Parker-Hannifin: A 67-Year Dividend Grower With Potential 40% Upside

In my series of exploring Dividend Aristocrats companies that consistently raise dividends annually for several decades I have analyzed Dover (NYSE:DOV), Procter & Gamble (NYSE:PG), American States Water (NYSE:AWR), Genuine Parts (NYSE:GPC) and Emerson Electric (NYSE:EMR). Each of these five corporations boast a remarkable streak, having increased their dividends to shareholders every year for at least 67 years.

This Powerful Chart Made Peter Lynch 29% A Year For 13 Years

How to calculate the intrinsic value of a stock?

This analysis highlights another member of this elite group: Parker-Hannifin Corp. (NYSE:PH). Like the other five companies mentioned above, Parker-Hannifin has an impressive record of 67 years of uninterrupted dividend growth. The company's shareholders have benefited from the dual advantages of long-term dividend growth and increasing share prices.

Two operating segments

A global leader in motion and control technologies, the company operates in two main segments: Diversified industrial and Aerospace Systems.

In 2023, the Diversified Industrial segment was the primary revenue driver, contributing about $14.7 billion, or approximately 77% of the company's total revenue. This segment also generated over $3 billion in operating earnings, achieving an operating margin of over 20%.

In contrast, the Aerospace Systems segment brought in $4.36 billion in revenue, with a significantly lower operating income of $562 million, resulting in an operating margin of around 12%.

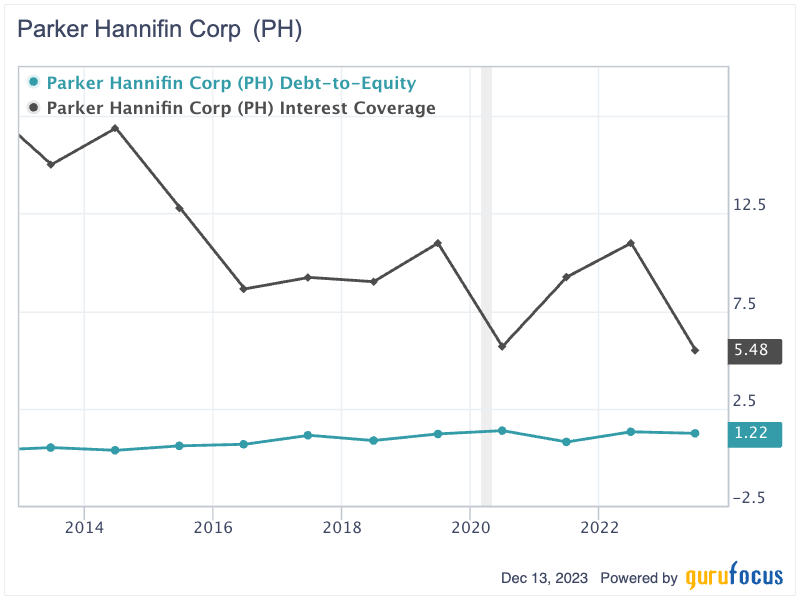

Rising leverage, but maintaining comfortable interest coverage

Investors might be concerned about Parker-Hannifin's growing leverage in recent years. The company's short-term and long-term debt levels have slightly increased, reaching $12.2 billion, while the total shareholders' equity came in at $10.56 billion. Over the past decade, there has been a notable shift in its financial stability: the debt-to-equity ratio climbed from 0.49 to 1.22, while the interest coverage ratio decreased from a high of 16.7 to 5.48 in 2023. Despite this decline, the current interest coverage of 5.48 is still reasonably strong, indicating the company can comfortably cover its interest expenses.

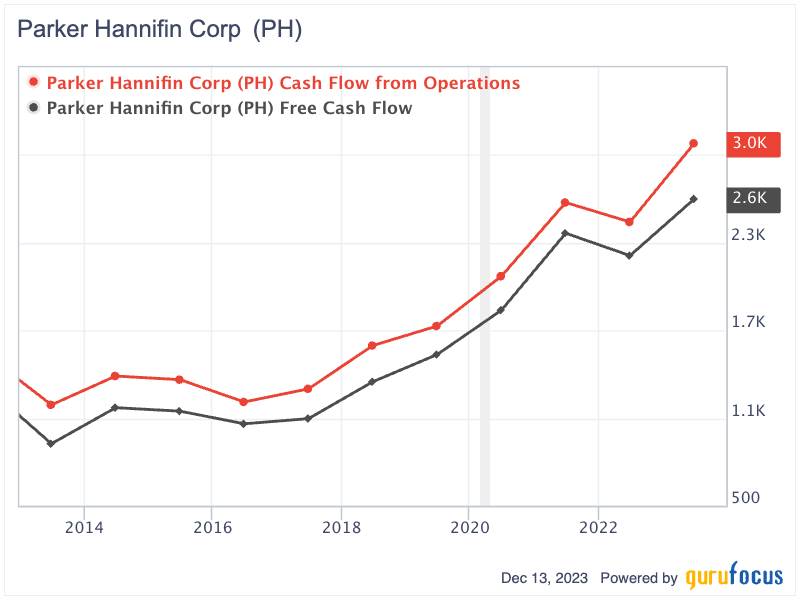

Robust free cash flow growth

Parker-Hannifin's ability to generate cash flow is an attractive feature for investors. The company has shown a consistent upward trend in its free cash flow. From 2012 to 2023, its operating cash flow grew from $1.19 billion to nearly $3 billion, marking a compounded annual growth rate of 9.7%. Its free cash flow has also seen impressive growth over the past decade, growing from $925 million to nearly $2.6 billion in the same period, enjoying an annual compounded growth rate of 10.9%.

A bright future outlook

Looking forward, Parker-Hannifin should experience more business growth, bolstered by favorable market trends in the aerospace industry. This growth is driven by two key factors: the resurgence in commercial air traffic and consistent defense spending. A pivotal development supporting this trend is the shift by major clients like Boeing (NYSE:BA) and Airbus (XPAR:AIR) toward more efficient narrowbody aircraft. This shift aligns perfectly with Parker-Hannifin's business offerings, positioning the company to capitalize on these industry changes.

President Biden's recent proposal in August to allocate an additional $20 billion in military aid and assistance to Ukraine presents new opportunities for the company. This proposal will likely benefit the company's business, especially given its history of securing significant government contracts.

Highlighting its ability in this area, Parker-Hannifin secured a crucial five-year maintenance, repair and overhaul (MRO) contract with the U.S. Army in May of this year. The contract demonstrates the company's ability to meet the demanding requirements of government projects and reinforces its strong position within the aerospace sector.

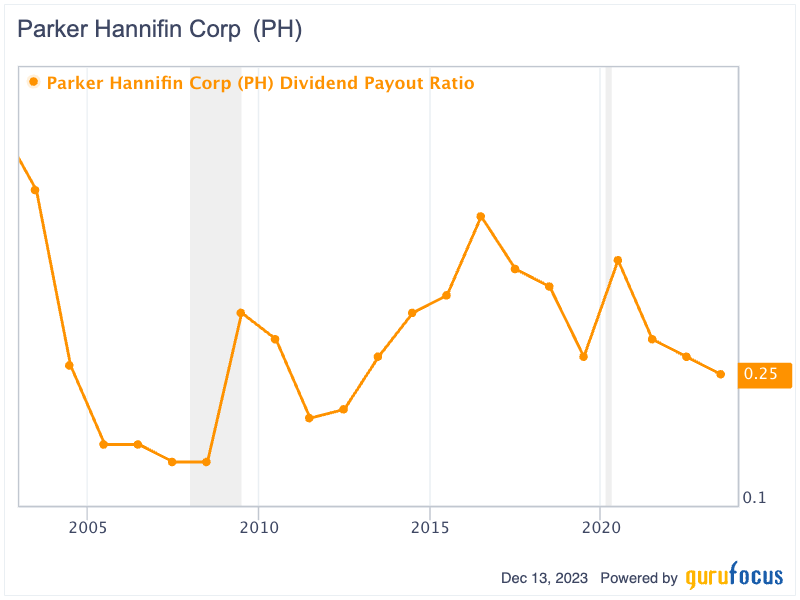

Strong dividend sustainability with low payout ratio

A key metric to consider when assessing a company's ability to maintain its dividend payments is the dividend payout ratio. This ratio, calculated as earnings per share divided by dividend per share, indicates whether a company's annual dividend payment is sustainably covered by its earnings for that year. A dividend payout ratio exceeding 100% is a cautionary sign for investors. It implies the company is returning more money to shareholders than it has earned in that year. If this trend persists, the company may eventually need to reduce or even discontinue its dividend payments. This metric is crucial for evaluating the long-term sustainability of a company's dividend policy.

Looking at Parker-Hannifin's history, the company has kept its dividend payout ratio well under 1 for the past 20 years. Since 2003, this ratio has remained in a comfortable range of 0.15 to 0.46, illustrating a consistent and prudent dividend policy. In 2023, the payout ratio was just 0.25, further demonstrating the company's effective management of its dividends in relation to its earnings. This track record underscores the company's long-term commitment to maintaining a sustainable dividend policy.

Significantly undervalued

In the past 20 years, the company has grown its dividend per share from 49 cents to $5.47, translating into a high 12.8% CAGR . The Gordon Growth Model, which is suitable for companies with consistent dividend growth, fits well with Parker-Hannifin considering its remarkable history of nearly seven decades of dividend growth. Assuming the company maintains a slightly lower dividend growth rate of about 12%compared to its annual growth rate over the past 20 yearsand applying a discount rate of 13%, we can calculate the intrinsic value of Parker-Hannifin as follows:

P = Expected Dividend for 2024 / (Required Rate of Return - Dividend Growth Rate)

= $5.47 *(1+12%) / (13%-12%)

= $612.6

Using the Gordon Growth Model, the intrinsic value of Parker-Hannifin is estimated to be approximately $612.60 per share. This valuation is 40% higher than its current share price of $439. Such a significant difference suggests the market may undervalue the company's potential for future growth and dividend increases.

Key takeaway

Parker-Hannifin stands out as a prime example of a Dividend Aristocrat with a solid 67-year history of increasing dividends. Despite growing leverage, its robust cash flow and low dividend payout ratio, coupled with a promising outlook in the aerospace and defense sectors, underscore its potential for stability and growth.

The Gordon Growth Model's valuation suggests Parker-Hannifin's current market price may not fully reflect its long-term value and capacity for consistent shareholder returns, marking it as a potentially undervalued investment opportunity.

This article first appeared on GuruFocus.