Parsons Corp (PSN) Achieves Record Earnings and Robust Growth in Fiscal Year 2023

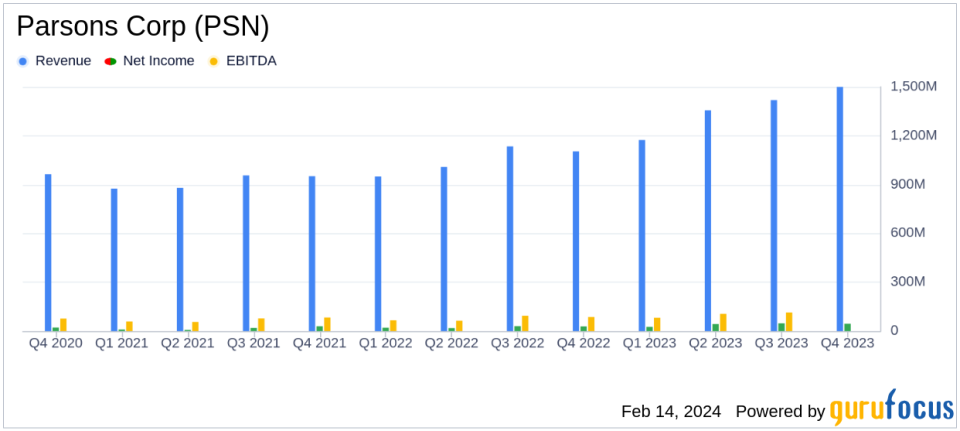

Revenue Growth: Fiscal year 2023 revenue soared to $5.4 billion, marking a 30% increase year-over-year.

Net Income Surge: Net income climbed significantly by 67% to $161 million for the fiscal year.

Adjusted EBITDA: Adjusted EBITDA rose by 32% to $465 million, reflecting operational efficiency and growth.

Organic Growth: Both Federal Solutions and Critical Infrastructure segments reported at least 20% organic growth for the third consecutive quarter.

Cash Flow Strength: Cash flow from operations jumped 72% to $408 million, underscoring strong cash-generating capabilities.

Contract Awards: A 40% increase in contract awards to $6.0 billion, with a book-to-bill ratio of 1.1x.

On February 14, 2024, Parsons Corp (NYSE:PSN) released its 8-K filing, disclosing record financial results for the fourth quarter and the fiscal year ended December 31, 2023. The company, a leading provider of technology-driven solutions in defense, intelligence, and critical infrastructure markets, has reported unprecedented growth since its initial public offering (IPO).

Financial Performance Overview

Parsons Corp's revenue for the fourth quarter reached $1.5 billion, a 35% increase compared to the previous year, driven by robust organic growth and strategic acquisitions. Net income for the quarter surged by 60% to $45 million, while adjusted EBITDA grew by 30% to $128 million. The company's cash flow from operations was particularly strong, at $190 million for the quarter.

For the fiscal year, the company's revenue grew by 30% to $5.4 billion, with organic growth contributing significantly. Net income for the year was up by 67% to $161 million. Adjusted EBITDA for the year increased by 32% to $465 million, and the company's cash flow from operations saw a substantial increase of 72% to $408 million.

Segment Performance

The Federal Solutions segment reported a 50% increase in fourth-quarter revenue to $843 million, while the full-year revenue jumped 36% to $3.0 billion. Adjusted EBITDA for this segment rose by 73% in the fourth quarter and 45% for the year. The Critical Infrastructure segment also saw growth, with a 21% increase in fourth-quarter revenue and a 22% increase for the full year.

Strategic Contract Wins and Corporate Highlights

Parsons Corp continued to secure significant contracts, including 15 contracts each worth $100 million or more. The company also made strategic acquisitions, such as I.S. Engineers, to bolster its capabilities and market position. Parsons was recognized for its commitment to diversity, ethical practices, and support for military veterans.

Outlook and Guidance

CEO Carey Smith expressed confidence in the company's outlook, leading to an increase in long-term guidance. The company has set ambitious targets for fiscal year 2024, although it has not provided specific net income guidance due to potential volatility in various factors affecting net income.

Parsons Corp's strong performance in fiscal year 2023 is a testament to its strategic focus on organic and inorganic growth, operational efficiency, and market expansion. The company's record results and positive outlook reflect its resilience and adaptability in a dynamic market environment.

For more detailed information on Parsons Corp's financial performance, including segment results and full-year guidance, investors and interested parties are encouraged to review the full 8-K filing.

Stay tuned to GuruFocus.com for further analysis and updates on Parsons Corp (NYSE:PSN) and other market-moving financial news.

Explore the complete 8-K earnings release (here) from Parsons Corp for further details.

This article first appeared on GuruFocus.