Pass Up On This 11.6% Dividend Stock

In the landscape of Australian dividend stocks, discerning between those that offer sustainable returns and those that may pose a risk to investors is crucial. While a high yield can be enticing, companies experiencing declining dividend growth, such as Platinum Investment Management, warrant a closer examination to determine if their dividends are a reliable source of income or a red flag signaling underlying issues.

Top 10 Dividend Stocks In Australia

Name | Dividend Yield | Dividend Rating |

Computershare (ASX:CPU) | 3.05% | ★★★★★☆ |

Nick Scali (ASX:NCK) | 4.57% | ★★★★★☆ |

Fiducian Group (ASX:FID) | 3.98% | ★★★★★☆ |

Joyce (ASX:JYC) | 8.26% | ★★★★★☆ |

Korvest (ASX:KOV) | 6.94% | ★★★★★☆ |

Centuria Capital Group (ASX:CNI) | 6.63% | ★★★★★☆ |

Charter Hall Group (ASX:CHC) | 3.28% | ★★★★★☆ |

Fortescue (ASX:FMG) | 8.22% | ★★★★★☆ |

Premier Investments (ASX:PMV) | 4.38% | ★★★★★☆ |

Diversified United Investment (ASX:DUI) | 3.20% | ★★★★★☆ |

Click here to see the full list of 46 stocks from our Top Dividend Stocks screener.

We're going to check out one of the best picks from our screener tool and one that could be a dividend trap.

Top Pick

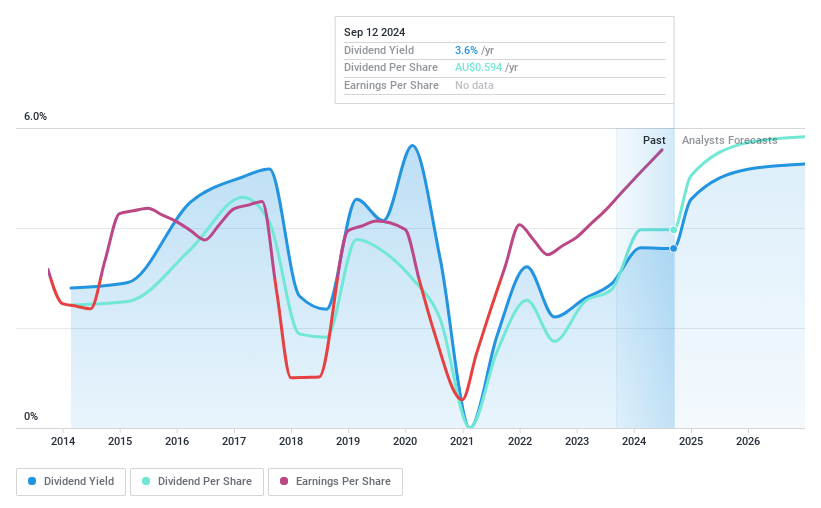

QBE Insurance Group (ASX:QBE)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: The company is a global insurer and reinsurer, operating across the Australia Pacific, North America, and other international markets with a market capitalization of approximately A$27.11 billion.

Operations: The firm generates its revenues primarily through three key regions: international markets (US$9.56 billion), North America (US$11.12 billion), and the Australia Pacific area (US$5.97 billion).

Dividend Yield: 3.4%

QBE Insurance Group's recent performance and strategic moves highlight its potential as a dividend stock, despite some volatility in its dividend history. The company reported a significant increase in net income to US$1.355 billion for the year ended December 31, 2023, from US$587 million the previous year. This financial upturn is accompanied by an increased final dividend of A$0.48 per share for 2023, up from A$0.30 in 2022, with expectations of mid-single-digit gross written premium growth for 2024. However, it's important to note that QBE's dividends have experienced fluctuations over the past decade and currently trade at a substantial discount to estimated fair value, suggesting potential undervaluation or investor caution regarding its dividend reliability amidst board changes and insider selling concerns.

Dividend Trap

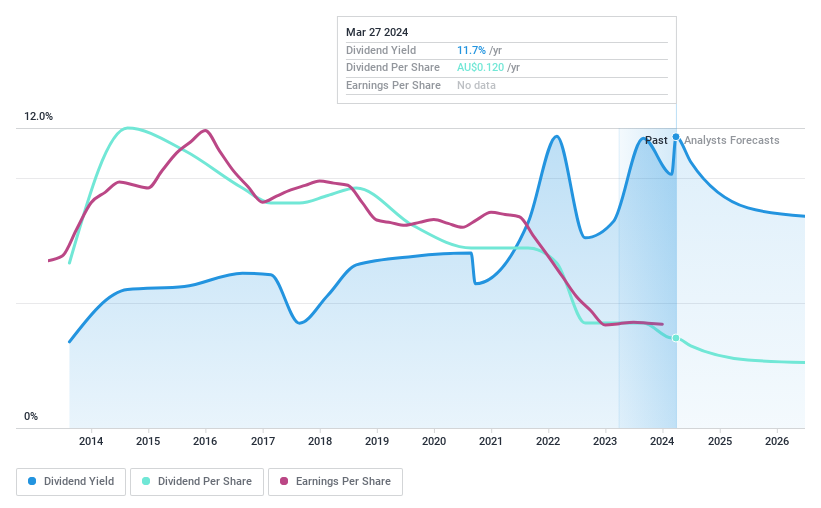

Platinum Investment Management (ASX:PTM)

Simply Wall St Dividend Rating: ★★☆☆☆☆

Overview: The company is a publicly owned hedge fund sponsor with a market capitalization of approximately A$581.41 million.

Operations: The firm generates its income primarily through funds management, contributing A$198.41 million, alongside a smaller revenue stream from investments and other activities amounting to A$16.62 million.

Dividend Yield: 11.7%

Platinum Investment Management's recent developments and financial metrics cast shadows on its attractiveness as a dividend stock. Despite an annualized dividend yield around 10%, the company's dividends are not well-supported, evidenced by a high payout ratio of 93.9% and a cash payout ratio of 94.8%. Recent executive board reshuffles, including the stepping down of key directors and the appointment of Jeff Peters as CEO, add to the uncertainty. Furthermore, being dropped from the FTSE All-World Index signals market skepticism about its performance. Coupled with an expected earnings decline of 15.7% over the next three years and unstable dividend payments in the past decade, these factors suggest caution for dividend-focused investors considering Platinum Investment Management.

Taking Advantage

Unlock more gems! Our Top Dividend Stocks screener has unearthed 44 more companies for you to explore.Click here to unveil our expertly curated list of 46 Top Dividend Stocks.

Shareholder in one of these companies? Ensure you're never caught off-guard by adding your portfolio in Simply Wall St for timely alerts on significant stock developments.

Unlock the power of informed investing with Simply Wall St, your free guide to navigating stock markets worldwide.

Curious About Other Options?

Explore small companies with big growth potential before they take off.

Fuel your portfolio with fast-growing stocks poised for rapid expansion.

Play it safe and steady with these reliable blue chips that offer both stability and growth.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com