Parker Hannifin Corp Reports Strong Fiscal 2024 Q2 Results with Record Adjusted Earnings

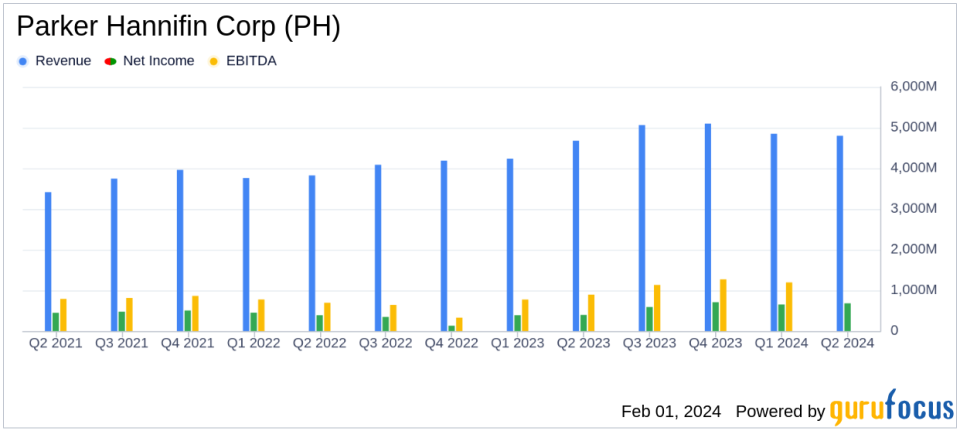

Revenue: Increased by 3% to a record $4.8 billion.

Net Income: Rose significantly to $681.9 million from $395.2 million in the prior year quarter.

Adjusted Earnings Per Share (EPS): Jumped 29% to a record $6.15.

Segment Operating Margin: Reached 21.1%, with an adjusted figure of 24.5%, up 300 basis points.

Cash Flow: Year-to-date cash flow from operations increased by 26% to $1.4 billion.

Orders: Overall orders increased by 2%, with a notable 21% increase in the Aerospace Systems Segment.

Outlook: Parker Hannifin Corp (NYSE:PH) raises its fiscal 2024 outlook for segment operating margin and EPS.

On February 1, 2024, Parker Hannifin Corp (NYSE:PH) announced its fiscal 2024 second quarter results, showcasing robust financial performance and record-setting adjusted earnings. The company, a global leader in motion and control technologies, released its 8-K filing detailing these results.

Parker Hannifin operates through two segments: diversified industrial and aerospace systems. The diversified industrial segment, which includes engineered materials, filtration, fluid connectors, instrumentation, and motion systems, is supported by a network of over 17,100 independent distributors and generates approximately 40% of its business outside the United States.

Fiscal Performance and Strategic Execution

The company's sales increase to $4.8 billion reflects a consistent demand across its diversified portfolio. The adjusted net income surge of 30% to $802.4 million compared to the previous year's quarter underscores Parker Hannifin's operational efficiency and strategic execution. The adjusted operating margin improvement across every segment, particularly the aerospace and defense sectors, demonstrates the company's ability to leverage market opportunities and integrate acquisitions effectively, such as the recent Meggitt acquisition.

Chairman and CEO Jenny Parmentier attributed the strong results to the company's portfolio strength and execution under its business system, The Win Strategy. She highlighted the significant margin improvements and strong cash flow, which has been directed towards reducing debt.

"We continue to produce exceptional results that reflect the strength of our portfolio and our ability to execute at a high level, underpinned by our business system, The Win Strategy," said Parmentier. "Our adjusted operating margin increased by 300 basis points year-over-year, as we saw meaningful margin improvement in every segment. Strong aerospace and defense results, including synergies from the Meggitt acquisition, were a key driver of performance in the quarter. We continued to generate strong cash flow and direct it towards reducing debt. Our results are a testament to the dedication and persistence of our global teams."

Segment and Order Highlights

The Diversified Industrial Segment saw mixed results with North American sales slightly decreasing by 1% to $2.1 billion, while International sales remained flat at $1.4 billion. However, both regions experienced operating income growth. The Aerospace Systems Segment, on the other hand, reported a substantial 15% increase in sales to $1.3 billion, with operating income soaring compared to the same period a year ago.

Order trends were mixed, with a 2% increase for total Parker, but a decrease in orders for the Diversified Industrial businesses in both North America and International markets. The Aerospace Systems Segment saw a significant increase in orders by 21% on a rolling 12-month average basis.

Updated Fiscal Outlook

Parker Hannifin Corp (NYSE:PH) has raised its outlook for fiscal 2024, anticipating another year of record performance. The company now expects total sales growth to be in the range of 3% to 5%, total segment operating margin between 20.7% and 21.1%, or 24.1% to 24.5% on an adjusted basis, and earnings per share in the range of $20.00 to $20.60, or $23.90 to $24.50 on an adjusted basis.

The company's focus on executing The Win Strategy and leveraging growth in aerospace markets is expected to support its positive trajectory, bolstered by favorable secular growth trends and opportunities to enhance customer experience.

For a detailed financial analysis and to access the webcast discussing these results, investors and interested parties can visit www.phstock.com.

Value investors looking for detailed insights into Parker Hannifin Corp's financials and future prospects can find comprehensive information and analysis on GuruFocus.com.

Explore the complete 8-K earnings release (here) from Parker Hannifin Corp for further details.

This article first appeared on GuruFocus.