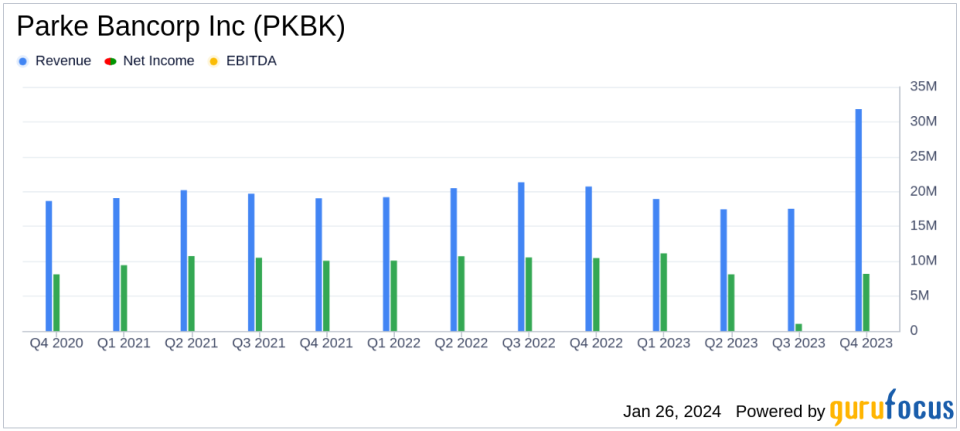

Parke Bancorp Inc (PKBK) Reports Decline in Q4 Net Income Amidst Rising Interest Expenses

Net Income: Q4 net income available to common shareholders decreased by 21.8% to $8.2 million.

Revenue: Q4 revenue reported at $31.8 million.

Total Assets: Increased by 1.9% to $2.02 billion as of December 31, 2023.

Total Loans: Rose by 2.0% to $1.79 billion compared to the end of 2022.

Total Deposits: Experienced a decrease of 1.5% to $1.55 billion.

Net Interest Income: Saw an 18.0% decrease in Q4 to $15.5 million.

Provision for Credit Losses: A recovery of $0.5 million in Q4, compared to a provision of $0.9 million in the same period in 2022.

On January 24, 2024, Parke Bancorp Inc (NASDAQ:PKBK) released its 8-K filing, disclosing its financial results for the fourth quarter of 2023. The company, which operates as a commercial bank offering a range of financial services to individuals and small to mid-sized businesses, faced a challenging year marked by a decrease in net income and net interest income, despite an increase in total assets and loans.

Performance Overview

Parke Bancorp Inc reported a net income available to common shareholders of $8.2 million for Q4 2023, which represents a decrease of 21.8% compared to the same quarter in the previous year. This decline was primarily driven by lower net interest income, which fell by 18.0% to $15.5 million. The company also saw a decrease in non-interest income and an increase in non-interest expenses. However, the provision for credit losses showed a positive recovery of $0.5 million, compared to a provision of $0.9 million in Q4 2022.

Financial Highlights and Challenges

The bank's total assets grew modestly by 1.9% to $2.02 billion, while total loans increased by 2.0% to $1.79 billion. However, total deposits decreased by 1.5% to $1.55 billion. The decrease in net income is significant for Parke Bancorp Inc as it reflects the challenges faced in generating revenue amidst rising market interest rates, which have led to increased interest expenses. Additionally, the bank's performance is crucial as it indicates the bank's ability to manage its interest rate risk and credit risk in a volatile economic environment.

"2023 was a challenging year for the country, our region and the banking industry," said Vito S. Pantilione, President and Chief Executive Officer of Parke Bancorp Inc. "Maintaining deposits remained challenging in 2023, triggering higher rates and the offering of special deposit programs."

Financial Metrics and Their Importance

The bank's net interest margin and efficiency ratio are key metrics that have been impacted during the period. The net interest margin decreased to 3.17% in Q4 2023 from 3.91% in the same period in 2022, while the efficiency ratio worsened to 36.99% from 29.68%. These metrics are important as they measure the bank's profitability and operational efficiency, respectively. A lower net interest margin suggests that the bank is earning less from its lending activities relative to its interest expenses, and a higher efficiency ratio indicates increased costs relative to revenue.

Parke Bancorp Inc's financial achievements, particularly the growth in total assets and loans, are important as they demonstrate the bank's capacity to expand its balance sheet and lending operations, which is a positive sign for future revenue potential. However, the challenges posed by the increased interest expenses and decreased net interest income highlight the pressure on the bank's margins in a rising interest rate environment.

Analysis of Company's Performance

The bank's performance in 2023 reflects the broader challenges faced by the banking sector, including high inflation, rising interest rates, and increased competition for deposits. Parke Bancorp Inc's ability to navigate these challenges while maintaining asset growth and managing credit losses is commendable. However, the decrease in net income and the efficiency ratio suggests that there is room for improvement in managing expenses and optimizing revenue streams.

Parke Bancorp Inc's financial condition at the end of 2023, with increased total equity and a strong allowance for credit losses, positions the bank to potentially benefit from an improving economic environment and anticipated interest rate cuts in 2024. The bank's focus on maintaining strong capital, asset quality, and reserves will be critical in supporting growth and profitability in the coming year.

For a detailed view of Parke Bancorp Inc's financial results and outlook, investors and interested parties are encouraged to review the full 8-K filing.

Explore the complete 8-K earnings release (here) from Parke Bancorp Inc for further details.

This article first appeared on GuruFocus.