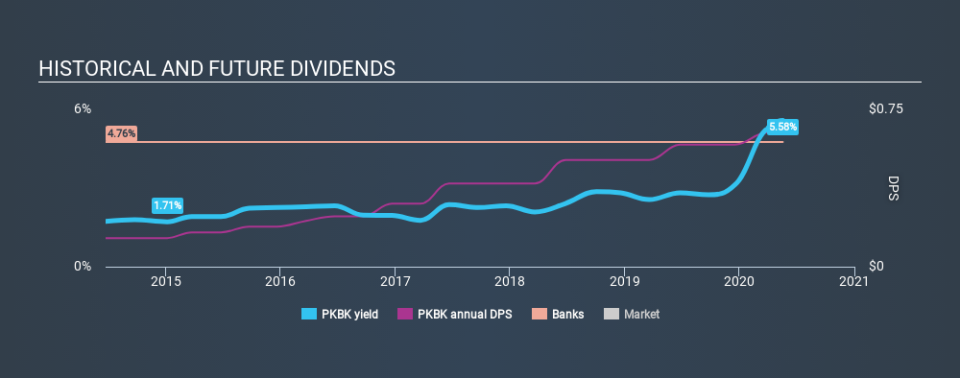

In this case, Parke Bancorp likely looks attractive to dividend investors, given its 5.6% dividend yield and six-year payment history. We'd agree the yield does look enticing. Remember that the recent share price drop will make Parke Bancorp's yield look higher, even though recent events might have impacted the company's prospects. Some simple analysis can offer a lot of insights when buying a company for its dividend, and we'll go through this below.

Click the interactive chart for our full dividend analysis

Payout ratios

Companies (usually) pay dividends out of their earnings. If a company is paying more than it earns, the dividend might have to be cut. Comparing dividend payments to a company's net profit after tax is a simple way of reality-checking whether a dividend is sustainable. In the last year, Parke Bancorp paid out 24% of its profit as dividends. We'd say its dividends are thoroughly covered by earnings.

Consider getting our latest analysis on Parke Bancorp's financial position here.

Dividend Volatility

From the perspective of an income investor who wants to earn dividends for many years, there is not much point buying a stock if its dividend is regularly cut or is not reliable. Parke Bancorp has been paying a dividend for the past six years. The dividend has been quite stable over the past six years, which is great to see - although we usually like to see the dividend maintained for a decade before giving it full marks, though. During the past six-year period, the first annual payment was US$0.14 in 2014, compared to US$0.64 last year. This works out to be a compound annual growth rate (CAGR) of approximately 29% a year over that time.

The dividend has been growing pretty quickly, which could be enough to get us interested even though the dividend history is relatively short. Further research may be warranted.

Dividend Growth Potential

While dividend payments have been relatively reliable, it would also be nice if earnings per share (EPS) were growing, as this is essential to maintaining the dividend's purchasing power over the long term. Strong earnings per share (EPS) growth might encourage our interest in the company despite fluctuating dividends, which is why it's great to see Parke Bancorp has grown its earnings per share at 19% per annum over the past five years. Rapid earnings growth and a low payout ratio suggests this company has been effectively reinvesting in its business. Should that continue, this company could have a bright future.

Conclusion

Dividend investors should always want to know if a) a company's dividends are affordable, b) if there is a track record of consistent payments, and c) if the dividend is capable of growing. Firstly, we like that Parke Bancorp has a low and conservative payout ratio. We were also glad to see it growing earnings, although its dividend history is not as long as we'd like. Parke Bancorp has a number of positive attributes, but falls short of our ideal dividend company. It may be worth a look at the right price, though.

Companies possessing a stable dividend policy will likely enjoy greater investor interest than those suffering from a more inconsistent approach. However, there are other things to consider for investors when analysing stock performance. Taking the debate a bit further, we've identified 3 warning signs for Parke Bancorp that investors need to be conscious of moving forward.

If you are a dividend investor, you might also want to look at our curated list of dividend stocks yielding above 3%.

Love or hate this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned. Thank you for reading.